This week, we went down to WebSummit along with 70,000 other attendees. The event was big, with over 2,000 startups and 1,000 investors. Climate and health were definitely on the agenda, with a few keynote speakers spread across the three days including the Vice Chair of Microsoft and CEO of Ovo. We summarise a few of the panels and our learnings below.

Our takeaways from WebSummit 🗞️

☁️ Carbon Innovation

The vice chair of Microsoft delivered a keynote on carbon crisis innovation. He noted that over 3,900 companies have made climate pledges worldwide. But a lot of these don’t go far enough, and aren’t achieved or reported on frequently enough.

He pointed to the UN report published last week (we wrote about this in last week’s newsletter). There were 51b tonnes of carbon emissions just this year. To reach our entire carbon ‘budget’, we can only emit a further 420b tonnes. There are a few enabling factors which we will we rely on around carbon innovation.

Data. We need to put new data to work. This was another consistent theme across various panels including Space Tech and Agri Tech who are monitoring biodiversity from space.

Markets. We need to build new markets (1/ carbon, 2/ waste, and 3/ electricity). While these already technically exist, they need to mature and become truly efficient and equitable.

Innovation. We need innovation around formalising these new markets, including new laws and policies. Quite a few talks included members from the Portuguese government who were explaining how they are approaching innovation and climate bilaterally.

Workforce. We need to foster new skills. This came up in a few other panels around building a new human capital stock, more specific to solving climate change issues.

There were several speakers encouraging funding towards adaptation as well as mitigation, given the current carbon outlook.

Key Point: Carbon innovation requires a variety of stakeholders beyond regulators to make markets more efficient.

⚡ Energy Transition

The CEO of OVO presented on the future of the energy markets. He spoke about the over-reliance on volatile fossil fuel markets, which have the opportunity to be smoothed as renewable power sources become more mainstream (spot the relevant graphic in our 3 key charts below!).

Squeezed middle. This energy crisis goes beyond the disadvantaged income classes. The ‘squeezed middle’ as he called it was also getting impacted.

Government support. While current UK government measures are set to drop off around April, he thinks there will be renewed support post April to continue helping the ‘squeezed middle’.

Housing stock. He mentioned that Europe has some of the most inefficient housing stock in terms of insulation and ‘leakiness’. Within that, the UK is also one of the worse-performing. There needs to be improved stock going forward and changes in existing stock for a more sustainable energy transition. While a lot of the work is around infrastructure changes, i.e. heat-pumps and better insulation, another important leaver will be smart behaviour change.

Changing behaviour. The second part of his argument around housing stock was more qualitative. Another important piece will be promoting consumer behaviour change (i.e. shorter heating times, smarter electricity usage). He said that it wasn’t Ovo’s role to tell people to use less energy, but it was their opportunity to provide consumers better advice about how they can make an impact.

Decarbonisation is a team sport. The responsibility for the energy transition isn’t in one stakeholder - it’s on everyone’s agenda. We need education on the consumer end (‘What is a heat-pump, what is smart usage?’), on the corporate level (‘How do I ensure the best sustainability plan for shareholders and consumers?’), and on the regulatory level (‘How do I make sure the rules are fair and equitable for all stakeholders?’). Looking at energy specifically, this needs to happen on the demand and supply side of the grid.

In the long term, he sees a decentralised grid system with hyper-local energy generation and consumption. This is a consistent theme we have been seeing across various supply chains (materials and fashion, travelling and tourism, farming and food consumption).

Key Point: Energy transition requires demand side and supply side changes, but the long-term energy grid will be very different to what it is today.

⛽ Alternative Fuels

Kiko Ventures presented with their portfolio company OXCCU spoke about their view on the future of alternative fuels. They see two predominant types of alternative fuels. The first is alternative biofuels such as hydrogen, which require redesigning entire structures (like the hydrogen airplanes). The second is ‘drop-in’ replacements. These can be plugged into existing engineering which is a positive for existing fleets.

Both speakers said these sources are not scaling fast enough. Kiko mentioned that in the UK, a lot of this is down to regulation. For example, it takes 10 years to take a new wind farm permitted in the UK. Hydrogen technologies in the first bucket require much more designing power compared to ‘plug-in’ fuels like sin fuels.

Key Point: Regulation needs to catch up and modernise to what is needed around alternative fuels.

💊 Psychedelics in Health

Ekaterina Malievskaia from Compass Pathways and Dame Til Wykes from King’s College presented on how psychedelics are improving mental healthcare. Compass Pathways recently published their trial results which posted a 20% success rate after three months to treat depression.

The selection criteria were very rigorous, with 233 participants starting out who had been treatment resistant for multiple years. The majority maintained the mental healthcare gains months beyond the trial.

Hype. Importantly however, both speakers mentioned that psychedelics will not be a miracle drug. The ‘hype’ around psychedelics are damaging for all stakeholders: investors are disappointed, and patients can have unrealistic expectations on their health outcomes.

Causality. There is also a causality question. There was prior and post treatment support for patients on top of psychedelic support. Understanding exactly what moves the needle will be important for scalability.

Cost. The treatment support makes the overall treatment expensive, but this is also necessary in assisting mental health support for patients. Dame Wykes made the point that many other physical health solutions are costly but we aren’t as concerned with high cancer costs, for example. She also said that ‘you don’t get skinny by taking steroids and watching the TV’ (our paraphrasing). Patients need end-to-end support which could include psychedelics supplemented with more traditional therapies.

Importantly, quality of care is very important in this space. Incumbents and start-ups need to avoid cutting corners to make sure standards are maintained, especially as psychedelics can create patient vulnerability. There are also a lot of things we don’t yet know in psilocybin and psychedelics. There are potential negative adverse effects which need to be explored.

Key Point: Psychedelics are making material headway in depression treatment, but we still have a way to go before making this scalable.

🤕 Addressing Chronic Pain

The Hinge Health co-founder Gabriel Mecklenburg presented on how his company is addressing the growing issue of musculoskeletal pain. They have raised over >$1b in funding.

In any given year, 1.7b globally will be affected by an MSK issue. In the US, 130m will be affected by MSK in a year (that’s almost 1 in 2 people). There’s an estimated $600b economic impact from MSK, which is roughly 1 in 6 of all health dollar spend in the US. It’s a leading cost driver for all employers. Cost of treatment has doubled in the past decade despite no improvements in clinical outcomes.

Today, Hinge is partnering with 1k large corporate clients in the US, which includes 21m covered lives and over 80% of market share for digital MSK solutions. There are three main pillars that Hinge Health is built on.

Reduce barriers to care. This is especially important for women’s pelvic health. 1 in 4 women are affected with pelvic floor disorders (higher than diabetes prevalence).

Human-centric care. Making sure that technology is fair and equitable.

Connected care. Going beyond technology and making sure there is a human-in-the-loop.

Hinge does this through personal trainer video visits, exercise therapy online, health education, and care team communication. They also have advanced computer vision full-body motion tracking. They say they need to work on making the device more inclusive for ethnic minority users as well as diverse body shapes.

Key Point: Health delivery needs to be accessible, human centric, and digitally scalable.

3 Key Charts 📊

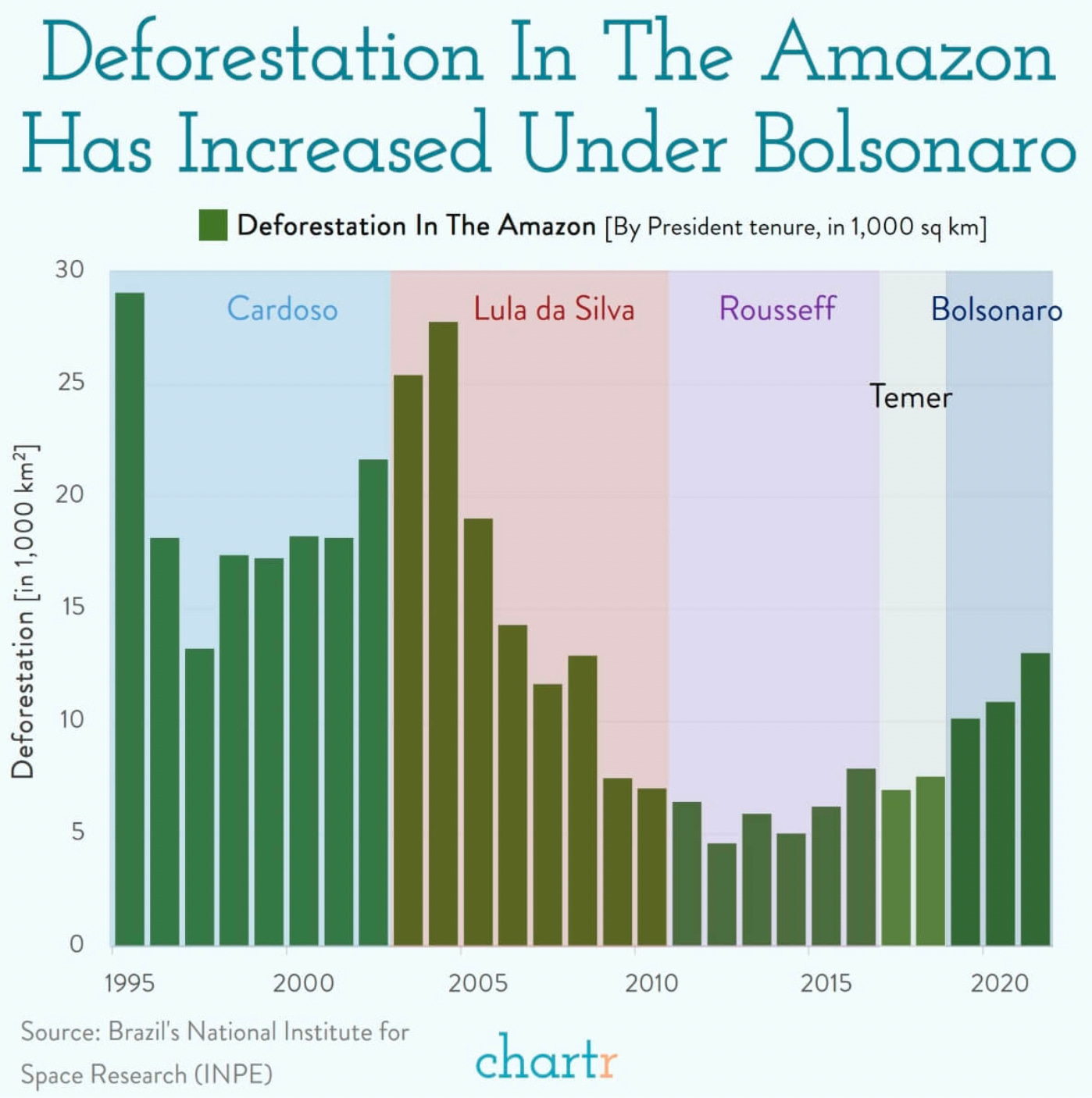

1. Deforestation was on the ballot in Brazil

2. Power output variation by source - the reliable renewables

3. VC negotiating power is back with the downturn

Deal Capture 💰

Deals in the impact space across the UK and Europe

Azowo

Mobility cloud service Azowo raised a €10m Series A round. Led by AEW Energie.

Howbout

Social app Howbout raised £2m in its seed round. Included ACF Capital, Supernode Global, and Boost Capital.

Orderlion

Food waste management platform Orderlion raised $4m in a pre-Series A.

Plend

Ethical consumer lender Plend raised £40m in its seed funding. Included both angel and VC funding.

Suri

Sustainable personal care company Suri raised £2m in a seed round. Included JamJar and Hambro Perks.

Stilride

Swedish e-scooter company Stilride raised €3.7m from angel investors.

Upcoming Events… ⌛

… you can catch us at in the not-too-distant future.

… and Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.

This is a great summary. Thank you for sharing!

Just an additional comment on the Amazon deforestation chart - the main drivers are the clearing for pasture for beef production (63%) as well as agriculture of animal feeds (about 9%, e.g. soy for mostly feeding poultry and pigs) that are then exported into Europe. Given the economic incentives driven by growing demand, the policy side and the consumer side (i.e. reduction of meat consumption) are probably both important in solving this issue.