We’ve gone through 20 prediction pieces and picked out the most exciting ideas for 2024 across Climate & Health, with some added Eka sparkle! ✨

In climate, we’re excited to see the early innings of a Virtual Power Plant, the next phase of decarbonised logistics, and circular economy tying up loose ends.

In health: we will move from AI-innovation to AI-application which will unleash a new wave of digital-first, patient-centric solutions. We will also see the second-order effects of weight-loss drugs, and some consolidation away from domain specific point-solutions to domain specific platforms.

Get ready to embark on a journey into the future with Impact-Optimism for 2024 🗞️.

Impact-optimism for 2024 🗞️

Here’s your one-stop shop for predictions across our two Impact themes: Sustainable Consumption & Consumer Health.

🌏 Sustainable Consumption “Climate Tech”

1. The year of the Virtual Power Plant ⚡

As Wills Wells wrote earlier this week, “we’ve yet to see one Digital Power Plant (DPP) 💍 to rule them all, but progress to link up EV chargers, storage & renewable assets will unlock bottlenecks”.

Virtual power plants are beginning to make a dent in grid energy operations driven by:

Increased growth of decentralised energy assets in the home.

A grid that's under increasing pressure due to energy security issues (Iran, Russia) and increased renewable penetration.

Regulatory policy such as virtual power providers being able to access wholesale markets in 2024 (see here).

Startups such as Axle Energy beginning to provide these services.

Hamish has written lots and lots about this - reach out to him if you’d like to chat more.

What changed in 2023:

Deployments. “Solar panel deployments broke the previous record set last year by over 50%, with more than half the worldwide total installed in China. Wind turbine, heat pump, and electric vehicle sales likewise set records globally in 2023” (Yale Climate Connections)

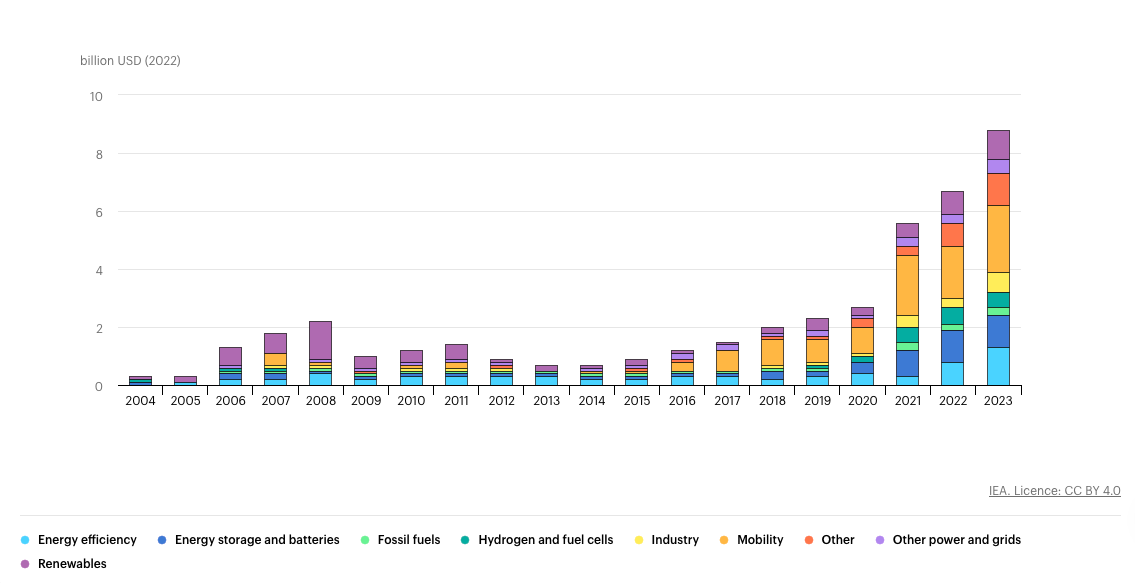

Investment Funding. The amount of venture funding in the space (see the IEA chart below), with Powerhouse reporting that 40% of funding went to hardware vs. 60% on software.

Home crisis. A continued home energy crisis, with 4 in 10 energy bill payers struggling to afford payments in the UK as of December 2023.

(See venture funding below for various energy areas).

Startups to watch: Arcadia, Enpal, 1Komma5, Tibo Energy, Axle Energy.

2. Climate adaptation moves from fringe, to centre stage 🌧️

Forbes wrote about adaptation in their 6 climate predictions for the year ahead.

Adaptation made headlines when it was the US’s Fifth National Climate Assessment mentioned adaptation >50 times (actually almost x2 more than mitigation) in the release. In short, the impact of climate change is already here and organisations are starting to spend more time on adaptation.

We published a note late last year about our thesis in Climate x Insurtech, with much of the companies playing in the adaptation phase.

Startups to watch: Jupiter, Mitigrate, Futureproof.

3. Mobility enters its next phase: heavy transportation 🚚

Mobility has been the black sheep in climate venture funding (if you’ve missed the debate, see below).

Inc42 wrote about “large-scale mobility is anticipated to receive more attention and funding since the potential to change the market is immense in such models”.

Whether it’s electrifying planes (Ampaire’s hybrid planes), boats (Candela’s electric hydrofoil), or trucks (Tesla’s Semi Truck), the world is moving much closer to de-carbonised logistics.

Startups to watch: Minimal, Ember, Hived.

4. Moonshoots continue around green hydrogen and nuclear ☢️

A lot of predictions focussed on green hydrogen (Inc42, Firstminute, Climate Insider), with some focus on nucelar (CTVC).

There are 60 power reactors being built in 17 countries, according to the World Nuclear Association. As an example, the US saw the opening of a new nuclear power plant (Vogtle) in 2023. One UAE project aims to supply 1/4 of the country’s energy over time.

Moving to Fusion, the UK updated its dedicated fusion strategy with a £650m package last October. The majority of this will go towards design and testing.

Yesterday, the UK Government published a roadmap explaining how the UK will increase nuclear generation by up to 4x to 24 GW by 2050. Fission could come back in vogue given similar issues outlined in (1), i.e. energy security and renewables volatility.

Startups to watch: Koloma, Tokamak, Helion Energy, Sunfire

5. Circular economy ties up loose ends🥻

Today, the global economy is now only 7% circular (Circularity Gap).

In the circular economy, the traditional linear "take, make, dispose" model is replaced with a closed-loop system that promotes resource efficiency.

Industries are increasingly prioritizing recycling and reusing materials to minimize waste and environmental impact. Innovations in recycling technologies are paving the way for more efficient and scalable solutions, transforming waste into valuable resources.

One dark horse could be TikTok’s marketplace with an estimated 40% of TikTok users buying or selling items from the TikTok shop by 2026 (Environmental Journal).

Startups to watch: Hurr, UseAgain, Ooodles, Backmarket, ByRotation.

Consumer Health “Health Tech” 🥗

1. Turning from AI innovation to AI application 📝

We saw a lot of activity in Health x AI last year.

The first half of the year was focussed on health-foundational models such as Hippocratic AI and Alana in the UK.

As the year went on, we saw a shift in attention towards co-pilot solutions like Corti, Tortus, and Nabla. We believe that this co-pilot trend will continue with a strong focus on task-specific (and over time, platform-level) for clinicians and broader health workers.

Startups to watch: Hippocratic AI, Abridge, Nabla, Tortus, Islacare, Flok.

2. Automating healthcare ops picks up pace 🤖

Following on from AI Application, we anticipate continued focus on streamlining operations as seen with Healthtech 1 and Cohelm.

We saw many point solutions getting funded here in 2023, and anticipate 2024 to be a mix of M&A, organic product & vertical expansion, and incumbents who will capitalise on the tough funding environment.

Google’s Health lab wrote an interesting post on this: “according to the (WHO), there were about 28 million nurses in the world in 2020. Save them just five minutes a day, and that's 266 years better focused on patient care.”

Startups to watch: Phare Health, Healthtech 1, Cohelm.

3. Consolidation in health point solutions: birth of the super-platform 🛍️

Since the beginning of Jan 2024, we’ve spoken to many investors who are seeing M&A across certain verticals (e.g. consolidating wellness brands, women’s health, or beauty companies).

Many healthtechs saw bridging rounds in 2022/23, which likely won’t be repeated in 2024/25. This should signal positive M&A opportunity for financial & strategic buyers.

One of the most memorable moves here last year was General Catalyst’s plan to buy a Health System, which it outlined in a thesis post here. The system will be focussed on three things (in quote):

“Working with our 20+ health system partners to help them develop and execute their transformation journey to health assurance;

Helping to catalyze the health assurance ecosystem, building an interoperability model with technology solutions including a subset of our health care portfolio companies to drive this transformation; and

Acquiring and operating a health system for the long term where we can demonstrate the blueprint of this transformation for the rest of the industry.”

Startups to watch: Not startups but two funds that are interesting: Enduring Ventures, **Resurge Growth Partner, or consolidator Octillion.

4. Longevity tech becomes mainstream 👵🏾

Longevity tech has been around for a while. See Whoop, Oura, or Eight Sleep as the first wave of these technologies.

In 2023, there was renewed focus on longevity following Peter Attia’s wild success with Outlive (side note - Lifespan is an equally exciting read from 2019 on similar ideas, often quoted in Outlive).

One quote in Bessemer’s 2024 Health Outlook summarises this well.

If you want to read more on Longevity - NFX wrote a great primer in Aug 2023.

Startups to watch: Zoe Health, Clock Bio, Holly Health, Runna, Oxcan.

5. Nutrition: A) Second-order effects from weight loss drugs, B) personalised nutrition medicine gathers pace 💊 🥒

In 2023, Novo Nordisk announced the launch of weight-loss drug Wegovy in the UK for people living with obesity. GLP-1s have been available for diabetes in the mid 2010s but was only cleared for weight loss since 2021. This year, we will be looking at the second-order impacts from Wegovy such as its (potential) impact on nutrition, alcohol consumption, and sleep.

More broadly, nutrition is coming into the limelight again (specifically, nutrigenomics).

Imagine receiving a diet plan specifically crafted for your body's response to certain foods, taking into account your genetic predispositions for weight gain, nutrient absorption, and potential food sensitivities. Companies are investing heavily in developing algorithms that can analyze vast amounts of personal health data to provide customized meal plans, fostering a more sustainable and effective approach to weight management.

Beyond wellness, there are companies like Faeth who are using nutrition & the power of metabolism to fight cancer.

Startups to watch: Heali, Faeth, Embla.

Week in Impact Articles ✍🏽

Monday: Debunking A Biased Report On EV Subsidies

Tuesday: Only 7% of US climate tech venture capital funding went to female founders in 2023

Wednesday: They’re Not Like Regular Dads. They’re Climate Dads.

Thursday: NHS England published heavily redacted Palantir contract as festivities began

Friday: UK Scientists Developing Smart Headband to Stop Teeth Grinding and Jaw Clenching

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.