The State of European Tech is rather gloomy these days, but there are a few bright spots across different investing themes such as sustainability and purpose-driven companies. This week, we delved into Atomico’s latest report and picked out the main takeaways for impact investors so you don’t have to!

Impact Takeaways from SoET 🗞️

Atomico recently published their State of European Tech report. The report covers all things from investor sentiment, underlying startup health, to trends in thematic investing. We pull out the key messages around climate and health below.

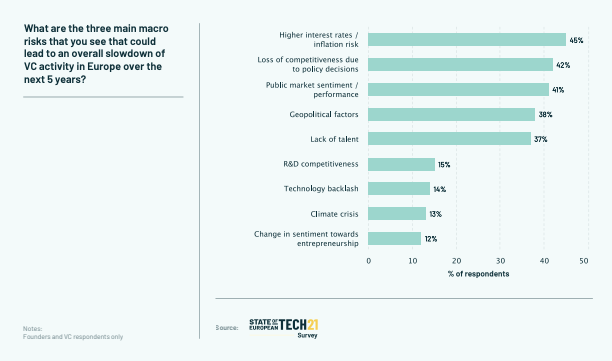

1. Climate is still a low-priority risk in the near-term for the ecosystem (not surprising in macro context)

The highest macro priorities for founders & VCs were higher interest rates, loss of competitiveness due to policy, and public market sentiment. By contrast, climate ranked quite low on the order of importance (only 13% of respondents saying this was a top three macro risk in the next 5 years). This makes sense to us given the relative importance (or change in importance) of interest rates and inflation risk this year, compared with prior periods.

2. Capital inflows around SDGs is still structurally growing

The key SDG here is around climate action, which has seen more than a 5x increase of capital invested between 2017-19 and 2020-22. The other top SDGs map well against clean tech and built environment, both of which have seen strong inflows of capital in recent years.

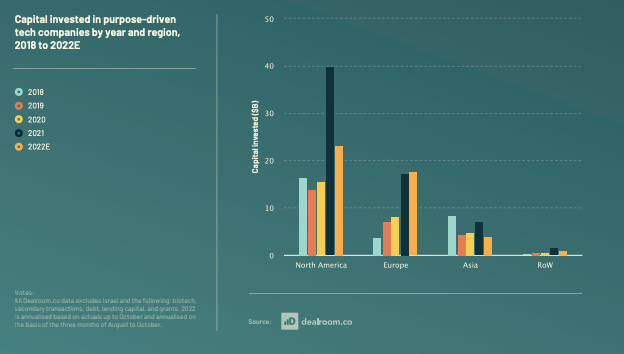

3. European funding holds steady for purpose-driven companies

Capital invested in purpose-driven companies has seen different types of swings across geographies. North American dollars fell around 50% from 2021 to 2022, amounting to $40b and $23b in the respective years. By contrast, European dollars were broadly steady at $17-18b across the two years. While it’s still lagging the US slightly, it looks as though funding has been more resilient during the turbulent year.

4. Purpose-driven unicorns are becoming more important as part of the wider mix

The number of purpose-driven unicorns is going up as part of the total unicorn mix. Today, they are now 12% of all European unicorns, or 42 companies. That’s a 3x increase from the 15 just three years ago (thought the new, ‘non-purpose’ baseline number of unicorns will be lower this year given the tech correction).

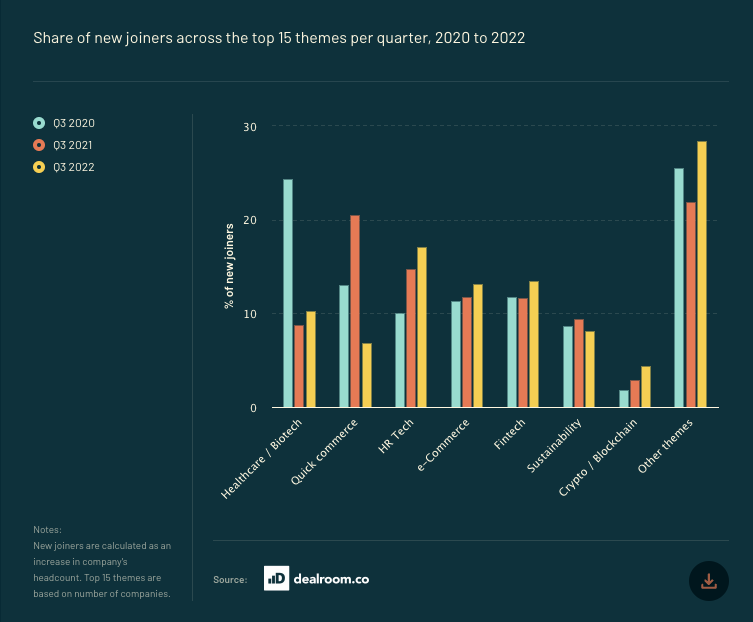

5. War on talent in sustainability holds steady compared to other verticals

Sustainability, FinTech, and e-Commerce have had a relatively consistent share of new joiners across the tech industry in the last three years. Sustainability still has some room to grow in order of importance compared to other verticals like healthcare, quick commerce, and HR. Interestingly healthcare has come down a long way from it’s Covid peak in Q3 20 (unsurprisingly).

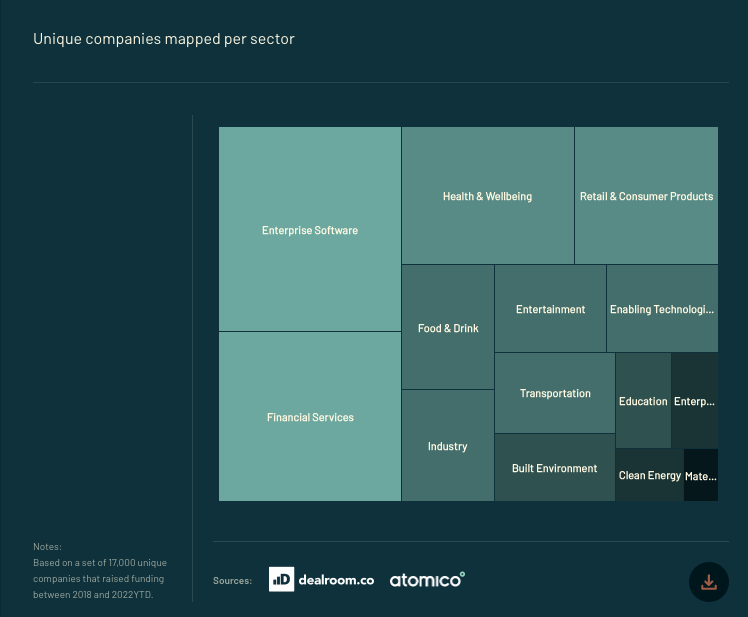

6. Still room to grow for clean energy companies as part of the wider ecosystem

The majority of companies in the ecosystem focus on Enterprise Software and Financial Services. Health & Wellbeing and Retail & Consumer Products are the two next largest slugs of companies. Lagging behind are Clean Energy and Materials, though as highlighted in other parts of the report, are growing on a year-over-year basis.

7. CleanTech is on the rise in the >$1b club

The largest distribution of $1b+ companies have centred around Enterprise Software, Financial Services, and Entertainment in recent years. However more recently, Food & Drink, Clean Energy, and Transportation have captured a greater share of companies across the more recent cohorts of $B+ companies.

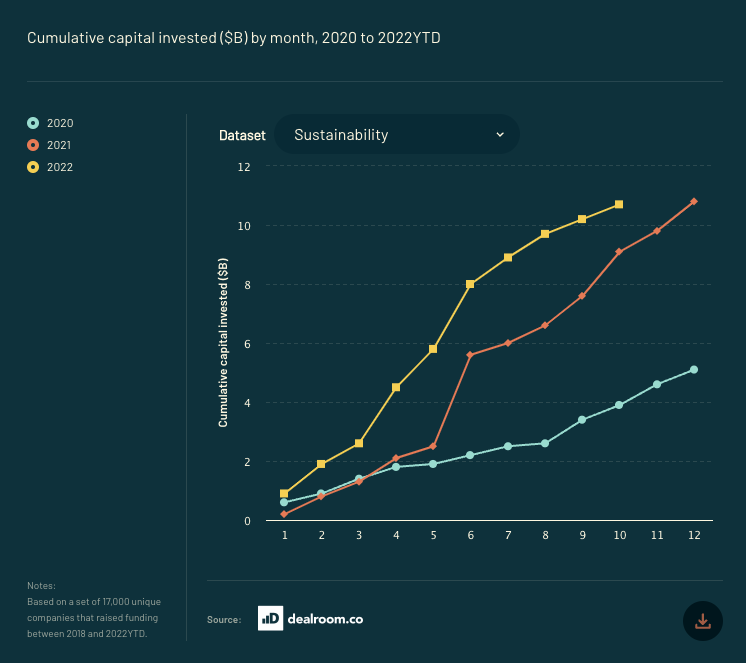

8. Speed of deployment in sustainability is up on 2021

This was the most encouraging chart for us - the 2022 deployment cohort within sustainability was up dramatically on 2021 and 2020. This is unlike other sub-verticals, which almost always saw a decrease on 2021 (though enabling technologies is marginally up versus last year).

What are we left with?

Overall, it’s been a tricky year for tech. But we’re excited about the opportunities that a reset will bring across the European tech space. We are especially excited about the role for Impact companies within the reset, and remain bullish on climate and health into 2023.

3 Key Charts 📊

1. Some ESG resiliency in fixed income indices

2. But public ESG funds under-performing S&P index

3. British real spend lagging other G7 countries

Deal Capture 💰

Deals in the impact space across the UK and Europe

Bactobio

Biotech company Bactobio raised £6m in a bridge financing round.

ImVitro

IVF fertility B2B SaaS platform raised $2.5m in seed funding. Led by LDV Capital, included MMX Ventures, Tiny VC, Fly Ventures, and Compound VC.

Sen

Deeptech climate startup Sen raised £2m. Led by Mercia.

Verna

Natural software company company Verna raised £860k in its pre-seed funding. Led by Vanneck EIS and included Octopus Ventures.

Virtue Health

Hospital management platform Virtue Health raised £1m. Included QVentures and MEIF.

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.