This week, we look at the impact that long-term illness has had on the UK workforce. In a three year period, economic inactivity due to long-term illness has gone up 41%. Some of this is down to long Covid, but there is also a wider structural trend around mental health across younger age groups. We dig deeper across a few datasets to analyse the impact on the workforce.

Where have the workers gone? 🗞️

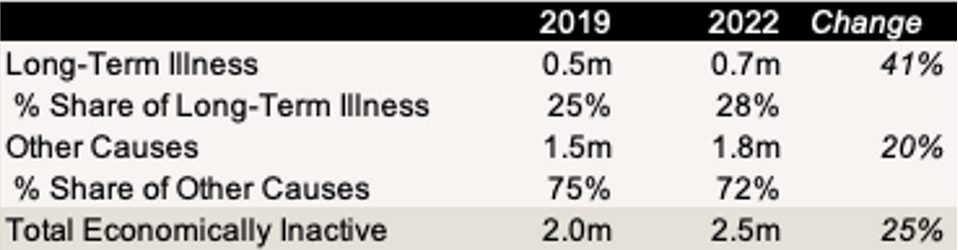

There are now a total of 2.5m economically inactive workers in the UK. This has seen a steep rise since 2019, when the figure was closer to 2m. As Robert Preston wrote a few days ago, half a million incremental workers dropped out of the workforce due to long-term illness since 2019. Within this number, Long Covid could be less than a fifth of cases, with younger people seeing disproportionately large increases. Some of this could be due to the long NHS wait-times and an ageing workforce, but these two forces don’t seem to fully account for the increase.

The chart below shows the cumulative change in number of 16-64 year olds who are inactive due to long-term sickness (seasonally adjusted).

How big is the problem? The causes of economic activity are varied, but long-term sickness is an increasingly common for this at around 28% of all those out of the labour market between June and August 2022 (slight increase on 25% at the start of the Covid-19 pandemic). As shown below, this implies a much greater increase in the long-term illness worker growth compared to other causes.

Where is it in the data? The ONS wrote on this extensively a few days ago. It buckets this in a few different ways including mental illness and nervous disorders, depression bad anxiety or nerves, problems with back or neck, and progressive illness (cancer). Most likely Covid will be spread throughout these and won’t have one specific categorisation.

Who’s most affected? When we look at the breakdown by age, we can see the younger age groups had a higher growth rate in economic inactivity compared to the middle and older age segments. The fastest growing segment was 25-34 year olds at 42% growth between Q2 2019 and Q2 2022, followed by 16-24 year olds with a 29% increase. This is off the back of a smaller baseline (see the absolute numbers on the left hand axis) but directionally it is still surprising. Another cause in the younger age groups rise was around mental health around depression, bad nerves, or anxiety.

Where were the workers before? The data suggests a strong inflow from Covid disrupted sectors like retail, transportation, and accommodation. The lowest paid occupations also over-indexed within the long-term sick mix.

How does this compare to unemployment & job listings? This is the number of vacancies across the UK, according to the ONS. These saw an initial uptick during the pandemic but have recently slowed as the economy has cooled.

The unemployment rate is indirectly related to the above but has been consistently trending down since the UK economy reopened. Exactly what happens to the future labour market is still in the air given the uncertainty around its influence (and impact) with the potential recession.

Why does it matter? Treating long Covid to ensure workers can have productive output will be an important task in the next few months. Visible recently raised a pre-seed round with the aim to find treatments for long Covid. In our view, this goes beyond a Covid issue and into a broader mental health and social wellbeing discussion.

3 Key Charts 📊

1. European gas storage in a better shape than 2021

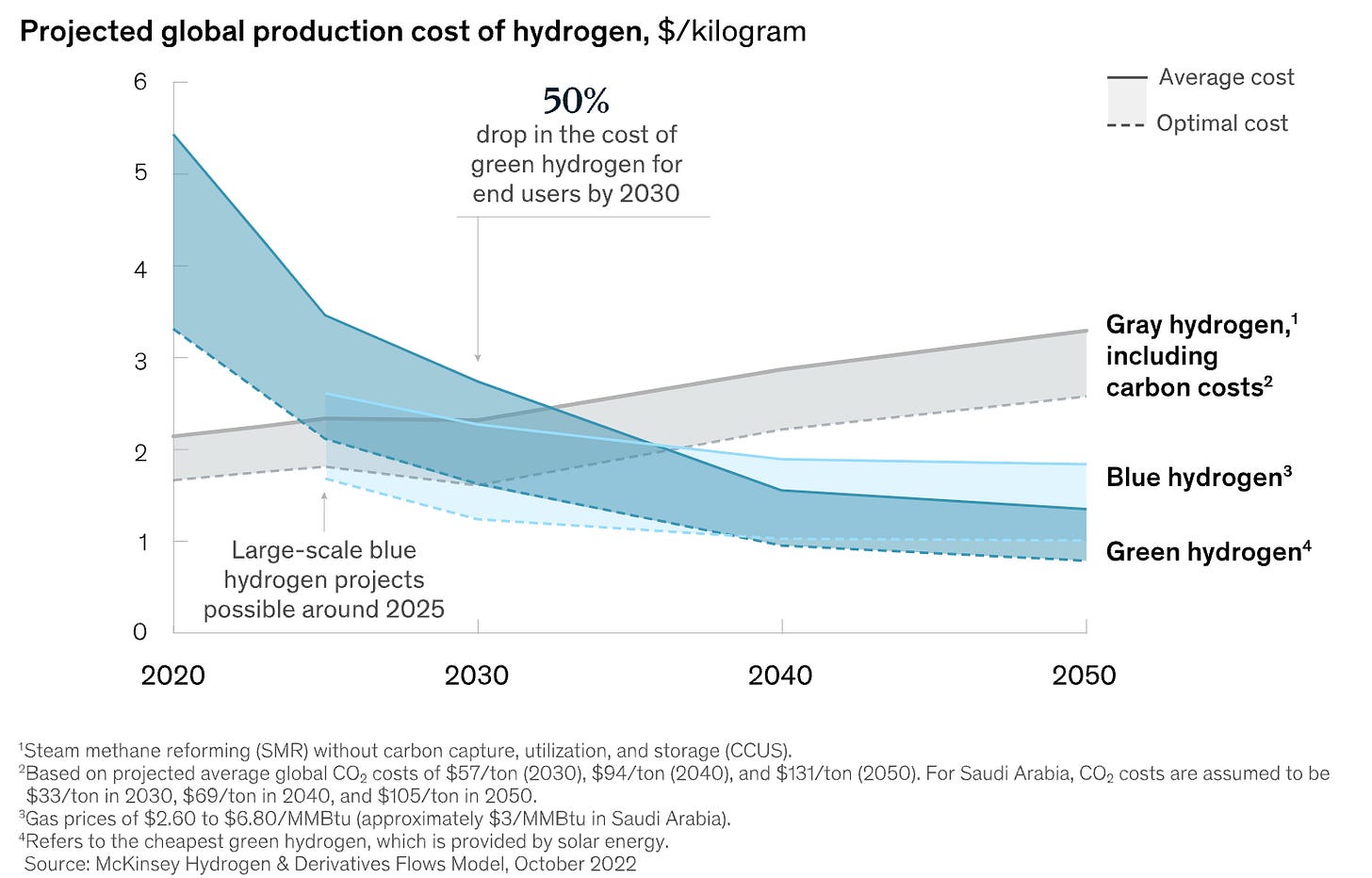

2. Hydrogen is becoming more affordable

3. Geographical differences of EV sales in recent months

Deal Capture 💰

Deals in the impact space across the UK and Europe

Circularise

Waste company Circularise raised €11m in a Series A. Led by Brightlands Venture Partners.

Bright Biotech

Regenerative biotech company Bright Biotech raised £2.7m.

Evyon

End-of-life EV battery company Evyon raised a €8m pre-Series A round.

Fiils

Sustainably toiletry and BPC company Fiils raised £4m. Included Aircore Ventures.

Julienne Bruno

Alternative cheese producer Julienne Bruno raised £5m. Led by Cherry Ventures, Outsized Ventures, Seedcamp, and Nicoya.

Visible

Long Covid startup Visible raised $1m in a pre-seed round. Let by Octopus, Calm?Storm, and Hustle Fund.

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.

Nice piece. I wonder how much 1) return-to-office policies and 2) lack of face-to-face training & teamwork during COVID have also discouraged young people to find a traditional job post-Covid. Moreover, the mix of inflation and anti-buy-to-let policies makes places have propelled the rental costs in cities like London, further squeezing out young people in lower-income job professions.