The UN Intergovernmental Panel on Climate Change (IPCC) released a report ahead of COP27 in November. It updates policy makers on our progress against the 1.5C temperature increase limit. In 2019, the IPCC warned that CO2 emissions would need to be cut by 43% by 2030, but the current run-rate show these would increase +11% by 2030 instead. This is a small improvement on last year’s +14%, but the bigger picture is that we aren’t doing enough fast enough. We pick out interesting bits from the report below.

Taking stock on climate 🗞️

📅 Recent developments post 2010

First, a few negatives. About 58% of the net carbon emissions historically from 1850 were emitted between 1850-1989. The rest, 42%, occurred between 1990 and 2019. That’s a pretty steep increase on a time weighted basis (but that’s been well flagged in the past).

Net emissions have increased since 2010 across all major sectors. In 2019, about one-third of GHG emissions came from the energy supply sector, one-quarter from industry, one-fifth from agriculture, forestry, and other land use, and the rest from transport and buildings.

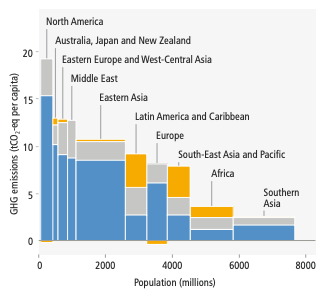

We know that production and consumption of emissions are distributed unevenly, both in present day but also cumulatively since 1850. The chart below shows net GHG emissions per capita and for total population in 2019.

The report splits emissions by production vs consumption accounting across various geographies. Most geographies have consumption broadly in line with production. The paper calls out that this isn’t a ‘static’ trend - i.e. quite a few (unnamed) geographies have already tapered their production-based emissions thanks to technological progress. The interesting divergent geography is Eastern Europe (higher production by 3 tonnes of CO2 per person). North America is not that much higher on consumption compared to production given their high skew of industry and energy production.

There are green shoots though 🌿! The unit cost of low-emission technologies has fallen continuously since 2010. The paper puts this down to several policy instruments which reduced costs, encouraged public R&D, and deployment subsidies.

🌍 Systems Change to Limit Warming

There are a few ways to limit warming. We are most interested in demand-side mitigation efforts. This involves changes in infrastructure usage, technology adoption, and behavioural change at the consumer level. The report estimates that demand side measures and new ways of end-use service provisions could reduce GHG emissions at the end-use end of the supply chain by 40-70%.

More efficient energy usage could improve upstream need for energy by 45% in 2050 compared to 2020. The report also mentions a better built environment, new and repurposed infrastructures with compact cities, co-location of jobs and housing, and reallocation of street space for active mobility as ways to improve overall GHG emissions.

Better city design and supply chain planning can help consumers improve access to sustainable nutrition, food waste reduction, adaptive heating, electric light-duty vehicles, and shifts to walking, cycling, and public transit.

The image above shows how demand-side mitigation can affect three sectors: nutrition, manufacturing, and electricity. We’re most excited about the technology-enabled change, which we think can have outsized impact compared to socio-cultural factors for example (though these have an important role to play in shifting consumer behaviour).

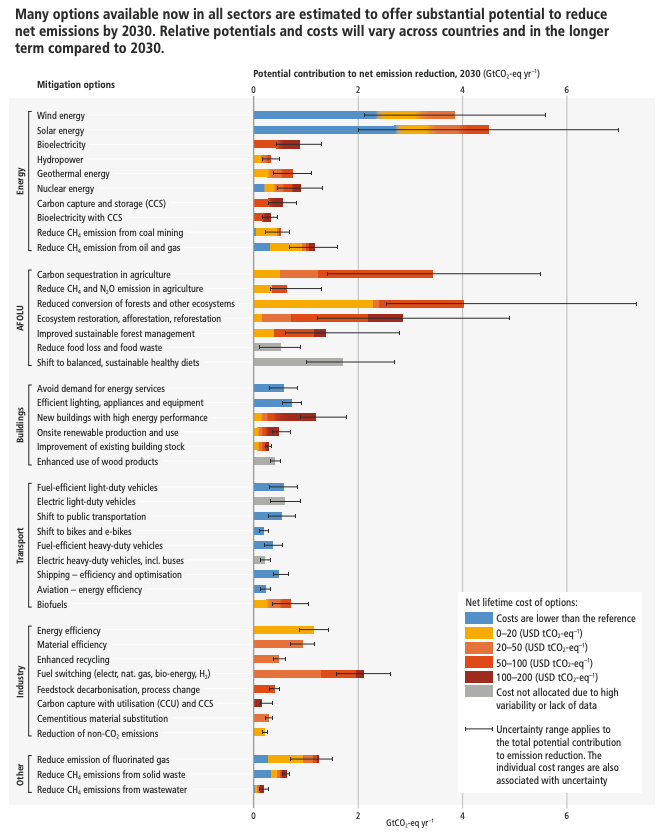

Then below, the report outlines mitigation options by different sectors such as energy, agriculture, build environment, transportation, and wider industry.

The negative effects of funding this transition are negligible compared to projected GDP. If we continue with the current 2020 pathway, global GDP reached in 2050 would be reduced by 1.3-2.7% assuming coordinated global action starting between now and 2025 to limit warning to 2C. This compares to the annual GDP growth reduction over the 2020-2050 period to only being down 0.04%-0.09%. Regardless of mitigation, global GDP is estimated to double between 2020 to 2050. Mitigation is cheap!

💪 Strengthening the response: the investment community can go further

A lot of the solutions presented by the paper are for policy makers (makes sense, given it’s supposed to inform policy making for policy makers 🙂). But towards the end, there is a callout for broad collaboration with business and private investment if incentives are correctly aligned.

Low-emission technological innovation is strengthened through technology-push investment, but also demand-pull policies like tariffs and taxes. Put together, these create incentives and market opportunities.

We’ve been hearing a lot around a second green-tech bubble, but the data suggests we need additional investment of 3x to 6x larger than current levels to get us to 1.5-2C scenarios by 2030. There are a few points worth calling out about the shortcomings of current investment philosophy:

Inadequate assessment of climate-related risks and investment opportunities

Regional mismatch between available capital and investment needs

Home bias factory

Having fair capital flows which match 1/ investment need and 2/ climate risks (beyond the GHG issue) is therefore important. But we also see the value in developing technologies where capital is readily available before scaling solutions internationally for the maximum impact.

The report gave us quite a lot of food for thought ahead of COP27. We are relentlessly positive on the opportunity to create shared value for people and planet. We also understand the sense of urgency around funding outlier ideas!

3 Key Charts 📊

1. Change in global value chains from segregated to integrate

2. Increase in disability reporting since Covid-19 in North America

3. Variation in life expectancy by gender

Deal Capture 💰

Deals in the impact space across the UK and Europe

Daye

UK Femtech company Daye raised a £10m Series A. Included Hambro Perks.

Heura

Plant-based startup Heura raised €20m. Angels include celebrities Ricky Rubio, David Broncano, and Sergi Roberto.

Okko Health

Eye care company Okko Health raised a pre-seed round of £2m. Led by DvH Ventures.

Oxford Medical Simulation

VR healthcare training company OMS raised £2.1m. Included ACF Investors and angel investor Dr. Nicolaus Henke.

Paebbl

Carbon storage startup Paebbl raised €8m. Led by Pale Blue Dot.

Ventive

Heat pump company Ventive raised £2.5m. Led by EMV Capital.

Upcoming Events… ⌛

… you can catch us at in the not-too-distant future.

… and Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.