UK Consumer Trends

Issue 93 l Eka’s Weekly Roundup (8 October 2024)

At Eka, we back consumer technology companies solving the largest consumer problems across climate & health. Over the past few weeks, we’ve spoken to numerous investors and founders in the UK consumer scene, and are publishing our findings in UK Consumer 2024.

In it, you’ll find a summary of the (1) the macro view in 10+ charts, (2) market maps of 100 consumer companies across key verticals, and (3) case studies of those that have reached >£500m of revenues in <10 years.

Click here to see the doc.

What’s changing in 2024? 🗞️

📈 Inflation, particularly in essential areas like rent, has put a strain on household budgets. However, taking a longer-term view reveals that consumer expenditure has remained surprisingly resilient on the whole.

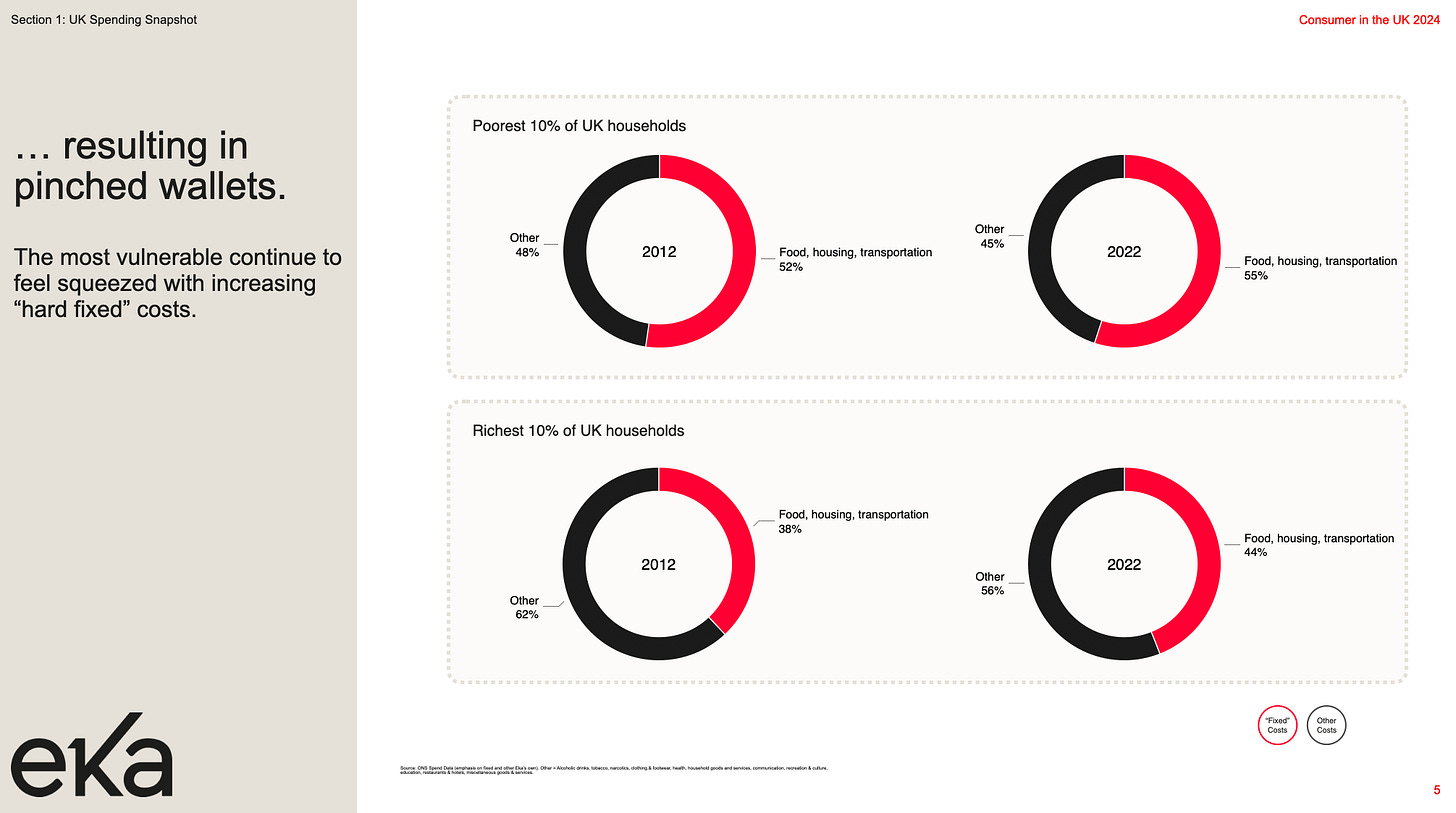

🏦 The UK savings rate, after a period of decline, is on the rise again. We’re now saving more than US consumers are. However, the poorest 10% of consumers are feeling seriously squeezed with fixed costs rising very quickly across food, housing, and transportation.

🌍 Sustainability and affordability are key areas of opportunity for consumers. There is huge demand for environmentally friendly and budget-conscious options (we call this “Shared Value”). This is evident in the increasing interest in electrification for both cost savings and sustainability. Hamish wrote about this earlier this year.

🏃♂️ Health and wellness are taking center stage. A significant portion of UK consumers, especially younger generations, are increasingly prioritizing their well-being. This shift in focus is reflected in the increased expenditure on health-related products and services. We did some ONS data digging here to look at alcohol and health spend in consumer expenditure data.

🔎 The digital landscape is evolving, with cost-per-click normalizing and new marketing channels emerging. Anecdotally there isn’t a clear cut answer here - some have felt normalising CACs, others haven’t.

🤖 While artificial intelligence (AI) is opening up new frontiers, innovation extends beyond AI. There have been clear advancements in areas such as solar energy, energy flexibility software, and glucose monitors.

🆕 A new cohort of consumer companies is emerging, building on the successes of the previous generation. These companies are characterized by their focus on significant consumer issues like sustainability and health, their innovative acquisition strategies that leverage community and organic growth, their rapid yet cash-efficient growth, their ability to foster long-lasting customer relationships, and their visionary founders.

📖 The UK has a strong track record of producing successful consumer companies, with a steady stream of unicorns emerging each year. Case studies like Gymshark, Hims and Hers, Dollar Shave Club, and Oddity provide valuable insights into the strategies and characteristics that contribute to success in this dynamic market.

Consumer Market Maps 🗺️

Not on the maps below? Reach out (estia@ekavc.com) and we can add you for our second drop.

1. Beauty & Fashion 👗

2. Food & Drink 🍸

3. Wellness & Health 🏃♂️

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.

Oh, how undervalued this substack is…