The UK health system has seen an increasing backlog in patients in secondary care. Following on from last week’s issue on Covid and the labour impact, we unpack how the waiting lists have grown in hospitals and GP clinics. While Covid was a strong shock to the healthcare system, there has also been critical underfunding of the NHS which is putting healthcare access and quality at risk. The National Audit Office published a report in mid-November about how current plans to shift the backlog are not going far enough. We believe digital therapeutics and healthcare management systems have a role to play in helping alleviate pressures for the NHS.

The Doctor won’t see you now 🗞️

There have been quite a few articles in recent weeks (BBC, Financial Times) highlighting the impact of the NHS backlog on quality of care outcomes. Around 7m people are waiting for non-urgent hospital care. Only 61% of patients started their treatment within 18 weeks of referral, against a target of 92%.

The British Medical Journal frequently updates its backlog data analysis, which we highlight below. These figures relate to the backlog specifically in secondary care.

General backlog (bad)

The backlog was already quite high prior to the pandemic. In February 2020, there were already >4m people on waiting lists. The rate of growth has however increased significantly since June 2020. Even since lockdowns ended, this trend has continued at the higher rate seen during the pandemic.

Severe backlog (worse)

There has also been a growing ‘severe’ backlog, with patients waiting over a year to receive secondary care (below). There were 1.3k people waiting for over one year before the pandemic, compared to >400k today. This is over a 300x increase compared to pre-pandemic levels.

Hidden backlog (unknown)

Importantly, the data doesn’t cover the hidden backlog of patients who have avoided coming into secondary care for fears of a backlog. There isn’t a sure way of quantifying this, but qualitatively the number of electives and outpatient attendances is still well below pre-pandemic levels.

How did we get here?

While the Covid shock was a significant short term factor, there are longer term trends in the NHS which have also led to the current state of shortages. Following the financial crisis, the UK cut the increase in healthcare expenditure significantly. This resulted in a below-trend growth rate since 2010. Looking out, this will be compounded by high inflationary pressures across the UK budget which could see an even stronger decrease in real expenditure going forward.

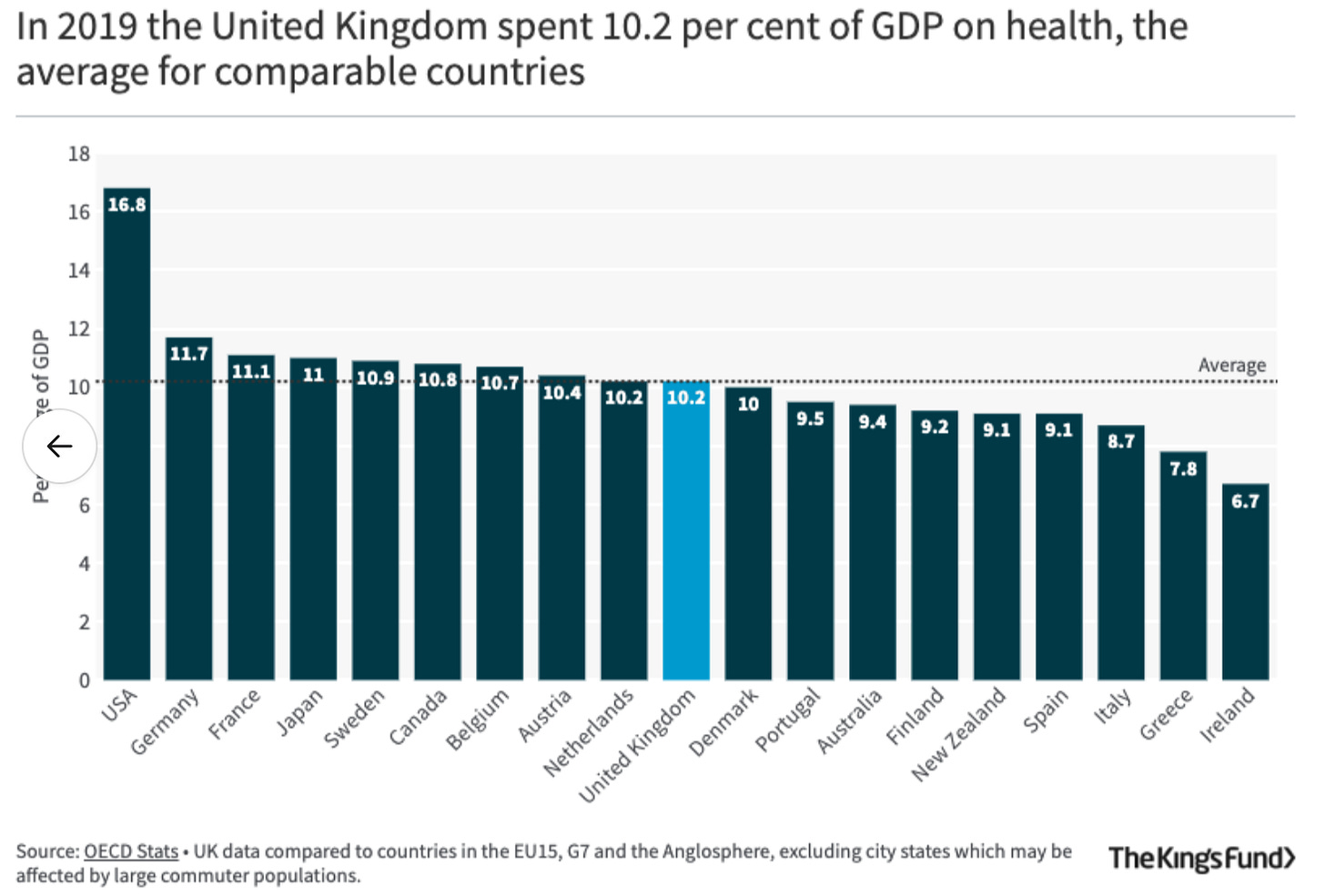

This results in the UK spending a much lower % of GDP on healthcare compared to other OECD countries. The graph below doesn’t account for differences in public versus private systems, but gives a helpful colour into broadly how spend breaks out across countries. The UK was at 10% of GDP in 2019 (pre-Covid) while Germany was closer to 12%. These are relatively small differences but we think the differences could get larger as the UK reigns in on budget in the coming months.

Outcomes for patients

Cancer care screenings are well below operational standards. Guidelines suggest that 93% of first consultant appointments for cancer care screenings should be within 2 weeks of an urgent GP referral. Currently, this stands at 73%. 85% of first cancer treatment should be within two months of an urgent GP referral - this is at 60% today.

A&E wait times are also up, with 44k people having to wait 12+ hours from decision to admission in September 2022 (compared to around 1k pre-pandemic).

Taking a step back: looking at GP care

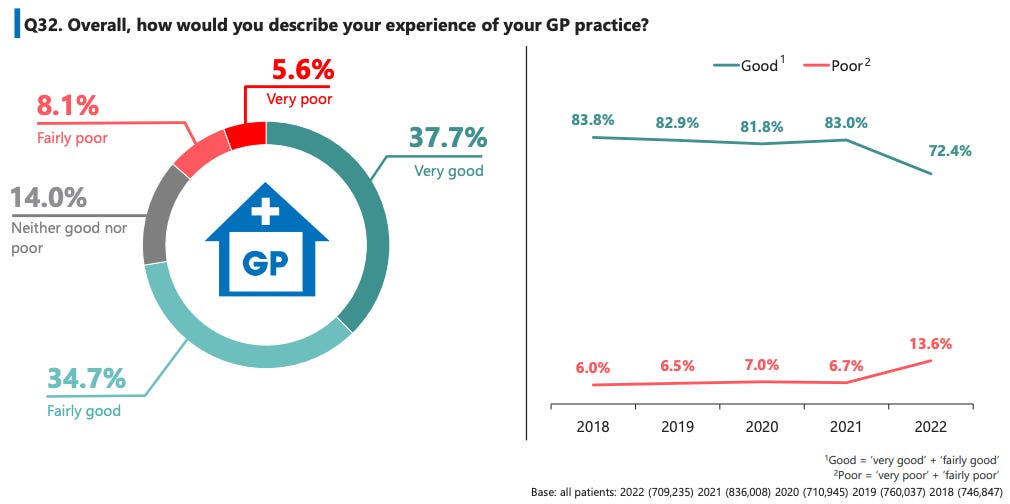

In order to understand hospital-based secondary care, we need to look at GP clinics themselves. The 2022 GP Survey conducted by the NHS and Ipsos Mori was recently published.

The 2020-21 figures will likely be distorted from the Covid impact, but 2022 shows the start of a downturn in perceived quality at GP practices. Previously, ‘good’ experiences had been around the >80% mark. This dropped c10pts in the last year. ‘Poor’ ratings were around the 6-7% mark, increasing to 14% in 2022 (the difference is in the ‘neither good nor poor’) rating.

GP access was another turning point. In 2021, there was a slight improvement in GP access via phone, which has now reversed to lower levels than pre-pandemic.

Turning to solutions: how tech can help

The government published a Delivery Plan to tackle the backlog earlier in 2022. The key points were around improving diagnostics testing, renewed focus on cancer screenings, and using technology to help alleviate outpatient appointments.

There have been alternative solutions proposed, such as encouraging chatbots like Wysa for the mental health backlog (1.6m currently), using AI tools like Symptoma to help with diagnosis, and developing the use of medical-grade wearables to help with health monitoring over time.

Virtual wards have also been implemented to improve home-based care in line with clinical standards. The cost savings are significant - Croydon NHS estimated to save >£700 per virtual ward bed compared to in-hospital care.

We believe that technological efficiencies on the healthcare supply side could help alleviate GP workloads, patient outcomes, and ultimately benefit the entire healthcare ecosystem.

3 Key Charts 📊

1. US consumers reigning in on volume (transactions)

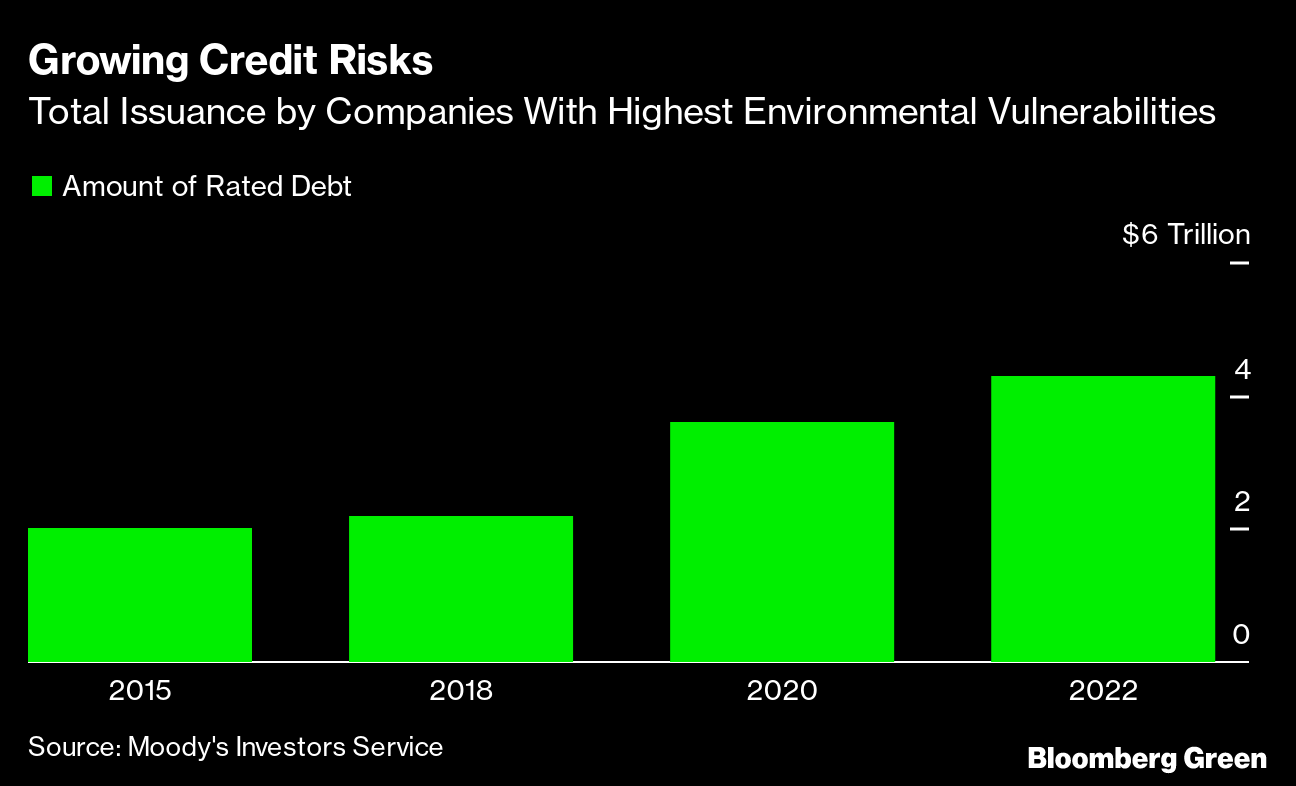

2. Increasing credit with high environmental vulnerability

3. Labour market is still relatively tight compared to recent crises

Deal Capture 💰

Deals in the impact space across the UK and Europe

Babaco Market

Grocery marketplace and delivery service Babaco raised a €6.3m Series A. Led by VC United Ventures.

Biorelate

AI drug discovery platform raised £6.5m in its Series A. Included YFM, Maven, Triple Point Ventures, NPIF, and Manchester Tech Trust angels.

EcoSync

AI energy management company Ecosync raised a £965k pre-seed round.

TreeCard

Green fintech company TreeCard raised £19m in its Series A. Led by Valar Ventures.

WeWalk

Visual impairment company WeWalk raised £2m. Included APY Ventures and Galata Business Angels.

Yeasty

Alternative protein company Yeasty raised a €1.4m seed round. Includes Asterion Ventures, Satgana, and Cameleon Invest.

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.