The last few weeks have been full of S-1/F-1 filings: Klarna, Coreweave, and now Hinge! This week, we’re taking a look at what the S-1 tells us about:

the huge demand for digital treatment,

how AI impacts the unit economics of care delivery, and

why we still need public-health native AI players within high volume / high burden conditions.

Let’s dive in!

Hinge’s S-1 filing: evidence that AI-driven treatment in musculoskeletal conditions has Shared Value 🗞️

There is clear demand for digital treatment within MSK care

There is a huge opportunity to use AI to transform how individuals approach physical therapy, treatment of chronic and acute pain, and care management for musculoskeletal (MSK) conditions. Within the US alone (Hinge's core market), c.40% of adults suffered from an MSK disorder in 2021. According to the MSK TAM Report, MSK medical costs rose to an estimated $661 billion in annual aggregate total direct spend in 2023.

Based on Hinge’s analysis of Health Claims Data, over $70 billion of that spend is on physical therapy. MSK conditions incurred an additional $624 billion in indirect costs, such as worker productivity loss, resulting in an estimated total MSK burden of nearly $1.3 trillion. We know there is a similar shape in the UK regarding direct & indirect burden.

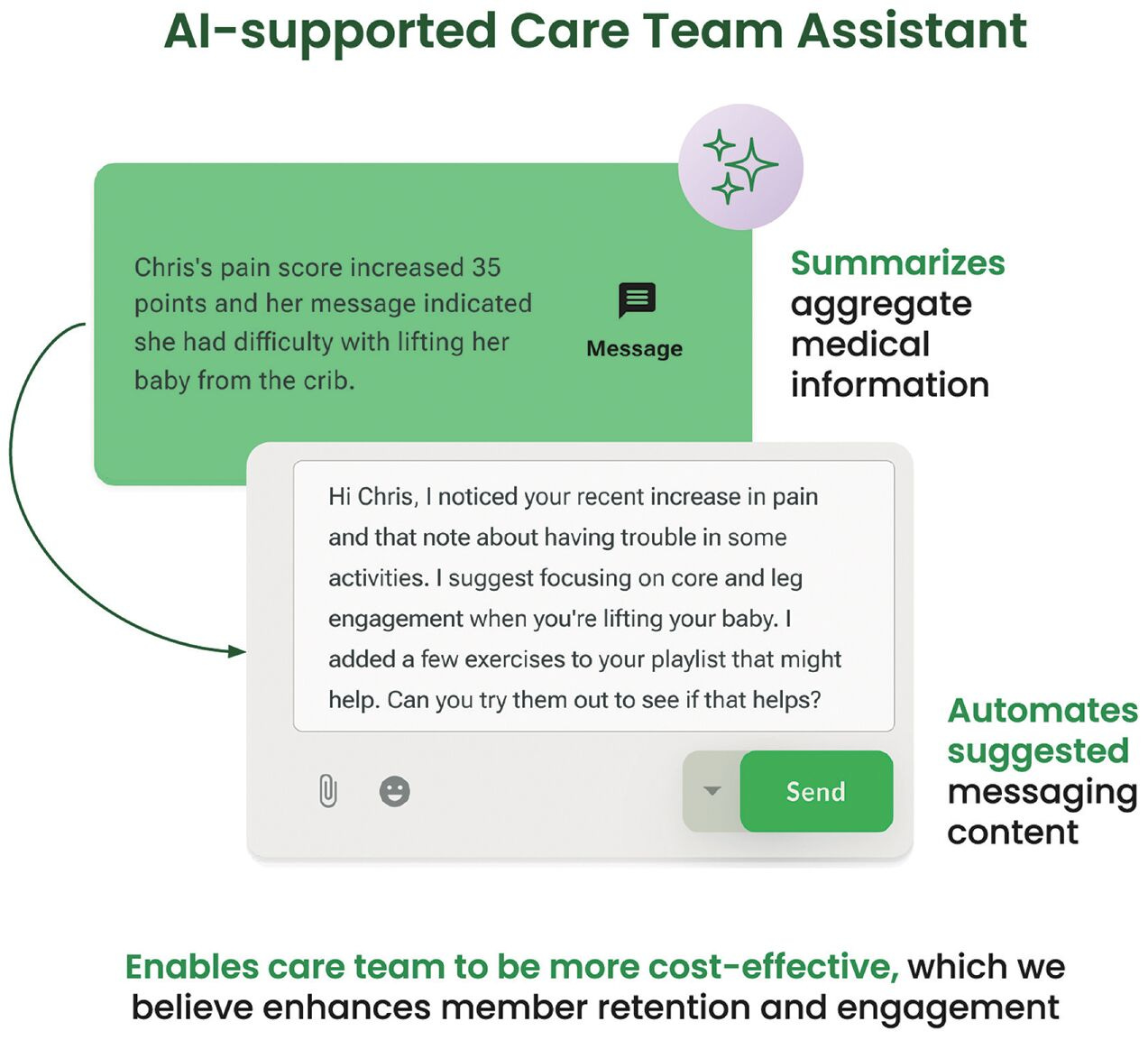

AI improvements within the structural unit economics are strong

Hinge’s gross margin went from 66% in 2023 to 77% in 2024 - an 11pt increase (!). Yes there is probably some IPO impact (prepping the financials 1-2 years out) but regardless an 11pt increase is huge.

They list their AI technology advantage as: “proprietary exercise personalization engine leverages machine-learning from more than one million lifetime members that have used our platform and has tracked over 65 million activity sessions and 30 million member-reported outcome logs as of December 31, 2024”.

Hinge didn’t give much colour on cost per life, but we can see do (very!) rough back of the envelope calculation as they tell us they have c.20m contracted lives and 2,250 clients in 2024. Revenue was $390m in 2024. This isn’t perfect as there are likely onboarding fees and/or member sign up periods which don’t totally tally up.

$390m across 20m lives is $19.5 per covered life. They also share they have 532k members (2.6% of the total base) as of Dec ‘24 (they don’t specify the activity level). Looking at it this way, revenue per member is closer to $733. Monetisation isn’t per-user but rather corporate contracts on the large part, but it’s still indicative of roughly where Hinge is being priced at.

There will however be clearly differentiated AI-led models across the market

This will depend on ultimate steady-state gross margin unit economics. Hinge printed $45m free cash flow this past year but they’ve cut loads of their R&D spend and are still spending a LOT on marketing (43% of sales in ‘24, and 50% of sales in ‘23). Hinge did -69m of FCF the previous year (pre IPO normalisation). They aren’t profitable on a net income basis.

Steady state unit economics will likely have been communicated during the IPO process, but we will wait and see post listing to see if they share any more information here!

Positive clinical outcomes are clear in the early data

Hinge’s participation in public health is still in the early stages in the USA

Hinge Health has been expanding its presence in government-funded healthcare programs such as Medicare and Medicaid, positioning its MSK digital care solutions within these markets. According to the S-1 filing, Hinge Health sees 112m lives as addressable under government healthcare programs, including Medicare and Medicaid, estimating this as a $9 billion market opportunity. Today, it’s still quite early in deployment into this population but has introduced programs tailored to Medicare Advantage populations, including a fall prevention program, aimed at reducing hospitalization and costly interventions.

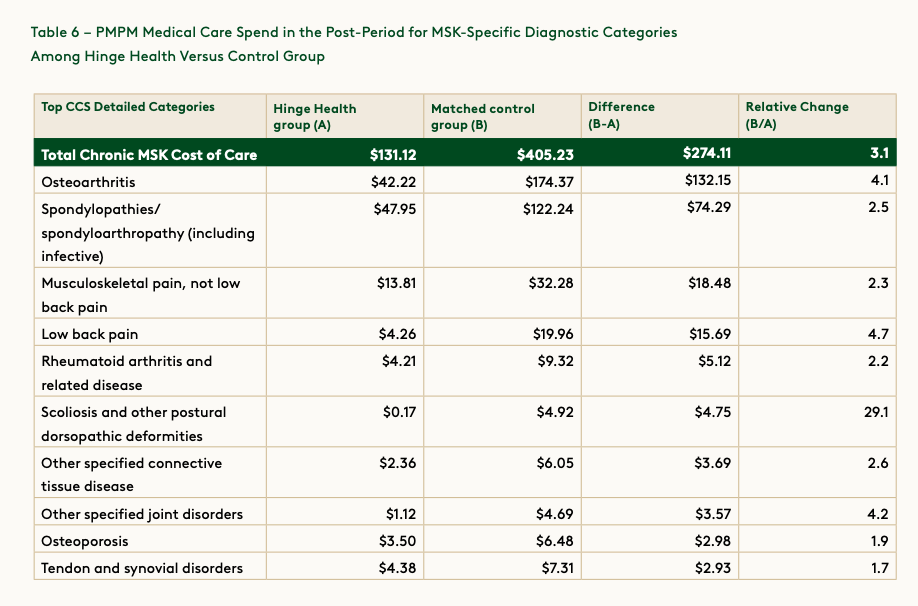

A Medicare-focused study conducted by Hinge Health in 2024 analyzed over 1,200 Medicare fee-for-service (FFS) beneficiaries and found that enrollees in Hinge’s chronic MSK program saved an average of $274 annually in healthcare costs compared to a matched control group. About 83% of cost savings came from avoided hospital inpatient and outpatient services, with the remainder attributed to reduced spending on professional services.

Making this work in an NHS context will look very very different, and requires a different approach (more below on Flok Health).

(Reminder on how Medicare/Medicaid works for the UK folk!)

Medicare is a federal health insurance program primarily for individuals aged 65+, as well as younger people with certain disabilities. It consists of Part A (hospital insurance), Part B (medical services), Part C (Medicare Advantage, offered by private insurers), and Part D (prescription drugs). Medicare Advantage (Part C) allows private companies to manage Medicare benefits and often includes additional wellness services, making it an entry point for digital health companies like Hinge.

Medicaid, on the other hand, is a state and federally funded program providing health coverage to low-income individuals and families. Unlike Medicare, eligibility and benefits vary by state. Since Medicaid covers a large number of people with chronic conditions, digital MSK solutions could play a role in cost reduction and preventative care. However, Medicaid reimbursement rates tend to be lower than commercial or Medicare rates, which can make it a more challenging market for digital health companies.

Hinge Health appears to be gradually expanding into the government payer market, starting with Medicare Advantage while exploring broader Medicare and Medicaid opportunities as part of its long-term growth strategy.

Enter Flok Health: we still require a player which will step in at the public health market layer

Flok Health, the UK's first AI-operated physiotherapy clinic, has demonstrated promising clinical outcomes in addressing musculoskeletal (MSK) conditions.

Improved access to care: In a series of three-month pilot studies involving over 1,000 NHS staff with back pain, almost all surveyed patients reported that their experience with Flok's AI physiotherapist was at least equivalent to traditional in-person physiotherapy. Nearly all (97%) of the patients who self-referred to Flok within Lothian received an automated triage outcome. More than nine out of 10 (92%) were immediately approved for AI physio and given access to an appointment that same day. A handful (5%) were automatically referred to another NHS service, including NHS 111 or their GP).

Patient satisfaction: 57% stated that they found the AI experience to be better. Four in five (86%) of participants said their symptoms had improved during the course of treatment.

Patient feedback: Flok publishes some user reviews on its website, with one stating, "It really does feel like a physical therapist is advising me in the moment."

Flok has been designed with the NHS at its core, and will sit more natively within the public health system in the UK.

✍🏽 Week in Impact Articles

Monday: Reckitt’s Mead Johnson, Abbott to face new trial in US infant-formula case

Tuesday: State of Subscription Apps 2025

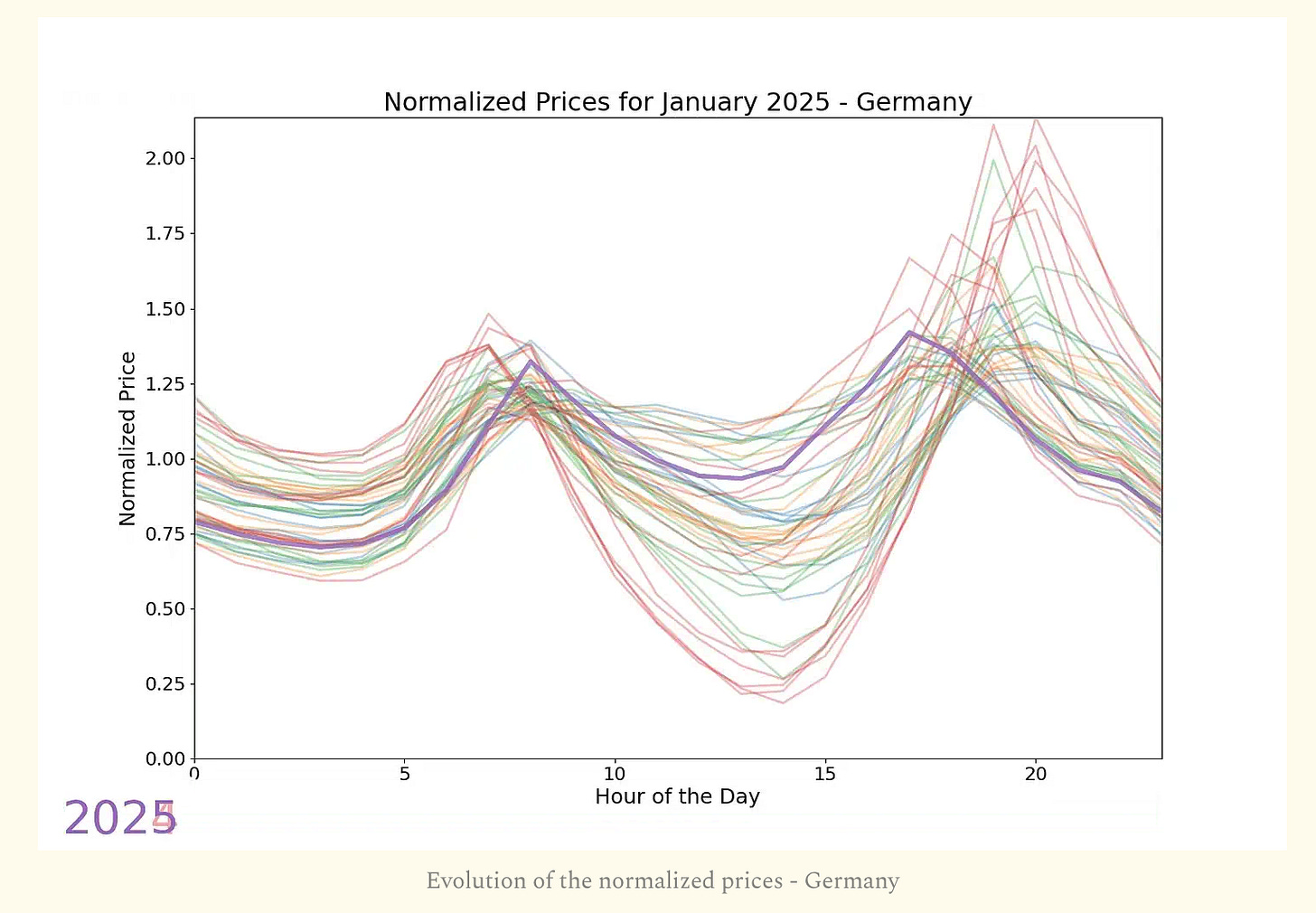

Wednesday: A 2024 update on the hourly shape of the electricity prices in Europe.

Thursday: No one knows what the hell an AI agent is

Friday: The Case for Digital Solitude (or Why We All Should Just Log Off)

📊 3 Key Charts

1. ‘The duck is growing’: German prices becoming wider across peak times

2. Cumulative CO2 emissions to date - the US is still ahead of China

3. Looking into Baby Boomber habits

🗣️ Review of the Week

👋 Getting in Touch

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.