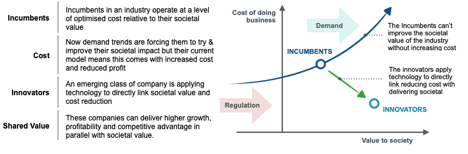

At Eka Ventures, we back founders building consumer technology companies with the potential to build outlier shareholder value in parallel with societal value. We call this building “shared value” (explained in the diagram below).

We have spent the last year building an investor base that shares this outlook and we are delighted that Big Society Capital, a leading financial institution dedicated to social impact investment in the UK, has played an instrumental role in Eka’s first investment into Urban Jungle, a fast growth insurance technology company. Urban Jungle is a great example of a company that we believe exhibits this shared value potential.

The challenge that Urban Jungle is addressing (Shared value thesis)

Urban Jungle is a technology enabled insurance provider on a mission to transform the £5bn UK home insurance market. Urban Jungle is best known for its monthly contents insurance product that has been designed to serve the needs of renters.

Insurance, when done well, provides a critical safety net in modern society and is a core component of achieving financial inclusion, providing individuals with security during periods of great stress and uncertainty. Whilst most families will have some savings, few have enough to deal with a financial shock like losing all of their possessions in a fire or flood.

The basic premise of running an insurance business is assessing risks and designing and pricing policies to match the risk. Today, insurers use a range of data to assess risk, many of these datasets are based on credit scores and demographic data with customers being grouped into broad “risk buckets” rather than being assessed on their individual risk. For example, age is a very common characteristic used in insurance pricing and it goes without saying that there is a huge variation in the risk profile of people who just happen to have been born on the same day. Insurers sometimes even use similar datasets to try and predict which customers they can charge an increased price and their likelihood to switch. Incumbent insurers make limited use of new or emerging sources of data which can give strong reads into the behaviour of an individual.

This has led to an industry that under-serves those that need insurance the most, with only 43% of households in the bottom income decile having contents insurance vs. 92% for the top decile. It has also resulted in vulnerable consumers being exploited by the industry. The FCA found that 1 in 3 consumers paying the highest premiums had at least one characteristic of vulnerability, such as having lower financial capability (the ability for an individual to manage their finances well). The regulators are currently evaluating what changes need to be implemented to ensure that insurers treat customers more fairly.

Urban Jungle are taking a lead in solving these problems which are a core part of their Company mission, which is incorporated in their articles “to build an insurance brand which is fair and transparent to all customers, and has a positive impact on our shareholders, employees, community and environment.”

Urban Jungle was founded by Jimmy Williams (CEO) and Greg Smyth (CTO) with a vision to use data and product design to more effectively and fairly serve the whole insurance market.

Urban Jungle is doing this in three ways:

Behavioural data vs demographic data: they assess and price an individual on factors that they can control (behavioural factors) rather than factors that are outside of their control (demographic factors), meaning customers get a fairer deal

Product transparency: they focus on making sure that people clearly understand what they are buying by ensuring that their insurance product, including terms and conditions and the claims process, is transparent, easy to understand and flexible so that customers can buy only the cover they need, when they need it.

Reaching out to customers where they are: Urban Jungle plays an active role in letting a new audience know about their insurance options, with up to 50% of their customers buying insurance for the first time. They do this by reaching out to customers in an accessible manner wherever they are, whether that be on Instagram or Facebook or working with like-minded partners such as Clearscore and Monzo who are united in their objective of making financial services customer centric.

To achieve this vision, the team has built an insurance company from the bottom up using technology. They have designed a straightforward consumer application process and streamlined customer service supported by a technology platform that is designed to collect sophisticated behavioural data, which it uses to better understand risk.

This approach enables Urban Jungle to assess individuals on merit rather than group that individual within a “risk bucket.” As a result, they can also more effectively identify and prevent fraud which allows them to provide insurance cover to individuals who could not previously access it while maintaining strong underwriting performance.

Urban Jungle’s route to market & execution (Consumer Technology thesis)

One of the characteristics that Eka looks for in founders is an ability to prioritise clearly and execute in a focused way. This is something we saw in Jimmy & Greg, by focusing on a specific, poorly served, customer segment (contents insurance for renters) they were able to rapidly establish their brand and innovate the industry approach to serving customers and assessing risk.

Jimmy & Greg saw a clear market opportunity to build a brand focused on renters. Renters are forecast to account for 42% of the housing market, 25% being private rentals by 2025 (as seen in the diagram below) but they are poorly served by incumbents. Content insurance penetration is c.45% vs. 94% for homeowners (as seen in the diagram below) and renters have different needs to homeowners, for example insurance that is suitable for shared housing or greater policy flexibility because they move around more.

Urban Jungle offers contents insurance products specifically tailored for renters. The customer journey is straightforward, with fewer questions than the typical process and provides customers with a quote for a monthly policy (no cancellation fees!) with prices starting at £5 a month.

Since Urban Jungle launched their proprietary contents insurance product, it has scaled rapidly to 20,000 customers and over 1,000 five-star Trustpilot reviews.

The Founder’s (Founder thesis)

At Eka, we believe that a founder’s ability to develop with their business is the single biggest driver of success. 90% of European technology companies that get to a $1bn+ are still led by the Founders and this was also something that we had seen anecdotally in our experience as investors; the very best Founders we invested in had grown over time and scaled their skill set in tandem with the growth of the company. As a result, when we look to invest a core part of our process is assessing through interviews, psychometrics and references, whether we believe the Founders have the ability to take the business all the way.

Greg (Founder & CTO) and Jimmy (Founder & CEO) have consistently impressed throughout this process and have a rare founding team combination of both exceptional technical and strategic capability, combined with a raw tenacity and hunger to change the World that we rarely see. This inspires strong advocacy across all stakeholders, be it employees, customers, industry partners and investors.

In summary, we are delighted to be part of the Urban Jungle journey and are looking forward to working closely with the team to build an insurer that is using technology to create shared value — both a better and fairer customer experience with stronger profitability through more accurate underwriting and strong technology led operational efficiency.