Biotech investments have traditionally performed better than generalist tech investments. However, much of the value that venture investors see in these companies is tied to IPOs unlocking value. Baybridge wrote a piece in April showing that Series A investors have an average return of about 1.5x from the IPO market alone. While the IPO window remains shut for many investments, biotech may see fewer rounds than it saw at the peak of the market last year (as we wrote about in our Solving for Impact Tech report).

The crazy world of biotech 🗞️

Biotech venture investments have been performing better than tech venture investments over the past decade, with fewer biotech investments leading to losses and more investments generating significant returns of 5 times or more. (Baybridge)

While this is good news for biotech investors, it's important to note that venture returns are largely driven by outliers. In particular, much of the biotech returns in recent years were down to one particular company.

When excluding the Moderna deal, we can see that the share of proceeds led by 10x+ hits in biotech is relatively less than generalist VC. In this analysis from A16Z and Horsely Bridge , 13% of the biotech VC deals account for 43% of the returns.

Drilling down into biotech funds from another Baybridge article, we can see that market timing and company picking are pretty impressive for some funds. The image below refers to Flagship Pioneering’s based in Cambridge Massachusetts.

This is almost certainly not a complete list of the Fund’s total investment. When this fund was operating, roughly 75% of Flagship’s portfolio companies were built in-house. Per its website, Flagship started 6-8 “protocos” per year. Orbimed, another life sciences manager, saw 17 IPOs from it’s fifth fund.

Sifted wrote a piece in mid-2022 about how the life science trend was well underway in Europe.

“According to Dealroom, VCs have put nearly $18bn into European biotech startups since the start of 2020, roughly the same amount that they invested in the six years prior. It marks a reversal of a trend that started in the early 2000s when the sector became the remit of specific biotech funds, which were mostly investing in companies developing a “single asset” like a drug.

In contrast, the biotech companies that VCs are interested in today are building platforms or infrastructure — think tech to improve drug discovery, better diagnose diseases or design new foods. It’s why some investors prefer the terms “Bio 2.0” or “techbio”. Some well-known examples include drug discovery company Recursion in the US and neural interface hardware startup CTRL-Labs, acquired by Meta in 2019.”

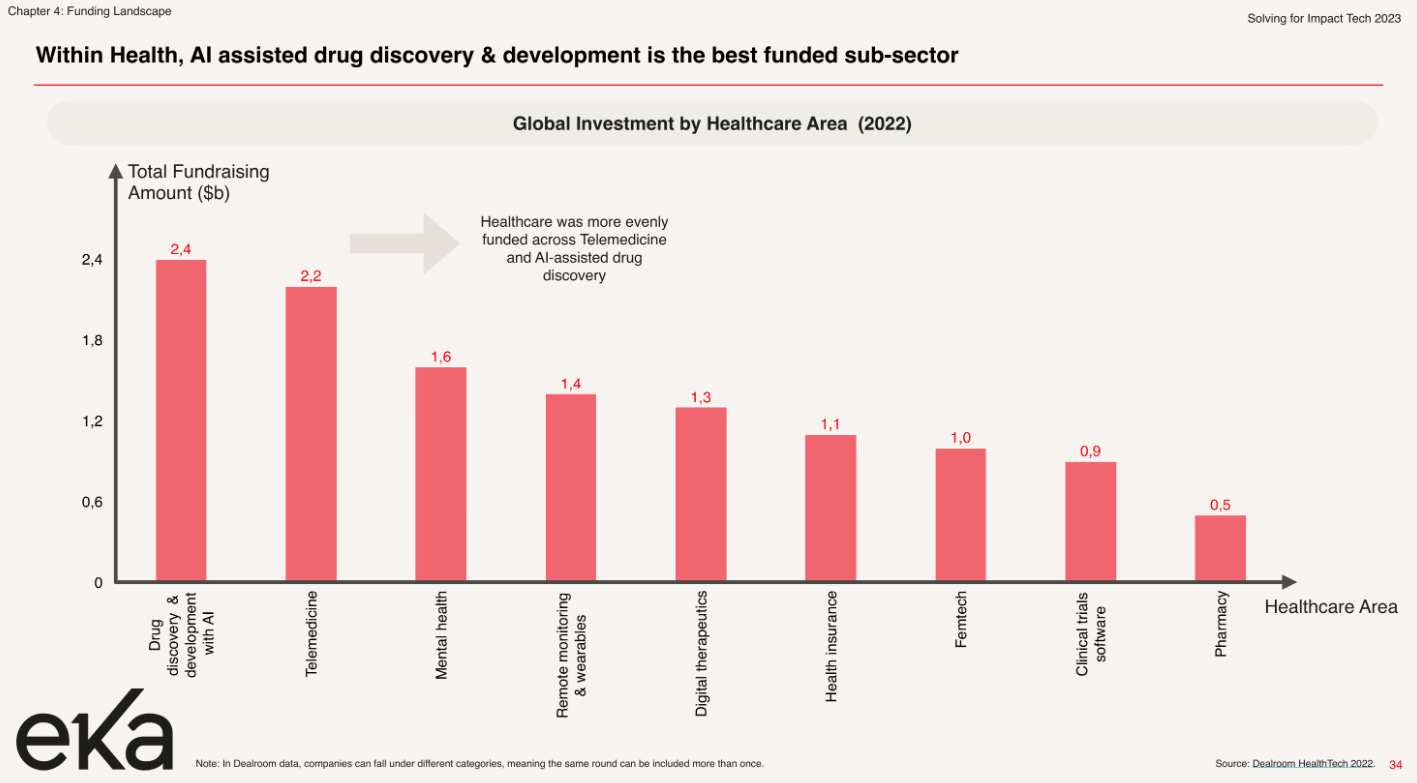

As we wrote in our Solving for Impact Tech report, drug discovery saw the strongest funding in health VC last year.

The most recent trends are slightly more concerning with a frozen IPO market. As Baybridge wrote, the majority of expected returns post Series A are embedded in IPOs unlocking value.

M&A is the other logical route, but the data shows that it may not be enough. “The amount of money big pharma spends on M&A has been relatively constant in the last few years, while the number of startups – and their valuations – have skyrocketed. If big pharma continues to spend the same amount on startup M&A as they have in the past, they only have enough to buy around 10% of each startup.”

We’ll look at how the funding data and breakdown trends for 2023, but once again it looks like public markets are making their way down to the earlier stages of the venture market.

Week in Impact Articles ✍🏽

Monday: State of European Tech: H1 2023

Tuesday: Airlines push against SAF mandates in Europe

Wednesday: Wegovy approved by the NHS

Thursday: Growth in demand of solar PV and heat pumps

Friday: Apple’s headset demo (we had to!)

3 Key Charts 📊

1. Tracking population growth (decline) and innovation

2. Changing tide in wellness - demand is still going up

3. Mid-stage venture continues to be slow moving

Deal Capture 💰

Deals in the impact space across the UK and Europe

GetHarley

Dermatology player GetHarley raised $52m in funding. Led by Index.

Jolt

Electrode startup Jolt raised $6m. Included Climentum Capital and Ship2B Ventures.

Solar Monkey

Solar startup Solar Monkey raised E4m. Co-led by Helen Ventures and Eneco.

Uncommon

Cultivated meat company Uncommon raised $30m. Led by Balderton and Lowercarbon.

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.