This week, we’re looking over GIIN’s 2023 report on impact capital markets and LGT’s 2023 ESG report, which are two of the top publications around the impact capital markets.

Five ways impact capital markets are changing 🗞️

1. Impact AUM* is now >$1tn across asset classes

Total *assets under management (AUM) for impact assets has reached $1tn according to GIIN. The GIIN collates a survey for asset managers across public and private markets on a yearly basis, and serves as a state of health of the overall impact market.

GIIN estimates that AUM has increased +18% in the past five years, which is broadly in line with private equity’s +20% increase in AUM in a similar time period.

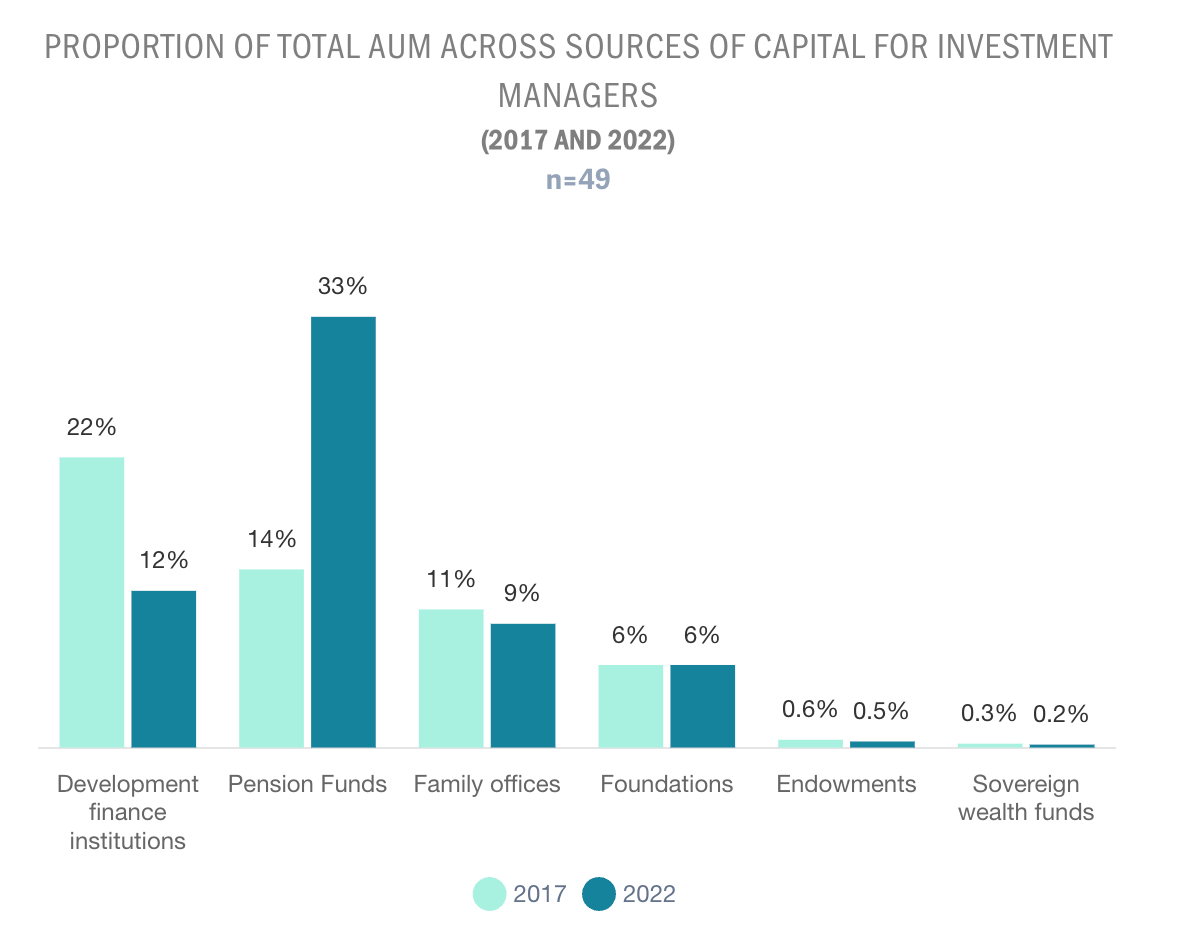

2. The LP base is shifting, pension funds are taking a bigger piece of the pie

Capital is increasingly flowing from asset allocators to managers, especially from pension funds and insurance companies.

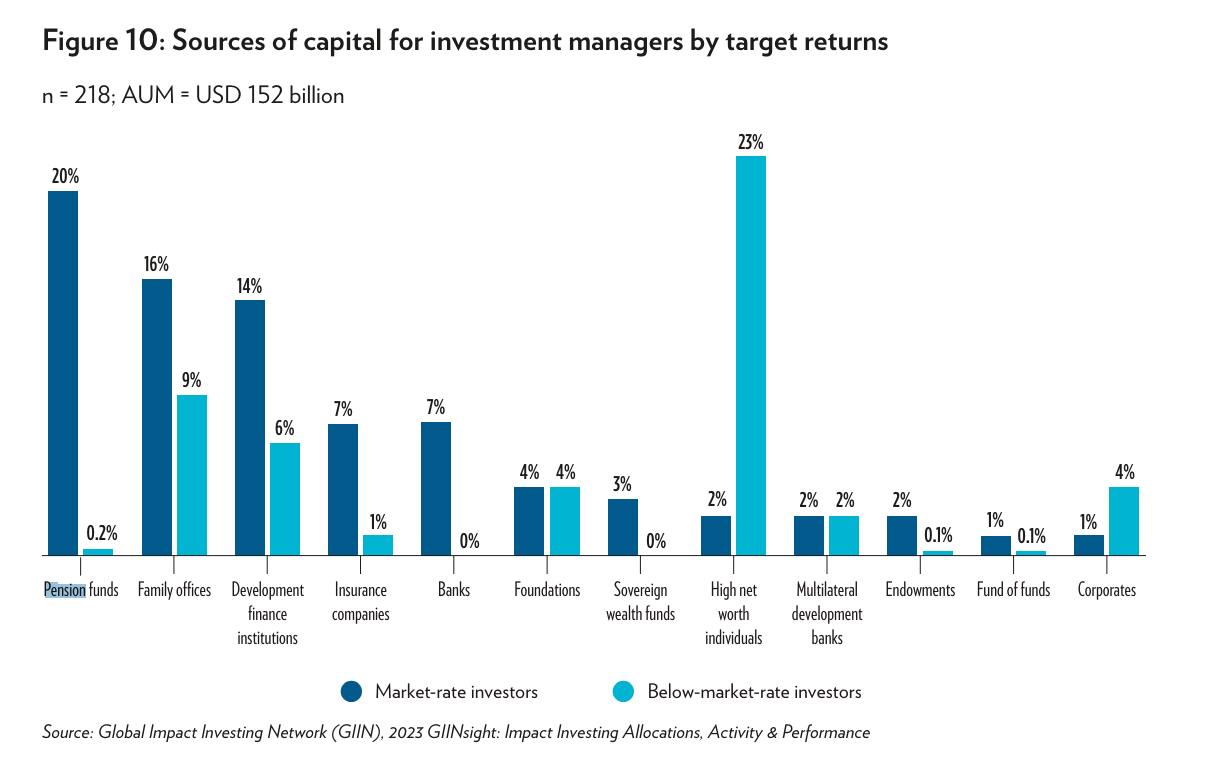

Then, GIIN cuts the data by market-rate vs. below-market-rate investors. Pension funds almost always enter the market at market-rate returns. By contrast, HNWs* (high net worths) over-index to below-market-rate investments.

As implied above, the institutional investors have a strong preference for market-rate investors (GPs). Note that the sample size isn’t very large, so this data should be taken with a pinch of salt.

3. Early data suggests Impact returns exceed expectations, especially in institutional developed markets

We haven’t yet found definitive impact vs. non-impact returns data in venture or in the broader market. This will come, we think, after SFDR 9 has been around for a full fund lifecycle.

But, there are some early indicators that it is paying off. Below, GIIN shows investor perspectives on impact and financial return.

Most investors reported outperforming or performing in line with expectations from both a financial (79%) and impact perspective (88%). While 16% reported underperforming relative to financial expectations, only 3% indicated the same for impact performance.

Digging deeper, performance relative to expectations varied greatly by investor type. Only 11% of developed market investors indicated underperforming relative to financial performance targets compared to 22% of emerging market investors. Just under a third of below-market-rate investors (30%) reported underperforming relative to expectations on financial performance compared to 11% of market-rate investors.

In other words, developed market institutional investing has lower underperformance figures than what is proposed above.

Of course, there are different target returns by asset class (shown below).

4. The SFDR* landscape is maturing

As a reminder, this is what we mean by Sustainable Finance Disclosure Regulation (*SFDR). It mainly relates to the climate part of our thesis. A European health taxonomy is in the works but is still a few years away from the SFDR maturity level.

In the last three years, there has been a positive trend in the proportion of managers that assess and measure climate change-related risks and opportunities. In 2023, 55% of managers did so today versus 32% two years ago in 2021.

5. Fund inflows are looking positive in the public markets

Another great report on this is from Goldman, published in the middle of last year. They showed that Article 8 & 9 inflows outgrew Article 6 inflows by 3x. Most recently, Morningstar published that Article 8 funds had seen some outflows in late 2023/early 2024 while Article 9 funds had remained robust.

Week in Impact Articles ✍🏽

Tuesday: Underrepresentation of Women in Revascularization Trials

Wednesday: Digital love revolution: the future of online dating

Thursday: The plant-based revolution has further to go

Friday: Dwindling biodiversity might make you sick

3 Key Charts 📊

1. Scientist crystal ball the 1.5C target

2. What’s in your wallet?

3. The pullback of inflation (almost everywhere..)

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.