This week, we wanted to showcase a podcast we’ve been following all summer: 99% Invisible’s “Not Built For This”.

The series investigates how climate change is impacting America's built environment, how communities nationwide are affected, and how disasters are exacerbating inequalities between the different groups. The series takes us from Vermont to California, Florida to Arizona, and exploring how communities are adapting to these new challenges across hurricane, fire, and flood.

How should we adapt our insurance policies as the weather changes? 🗞️

Recap on our climate x insurance thesis

We spent much of 2023 digging into Climate x Insurtech and mapping out the value chain from climate models, risk pricing, all the way down to climate-native insurers.

Since then, there have been increasing headlines around the housing and insurance problem. For example, see:

Kyla Scanlon’s Home Insurance is a Really Big Problem

Bloomberg Green’s Risky Business of Predicting Where Climate Disaster Will Hit

Google’s article in nature around Neural General Circulation Models for Weather and Climate (ok this is more on the climate modelling side but still fascinating!)

99% Invisible’s latest podcast was another great example to uncover the human stories and policy decisions that define who gets impacted and how communities recover — or don’t.

From here, we’ll be focusing on the complex world of flood pricing and insurance, examining who really bears the cost when the waters rise.

Flood insurance dilemma: rising waters, rising costs, and few long-term solutions.

Flooding is one of America’s most common and costly natural disaster, and managing flood risk has become a critical issue for homeowners, policymakers, and insurers alike.

The Federal Emergency Management Agency (FEMA) has played a central role in the National Flood Insurance Program (NFIP), which provides flood insurance to property owners, renters, and businesses. Traditionally, FEMA's approach to pricing has been to subsidize flood risk, keeping premiums artificially low to encourage participation. However, this strategy masked the true cost of living in flood-prone areas.

The image below showcases how the NFIP insurance premiums compare to the ‘true’ cost of risk. For example, areas in Florida and Western California are seeing +1000% rates of risk relative to the premium.

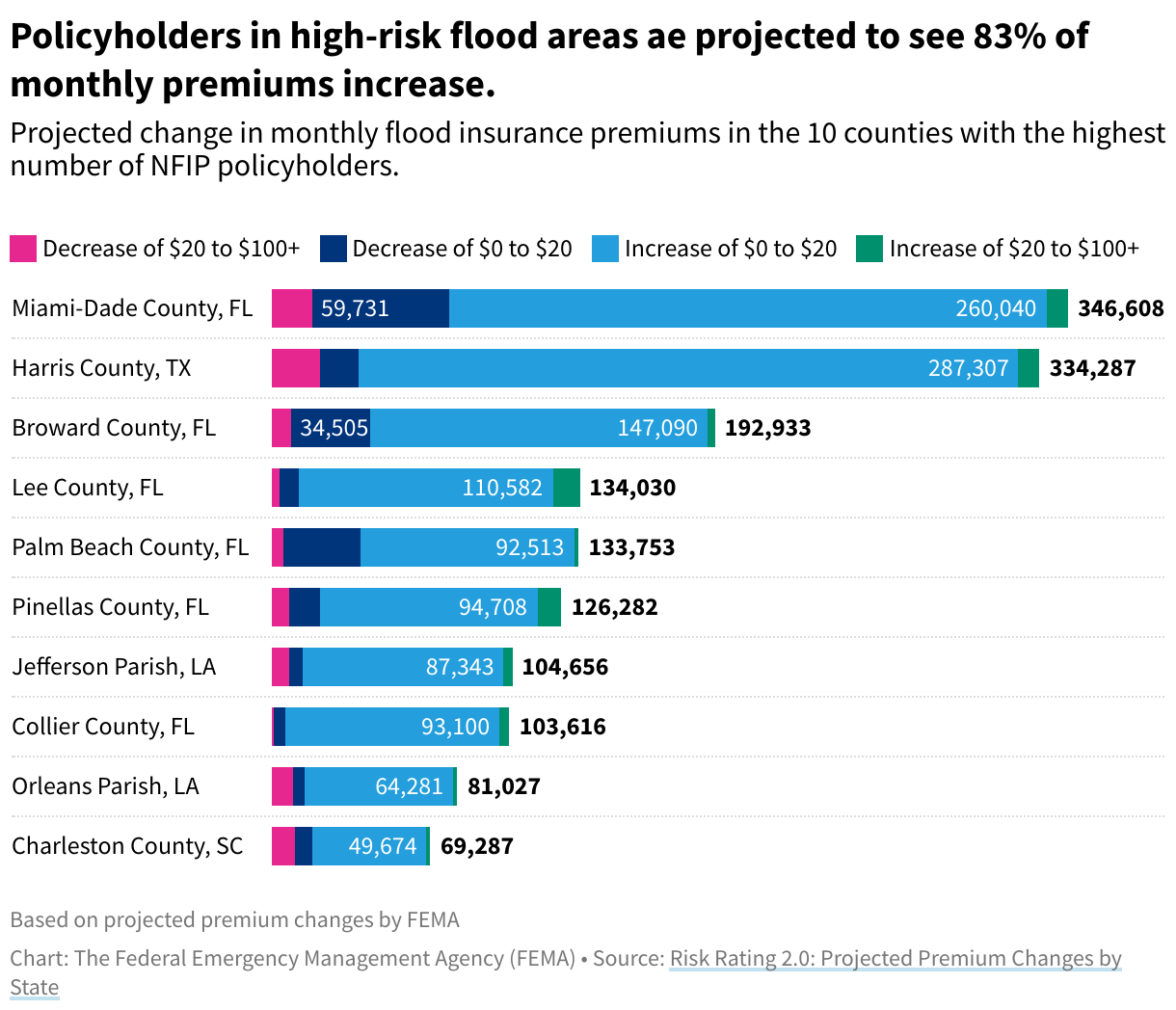

Recently, FEMA has begun phasing in a new pricing methodology called Risk Rating 2.0, which is designed to reflect more accurately the real risk of flooding. For some, this means a staggering increase in flood insurance premiums—upwards of 250% in certain cases. The goal is to make the NFIP more financially stable and ensure that premiums better reflect the actual risk of flooding. However, the rapid increase in premiums has sparked controversy and concern, especially for those in vulnerable communities.

An annual increase of $500-600 on flood insurance is bearable for many who are in steady employment, but will impact seniors or those on fixed income disproportionately.

How FEMA’s buyout program helps the most vulnerable with cash-in-hand.

The impacts of these rising insurance costs are not felt equally. Wealthier homeowners might absorb the increased costs or invest in mitigation measures, but low-income families face a much tougher choice.

In some areas, buyout programs are being offered as a solution. These programs provide cash incentives for residents in high-risk areas to sell their homes to the government, which then demolishes the structures and returns the land to its natural state as a floodplain.

While buyouts can reduce the overall risk and future cost of flood damage, they also dismantle communities and uproot families. Additionally, exchanges can take up to 4-5 years as people need to find a suitable home with close to zero flood risk, which FEMA approves for purchase.

The view across the pond: flooding in the UK

The challenges faced in the U.S. have parallels in the United Kingdom, where flood risk is also a growing concern. Like the U.S., the UK has had to grapple with the reality that certain areas are simply not built to withstand the changing climate.

Flooding was the largest component of weather related claims last year, at around c50% (or double that of burst pipes).

Flood Re, a joint initiative between the UK government and insurance industry, provides a level of protection by subsidizing premiums for high-risk properties, similar to the NFIP's approach before Risk Rating 2.0. The latest annual report shows that:

4 out of 5 households with previous flood claims continued to see a price reduction of c.50% after Flood Re’s inception.

99% of households at high risk of flooding can now obtain quotes from 15 or more insurers.

Looking ahead to policy, retrofit, and innovation to address increasing climate risk.

Our climate x insurance thesis maintains that asset owners, insurers, and consumers need to decrease their exposure to climate risk if we are to keep a functioning insurance system.

Retrofit is one part of this solution. Here, asset owners can start to map high risk properties and make relevant retrofits to enable better climate protection. Other solutions help homeowners understand how to upgrade their properties to achieve the same ends.

We are always looking for innovative solutions in or beyond our thesis. Don’t hesitate to reach out to us if you’re building here 👋

Week in Impact Articles ✍🏽

Monday: HVAC: the next frontier

Tuesday: How long until we’re all on Ozempic?

Wednesday: When grid power fails, can green energy keep data centres running?

Thursday: SoftBank-backed startup Enpal doubles revenue amid tough year for solar

Friday: Vitality sees 45% increase in claims over last five years

3 Key Charts 📊

1. Going from red tape to tailwinds with permitting reforms.

2. Breeze on hold with wind energy’s slow deployment.

3. The pharma turnaround: how J&J transformed into a medicine’s giant.

Eka Portfolio News 🎉

Murvah from Hived was recently featured in The Times 💪 . The interview covers her experience captaining Man City’s youth team, how football helped her learning to give direct feedback, and the importance of resilience & discipline in building a great business.

Runna x Strava are launching their latest Marathon partnership 🏃 . Off the back of the successful January edition, Runna x Strava are back with their in-month marathon challenge. Users must complete 42.2km in 30 days to win a year’s supply of running trainers.

Review of the Week 🗣️

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.