Looking ahead to Sustainable Disclosure Regulation

Issue 79 l Eka’s Weekly Roundup (21 June 2024)

The reporting world is changing for Impact, ESG, and Traditional funds. In the EU, regulation came into force a few years back which requires funds to report more on impact and ESG KPIs depending on how green they claim to be. In the UK, a similar regulation is on its way (the anti-greenwashing rule just came into force last month).

We pulled together a few third-party resources on Sustainable Disclosure Regulation (SDR) & Sustainable Finance Disclosure Regulation (SFDR) to give you a recap on:

what the regulations are,

what the key timelines will be in the next few years,

how they are currently being implemented, and

the impact on VCs from both of the regulations

Let’s get to it!

🗞️ Recap on the new wave of Sustainable Finance Regulations

Sweep wrote a great article summarising the key tenants of SDR and SFDR.

The UK Sustainable Disclosure Regulation (SDR) and the EU Sustainable Finance Disclosure Regulation (SFDR) are both legal frameworks for sustainability disclosure targeting financial market participants.

In other words, they are setting the guidelines for what funds are going to be able to claim about impact, ESG, and traditional investing. More specifically:

SDR (United Kingdom), overseen by the Financial Conduct Authority (FCA), seeks to equip investors with more detailed, consistent, and comparable sustainability information from issuers and investment managers. This regulation applies to issuers of bonds and shares listed on a UK regulated market as well as UK-based investment managers.

SFDR (European Union), under the European Commission, mandates sustainability-related disclosure requirements for financial market participants such as investment firms, and insurance and reinsurance companies. The SFDR applies to entities established in the EU and extends to products marketed within the EU, regardless of the entity's location.

While the UK SDR is specific to UK-based companies, the EU SFDR encompasses EU-based companies and any entities marketing products in the EU*. Consequently, many firms will need to navigate both UK and EU requirements.

*There is some nuance here which we don’t have the space to go into today.

⏱️ Timelines for both regulations

🇬🇧 Background for SDR

As detailed by this report published by JP Morgan:

July 2021: The FCA issues the “Dear Chair Letter” addressing greenwashing concerns and setting a regulatory framework to mitigate these issues.

November 2021: Initial proposal for the UK SDR is released by the FCA.

October 2022: FCA releases a consultation paper to gather feedback on the proposed UK SDR rules.

April 2022: The UK implementation of the Task Force on Climate-related Financial Disclosures (TCFD) comes into effect.

28 November 2023: The FCA releases its final Policy Statement (PS23/16) on Sustainability Disclosure Requirements and investment labels, collectively known as the UK SDR.

January 2024: The FCA updates its Environmental, Social and Governance sourcebook with the final rules.

Throughout 2024: Expected guidance on overseas funds, such as UCITS funds domiciled in the EU, to be issued.

Going forward, this is what the practical SDR implementation will look like. The anti-greenwashing rule came into force in late May 2024. Firms will be able to use the four labels to market funds starting from late July*. Reporting disclosures will only apply from late 2025 at the product level and late 2025 at the entity level.

*The four labels which SDR introduces are: Sustainability Impact, Sustainability Focus, Sustainability Improvers, and Sustainability Mixed Focus. For more information read here.

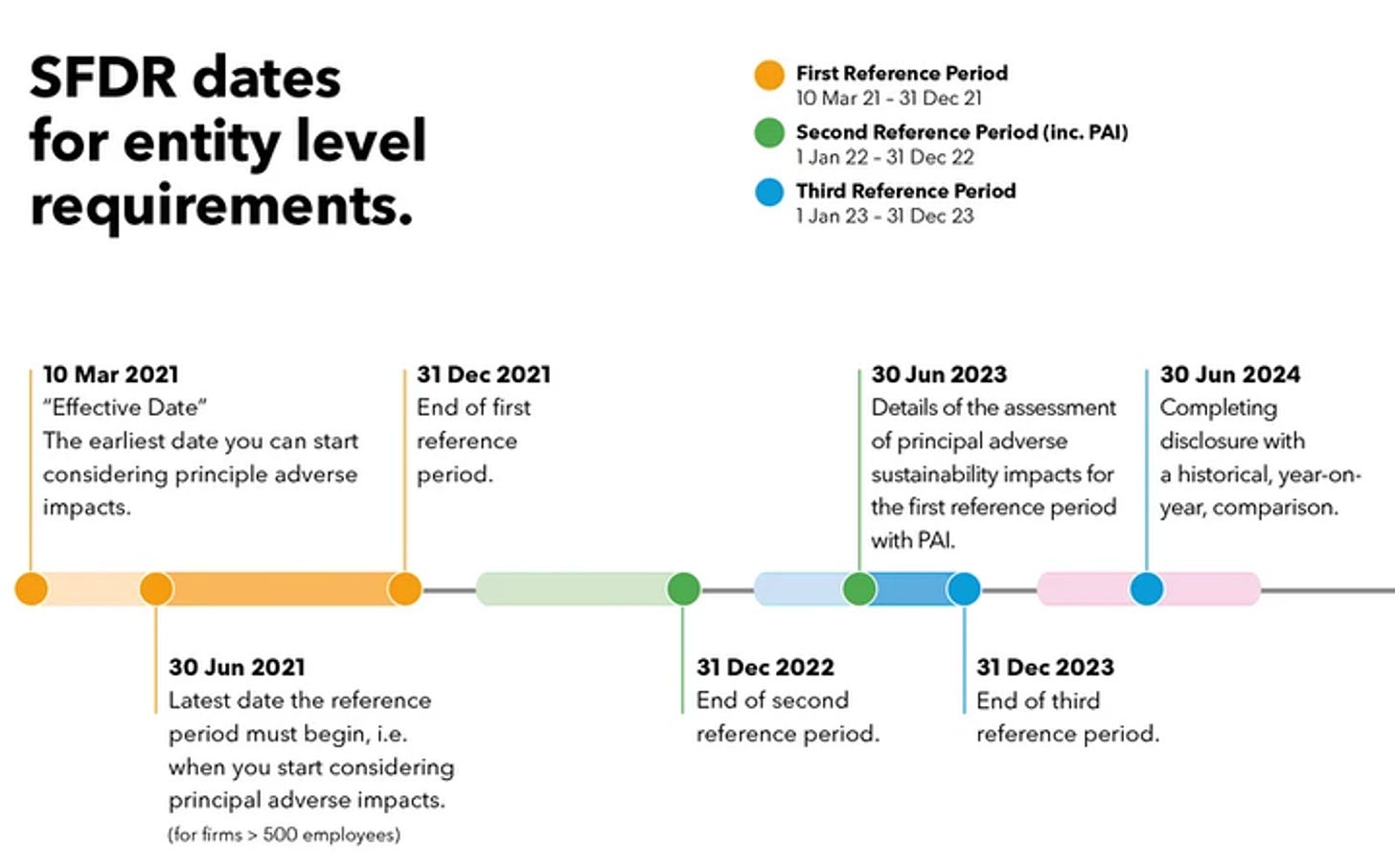

🇪🇺 Background for SFDR

Bloomberg and Worldfavor published background timelines to the SFDR regulation, which we highlight below.

June 2021: PAI statement must be available to the public on the firm's website. "Comply or explain" obligation becomes mandatory for Financial Market Participants (FMPs) with over 500 employees.

December 2022: Firms must collect relevant data for SFDR reporting for the period January 1, 2022 – December 31, 2022.

January 2023: SFDR Level 2 becomes mandatory. FMPs must comply with detailed disclosure obligations, including mandatory reporting templates and methodologies. Second reference period starts (January 1, 2023 – December 31, 2023).

June 2023: Reporting of the first reference period (2022) must be completed. Principle Adverse Impact (PAI) statement and other disclosure requirements must be published on the firm's website.

June 2024: Reporting of the second reference period (2023) must be completed. Reports must include a year-to-year comparison between the 2022 and 2023 reference periods.

June 2025 and onwards: Annual reporting continues, each year including a historical comparison covering at least the past five reference periods once reached.

📈 Tracking label uptake for SFDR

While we can’t yet show SDR uptake (given it only comes into force later in July), we can start to see early signs of how SFDR is rolling out according to its Article 6, Article 8, and Article 9 categorisations.

The chart below from Morningstar will relate to public markets rather than private markets, but we can see that the majority of outflows in Q3 2022 where in Article 6 (non Impact and non ESG) funds. More recently however, inflows were focussed again on this Article 6 category. Article 8 funds (ESG funds) saw consistent outflows in late 2023.

🧑🏾💻 How VCs are adapting

Much of the SDR and SFDR regulation relates to large enterprises. In the SFDR case, a lot of the reporting requirements on FMPs relate to those with >500 employees, while in SDR it will (over time) relate to funds with a large AUM >£5b. However many private market funds below these thresholds are still looking to take on much of the reporting.

However there are early signs of VCs taking up the Article 8 and 9 label who are based in Europe. Sifted compiled a list here of European funds who are reporting in line with SFDR as of summer last year.

Week in Impact Articles ✍🏽

Monday: The solar industrial revolution is the biggest investment opportunity in history

Tuesday: Decade of the Battery

Wednesday: Germany under the sun

Thursday: Impact of industrial robot on labour productivity: Empirical study based on industry panel data

Friday: Comparative advantage of humans vs AI in the long tail

3 Key Charts 📊

1. Vegetarian or omnivore? Protein around the world.

2. Wind and Solar growth curves are the fastest to date.

3. Renewable investment is now x2 the spend on fossil fuels.

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.