We’re publishing our latest deep dive on climate and insurance. In it, we explore the benefits of better risk pricing, diversity of hazard modelling, and high potential of home adaptation measures for an improved consumer experience.

As a very, very short summary:

📊 Insurance Trends: Extreme weather events are becoming more frequent. As a result, insured losses are growing at a rate of 5-6% annually, which are flowing through into home-premium hikes in the mid double digits.

🏦 Struggling Incumbents: Incumbents are caught up with rising interest rates, inflationary pressures, and of course rising hazard risk. Their return on equity has been slim relative to their cost of capital, and so urgently need to find profitable solutions.

🏡 Potential for Home Adaptation: Adapting consumer homes could be a critical solution to address 1) better consumer access with lower premiums, 2) improved insurer profitability, and 3) lower reliance on governmental funding for high-frequency low-loss events. One study found that basic flood resilience improvements could result in >50% reduction in hazard risk premiums.

🗺️ Market Map: Plotting 40+ global early-stage companies across the value chain, from data to underwriting to distribution.

📚 Three Playbooks: Writing our thesis on how innovators can best challenge, and help, incumbents with hazard risk using 1) better data, 2) improved models, and 3) home adaptation platforms.

Click here to view the report - happy holiday reading 🌎 🏦

Please reach out to us if (1) you’re building in the space, (2) have strong thoughts on our thesis, or (3) want to chat more generally about the work we’re doing at Eka!

Where we see value in Climate x Insurtech 🗞️

TLDR: the climate is warming, it’s hard to price, and everyone is footing the bill

Insured losses are growing at a 5-6% annual CAGR. Premiums are rising, and may become unaffordable.

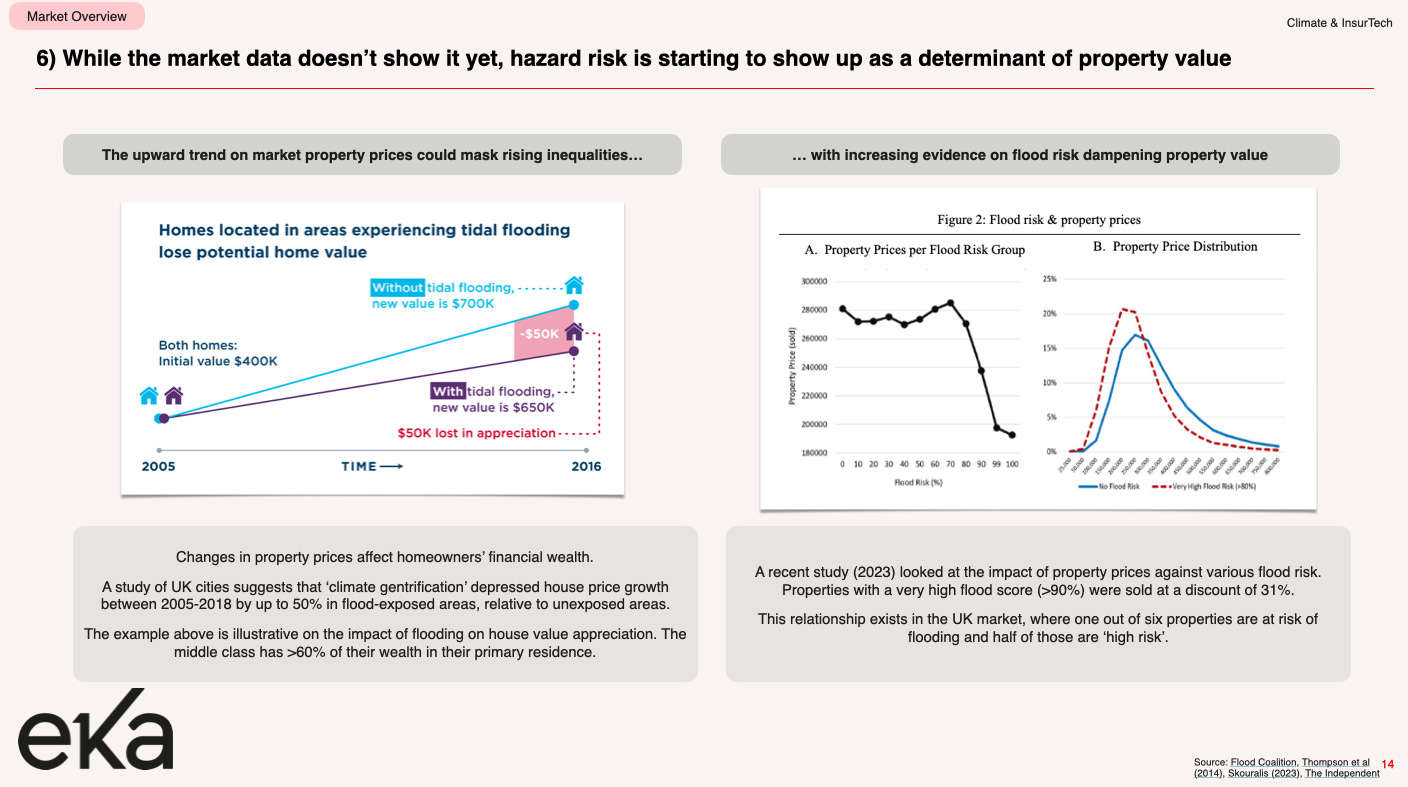

As a result, people’s homes may start to see decreasing value as risk rises.

Home adaptation has the potential to reduce climate-risk premiums by >50% if done right

We are excited about the entire Insurance spectrum, with a focus on (1) data & risk models, (2) marketplaces, and (3) home adaptation plays.

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.