We started our Consumerisation of Health series last week, and dug into how Neko Health is revolutionising the health screen.

We’re continuing with Consumer Health and looking at Daye. Daye is developing products & services to improve gynae health, specifically 1) better understand the vaginal microbiome and 2) improving pain relief for periods.

Thinking back to Neko, their approach brought preventative health to the mass market. But how does Consumer Health work with specific sub-groups? Daye is a great example of how Consumer Health diagnostic companies can have outsized impacts on populations not traditionally covered in a mass-market health system with underlying health inequity.

I’m particularly excited about Daye given the microbiome buzz (i.e. Zoe, the kefir hype, or how even toothpaste can impact your gut). So without further ado, here is our Daye dive, a company redefining women’s health through science and innovation.

*We’ll be covering our Daye experience in this article, with OxCan to come in next week’s edition. Note that the information in this newsletter is all publicly available.

P.S. A reader flagged two (fun?) Tiktok trends from earlier in 2024 relating to women’s health, which we had to share in this edition: (1) Nasa reportedly gave a woman 100 tampons for a 6 day space mission and asked if it was enough, and (2) “we never studied the female body”.

Daye: Pioneering Women’s Health Diagnostics (Part 2) 🗞️

Founded in 2018, Daye is on a mission to close the gender health gap by tackling gynae health across STIs, vaginal health, and period pain management. Daye offers innovative at-home testing solutions that focus on early detection of common conditions like vaginal infections and certain STIs.

Plus, they’ve become more and more common across London billboards (see below from our “on the ground” research March 2024, and Daye’s facebook page in February).

What sets Daye apart is their holistic approach. Their diagnostic tools are paired with eco-friendly menstrual products, such as tampons infused with CBD to relieve menstrual cramps. In their words:

“We recognise that the one-size-fits-all healthcare model doesn’t work. There is no one way to be healthy.

We go with your flow by delivering convenient, high-quality products that fit your needs and lifestyle, without compromising on your values.

We see privacy and continuity as the bedrock of being your own health advocate and owning your health record—the central purpose of our digital platform.” (Daye)

Daye has raised from investors including Index, Kindred, Khosla.

Unboxing Daye’s product suite: from tampons to diagnostics.

Unlike Neko, Daye is bringing healthcare directly to people’s homes — with a sharp focus on women’s health, a space that’s historically been underserved.

Daye’s offers research-backed products & services alongside a seamless consumer experience to unlock better health experiences for women.

The product suite started in the CBD tampons space but has expanded to diagnostic services. The Daye Vaginal Microbiome Screening Kit, for example, enables women to monitor their vaginal flora and detect infections like bacterial vaginosis, yeast infections, or even sexually transmitted infections without the need for a doctor’s appointment.

There are a few other companies in the US like Evvy who are also innovating on the vaginal microbiome. Both companies are collating a unique dataset of gynaecological health which, over time, will lead to strong compounding data moats.

The current pathway: long waiting times for diagnostics, often treated by OTC products.

The current pathway for vaginal infections is 1) calling your doctor, 2) scheduling (often) a telephone appointment, 3) typically either being called in for a test or being directed to OTC solutions in the case of certain vaginal infections. There’s a lot more complexity to this if there depending on the symptoms, diagnosis, and impact but broadly this covers a lot of the consumer health cases.

See one practice’s pathway below, and how (if there is a low risk of an STI) typically the follow through is OTC products or broad vaginal health advice.

So, half of the Eka team ordered went onto the website earlier this month and put Daye to the test.

Our experience with Daye: design, customer flow, and monetisation.

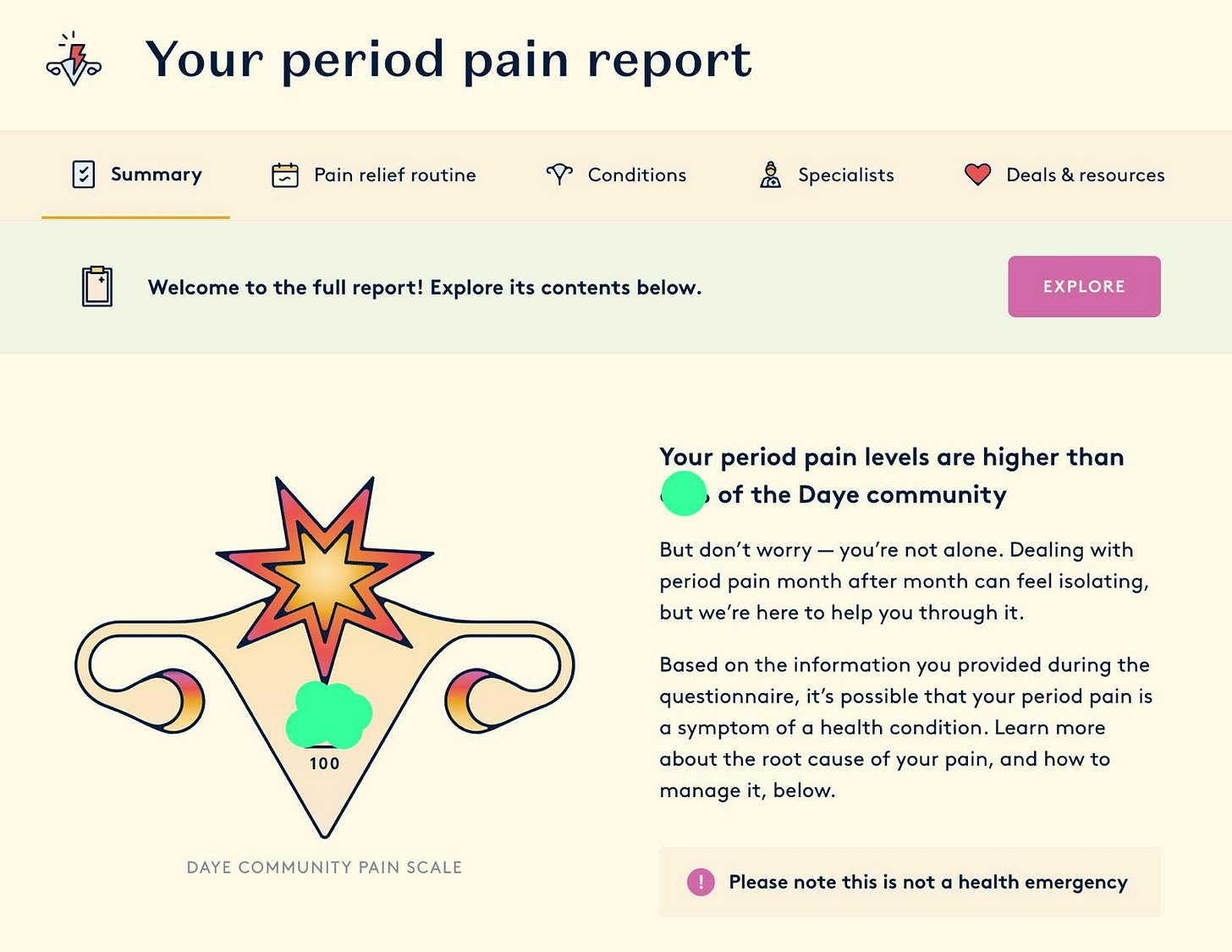

The first interaction Daye pushes you into a period pain quiz.

Being big fans of consumer health quizzes, we immediately tried this out and had interesting results. This is used to introduce the problem of period pain (“educate the consumer on the problem”), but there were already some mentions of the microbiome across its website. Click through here if you’re also interested in taking part in the quiz.

We then wanted to dig into the microbiome diagnostics, so ordered a £99 testing kit (more on pricing later).

The parcel arrived promptly after 3-5 working days. In it, there was:

A QR code which led to a 10 minute video explaining the purpose of the test and instructions to take the sample.

Two tampons (these looked pretty normal).

Pre-planned return box with all the necessary vials to ensure the sample stayed stable throughout.

Taking the test itself was straightforward (although I would have struggled without the video, so that was a helpful touch). The consumer experience has come a long way since the days of STI finger prick tests!

Once the swap was completed, we sent it back in a pre-paid envelope and received our results within 5 days via Daye’s online portal.

What the results told us.

Within the Daye app, we were presented with detailed insights into our vaginal microbiome. The results were broken down into a few areas (below).

*Based off definitions in Daye’s downloadable results pack.

Interestingly, the test doesn’t confirm or deny infections but rather points to individual bacteria types and sees whether there are more, less, or a ‘healthy’ amount relative to guidelines.

Daye’s pathway then splits, either:

Referring you to a clinician to talk through the results (these range from £20-£80 per 30m session depending on their background) and/or

Referring you to their maintenance products including period care and microbiome maintenance.

The pricing is a bit convoluted because, at this point, you’ve already put out £99 for a test. This is what we think the broad pathway & monetisation looks like, depending on your level of need.

BUT, as much as this is expensive, it is much better than the current pathway of call GP, book appointment, get little data driven insights, and get offered OTC products.

A new era for women’s health, starting with the microbiome.

Daye represents the convergence of tech, design, and clinical rigour in women’s health. The seamless integration of diagnostics with personalized care sets it apart from traditional healthcare systems, where women often wait weeks for appointments or results.

(More) common pushbacks to health diagnostics

As with any healthcare innovation, there are challenges and criticisms to address.

Affordability: Much like Neko, Daye’s monetisation pathway — while more affordable than private gynecological visits — may still be out of reach for many.

Daye is working on expanding workplace partnerships, but for now, it’s still a premium product. We’re keen to see more accessibility and affordability as the business scales.

Public vs. private health pathway integrations: One pushback I heard off the back of Neko was that moving between public & private pathways can worsen the level of consumer data leakage (i.e. the NHS doesn’t have a full picture of your health, private misses some of the NHS follow-up outcomes).

This feels like a fair pushback on some more clinically serious pathways, but in Daye’s example the NHS pathway is very very convoluted and so having an option to take the pathway totally outside of the public health system feels valuable (note that Daye does both the diagnosing and the treating).

There are two solutions here: 1) making the raw data accessible (which Neko and Daye do and, like a good nerd, I now have lots of .json files of all my health data) and 2) improving EHR data similar to how open banking shifted fintech.

Daye in the broader healthcare landscape

Daye is a great example of the Consumer Health trend, similar to Neko and OxCan. By putting high-quality diagnostics into the hands of consumers, these companies are allowing people to take control of their health in a way that feels personalized, actionable, and accessible.

Enabling earlier treatment, better health outcomes, and a more efficient healthcare system for all is core to our investment thesis. We’ll be looking at an Eka portfolio company (Oxcan) next week to wrap up our Consumer Health series.

Week in Impact Articles ✍🏽

Monday: Are renewables actually replacing fossil fuels?

Tuesday: Actually, we can deploy energy infrastructure very quickly.

Wednesday: The NHS’s digital problem: how old infrastructure is slowing down healthcare services

Thursday: 🔮 Why energy tech is eating the world

Friday: Use of an ambient artificial intelligence tool to improve quality of clinical documentation

3 Key Charts 📊

1. Experiences are now expensive

2. Visualising OpenAI’s latest model improvements

3. Identity in the digital age

Eka Portfolio News 🎉

Thank you to Erevena for co-hosting a Brand Building event with us last week 🙏 We hosted 30 portfolio founders and marketeers for a roundtable with high-level marketing execs from Wise, Cleo, and Zoe.

Review of the Week 🗣️

From Jude:

We also loved this from Hived!

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.