In one short month, we’ve had S-1s filed for four high-profile listings: Hinge, CoreWeave, Klarna, and Stubhub. No, wait, make that five with eToro filing its S-1 yesterday!

This week, we’re looking at Klarna, Coreweave, and Stubhub. These aren’t totally relevant to our investment theses of Sustainable Consumption and Consumer Health, but there is still helpful read-across regarding AI’s energy consumption, consumer credit (the good and the bad), and in-person communities & experiences.

Let’s dive in to the ten interesting things we pulled out from the filings 👇

At least 10 interesting things we learned from the S-1 filings 🗞️

Primer on Coreweave, Klarna, and Stubhub

At least ten interesting things we learned from reading about Klarna, Coreweave, and Stubhub

Coreweave’s explosive growth is a real example of outliers & the power law. Coreweave was founded in 2017, and has seen revenues grow 119x in 2 years with the growth of AI hyperscaling. It works with AI labs, other AI hyperscalers, and tech incumbents to help them secure compute over long-term contracts. Typically 15-25% of the TCV is paid upfront and revenue is recognised over the term of the contract. 96% of revenues are now from committed contracts (up from 20% in ‘22) with average contracts lasting 4 years. There are $16b remaining of performance obligations as of YE 2024.

Brownouts from data center operations can be caused by ‘saving’ work in intervals of 30m. Data centre energy demand has strong peaks and troughs depending on when tasks are saved to the Cloud to make sure progress isn’t lost - this causes energy demand from data centres to go from 100% for c.29m to 10% for c.1m which has large impacts on local energy grids and can cause brownouts. (from OddLots episode this summer, with the Coreweave CSO).

Some are sceptical on Coreweave’s performance (see here) as a result of filing delays and reliance on core customers (Microsoft is 62% of revenues in ‘24). This is a great critique on Coreweave’s S-1 by Edward Zitron (ok, a bit dramatic at times). The piece also claims that the founders have cashed out $500m pre IPO, meaning they only retain c.30% of economic ownership but 82% of the voting power. Again, I think the voting piece is quite typical of founding teams going public. There have also been reports that Microsoft walked away from some services with Coreweave (FT), which has since been refuted by both parties.

As a side note (& from an F1 fan 🏎️ ), the Coreweave CSO reported that F1 testing will be allowed to use more compute from the 2026 season onwards. The Coreweave CFO mentioned that F1 teams will be allowed to use more compute from the 2026 season onwards. The teams use computational fluid dynamics (CFD) to predict how cars will react in the physical world (also from OddLots). We didn’t find other sources corroborating this so take this with a pinch of salt! Lowkey quite a big F1 fan here so this got me pretty excited…

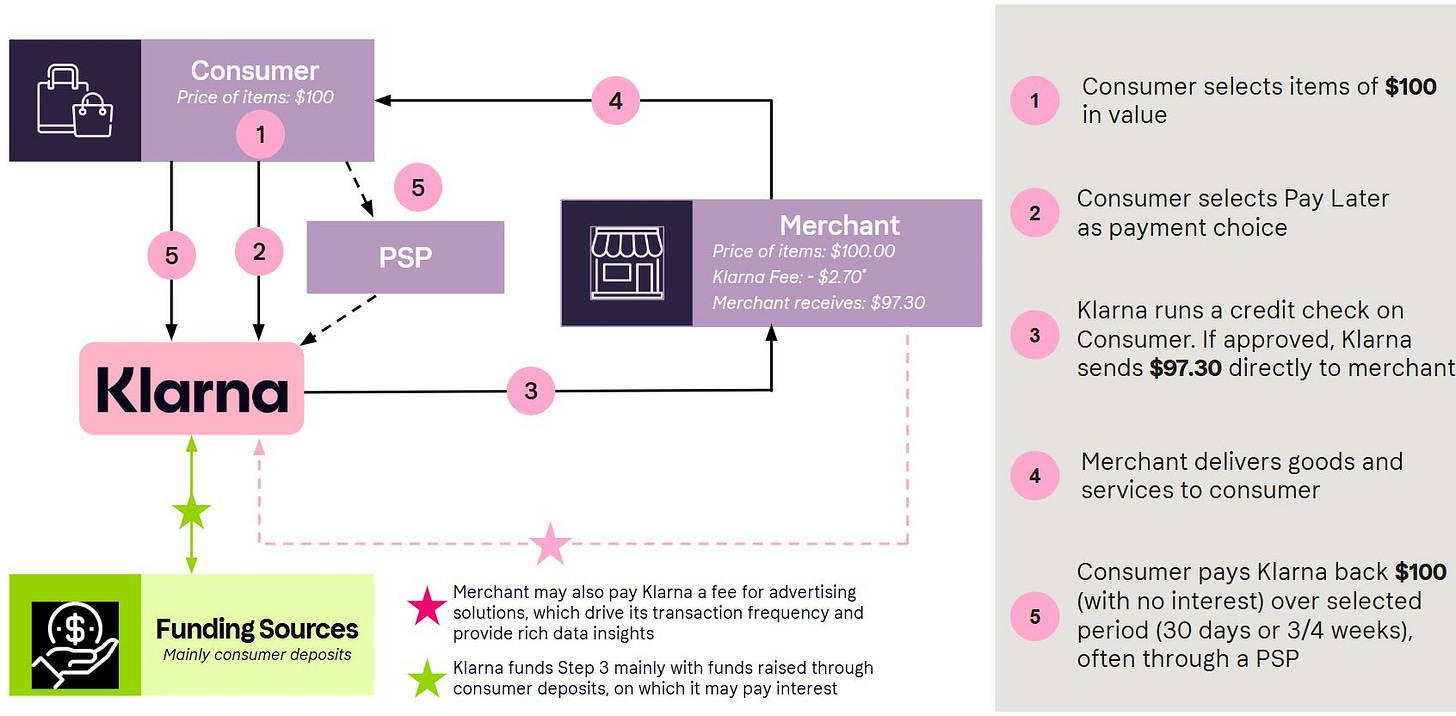

Klarna monetises both merchants and consumers, but drives the majority of the revenue from merchants. This is a helpful diagram of how the value flows through Klarna, the merchant, and the consumer. On average, loan durations are c.40 days, with average balance per Klarna customer being $87.

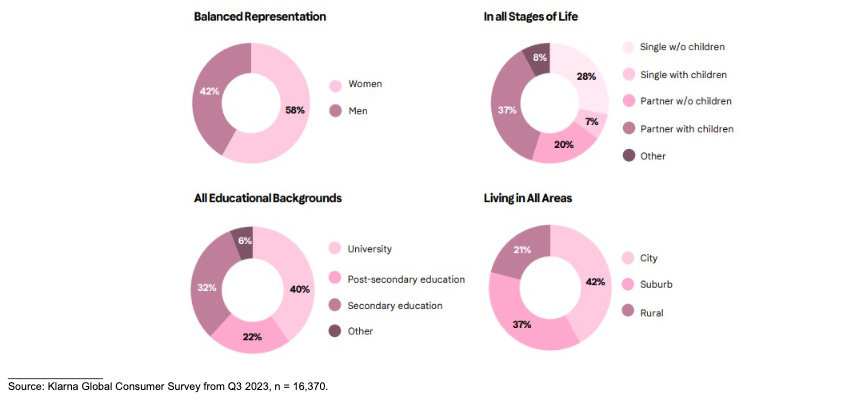

Customers are balanced across Klarna, but they don’t disclose the customer breakdown who claims interest-bearing credit. The charts below don’t correlate to the interest income customers. Customer credit has been controversial in public opinion debates.

Within the revenue segments, Merchant is the largest (75%) and Advertising is the smallest (8%). Interestingly advertising has come down as part of the overall revenue mix, from 11pts in ‘22 to 8pts in ‘24. I’d be interested in understanding why this is (lower customer engagement? brand saturation? something else?).

Stubhub is growing GMS close to 30% YoY (with all the necessary pre-IPO caveats). That’s quite a lot for a >25 year old business! For context, ‘22 GMS was $4.8b and ‘23 GMS was $6.9b. GMS represents the total dollar value paid by buyers for ticket transactions and fulfillment. GMS includes fees which Stubhub charges buyers and sellers that can vary by transaction, as well as the net proceeds we remit to sellers (and excludes sales taxes). Some notable events were Taylor Swift’s Eras tour, and the FIFA World Cup.

Mostly Metrics benchmarked Stubhub against other marketplaces. It’s >2x the size of Eventbrite by GMV, and about 2/3 the size of Etsy. The article also marks take rates (Stubhub at 20%, which is the highest of the researched marketplaces). For context, Stubhub is taking 20% of GMS, Etsy 18%, and Airbnb 14%.

Is IPO season truly back? After a flurry of filings, it does seem like the markets are warming up to the ideas of IPOs. But we’ve been here before (below) and the recent market turmoil is casting doubts on whether these will all go ahead. We’ve been enjoying combing through the releases and learning more about various businesses regardless.

✍🏽 Week in Impact Articles

Monday: How chatbots could spark the next big mental health crisis

Tuesday: The rise of the new joule order

Wednesday: This smart ring promises health insights even Google and Apple haven’t cracked

Thursday: Can AI help detect cognitive impairment?

Friday: Startups take on big tech: women’s health companies file EU complaints over digital censorship

📊 3 Key Charts

1. La Nina is officially here!

2. What NHS England actually does across ICBs and Local Authorities

3. Who pays the most of the foreign aid bill? Government, with almost 41x the commitments of private donors

🗣️ Review of the Week

👋 Getting in Touch

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.