We take a look under the hood of people’s financial health in the UK and how the most financially vulnerable are faring through the cost of living crisis. A few stats to call out:

Almost half of Brits have less than £1k in savings.

13% of consumer insurance or protection policies were cancelled from 2022 to 2023 because of the cost of living.

The most vulnerable consumers in insurance actually contribute some of the highest margins to incumbent insurers.

We backed Urban Jungle to fix this problem and improve access to financial wellbeing for all.

Financial wellbeing 🗞️

The state of financial health

Financial security is a key determinant of health. Yet, many adults don’t have adequate savings, insurance or other types of financial cushions today.

A worryingly low amount of £ savings. Almost half of Brits have less than £1k in savings and a quarter have £200 or less. This includes insurance and the ability to plan ahead for planned and unplanned expenses.

Low savings account penetration. 2022 FLS data shows that 3 in 10 adults (16m people) did not have a savings account of any type. This is up from 24% in 2020.

People are missing domestic bills payments. In the UK, the number of adults who missed payments on any domestic bills or meeting any of their credit commitments in late 2022 went up by 1.4 million: from 4 million (8%) in May 2022 to 6m (11%) in January 2023.

Insurance policy cancellation because of cost of living. Of the UK adults who were insurance or protection policyholders in May 2022, 8% cancelled one or more of their policies, and 7% reduced the level of cover on one or more their policies within six months. This was specifically to save money due to the rising cost of living.

The impact goes beyond financial health. The FCA’s 2023 report found that 1 in 2 UK adults, or 28.4 million people, were more anxious or stressed due to the rising cost of living.

Going under the hood: who is most affected?

The most financially vulnerable in society are disproportionately affected by financial stresses.

The poverty premium can compound across different areas of financial health: from spending on nutrition (as we wrote about last week), to housing, to insurance.

Today, many people don’t have access to insurance because of their sociodemographic background or living location. The Social Market Foundation wrote a very helpful article around how financial vulnerability compounds across different health areas.

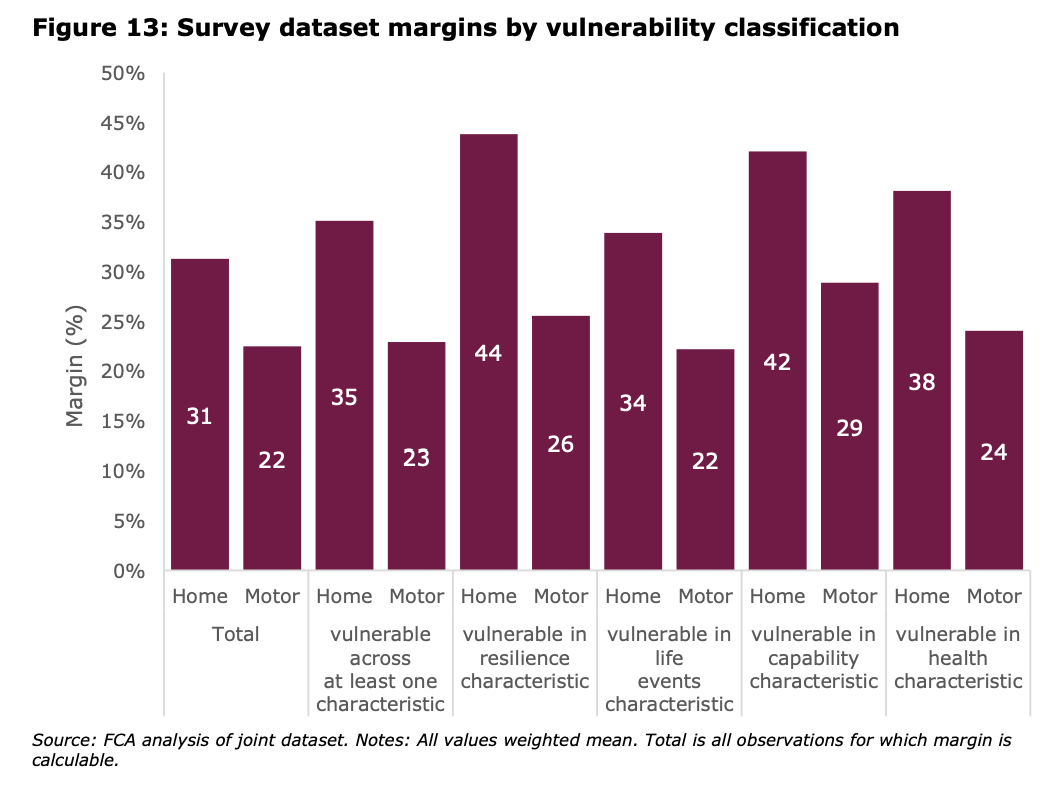

What’s more shocking is that the most vulnerable consumers pay higher margins and are more profitable for insurers. The FCA conducted a study in 2019 highlighting that the more vulnerable customers actually showed higher margin dynamics for insurers.

This leaves two problems big problems for vulnerable populations:

Some people are priced out of insurance or simply not insured because of behavioural factors.

Some people are accessing insurance at the discriminatory price and are being taken advantage of.

What solutions are out there?

Urban Jungle is taking home insurance to the next level. They spend time educating consumers around policy cover and excess options to help everyone feel confident about their financial future

Week in Impact Articles ✍🏽

Monday: GPT is a biased recruiter

Tuesday: Where Heat Pumps Win — And Where They Lose

Wednesday: The shifting sands of M&A in transportation and logistics

Thursday: Microscopic plastics could raise risk of stroke and heart attack, study says

Friday: Semaglutide reduces severity of common liver disease in people with HIV

3 Key Charts 📊

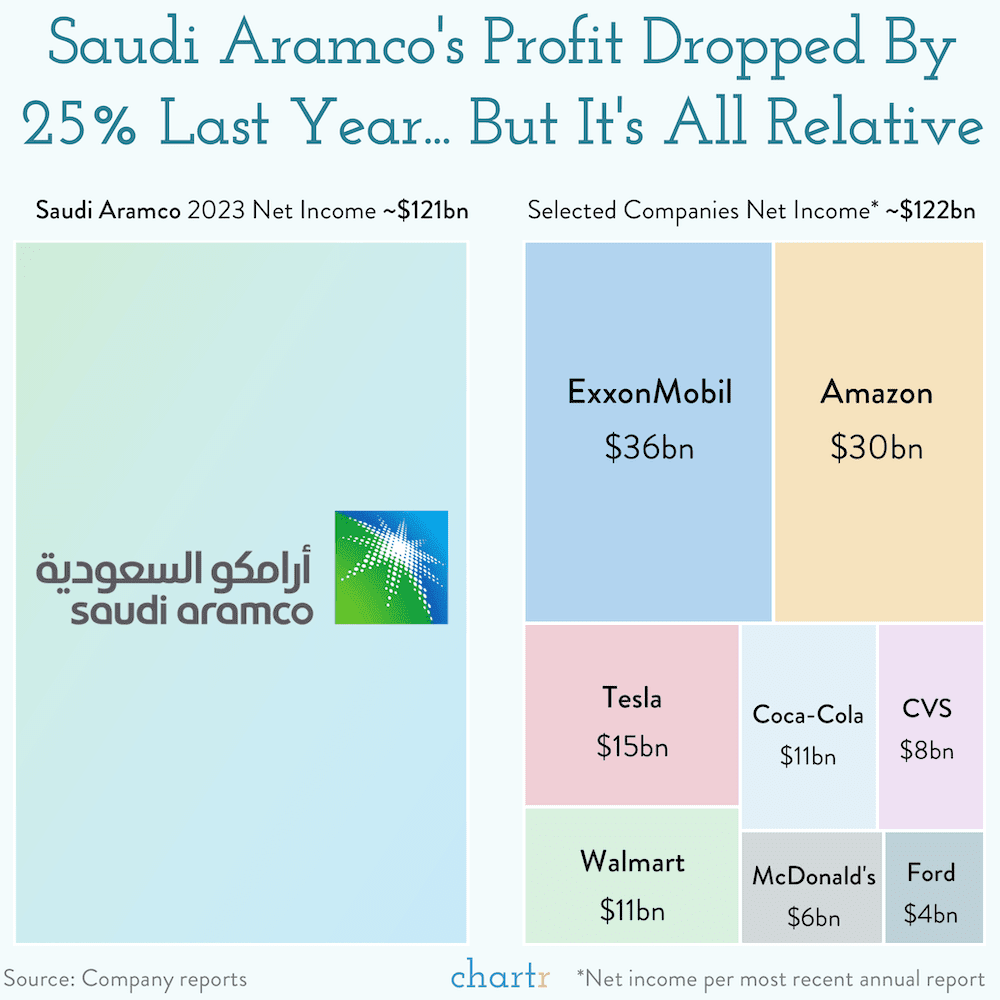

1. Energy is seriously valuable

2. The explosive rise of ‘ADHD Music’

3. Cybercrime is expensive

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.