Eka’s Weekly Roundup (8 September 2023)

Issue 45 l UK’s (back)step on offshore

In a recent government auction for renewable energy projects, the UK's offshore wind sector faced a major setback as no developers submitted bids. This development has dealt a blow to the country's ambitious renewable energy goals, including the aim to achieve 50 gigawatts of offshore wind power by 2030. While solar, tidal, and onshore wind projects secured contracts, concerns over the low electricity generation prices set by the government deterred interest in offshore wind farms. Rising construction costs for offshore projects have also been a significant challenge. Despite this setback, the UK remains a global leader in offshore wind, and the government is committed to retaining its leadership in this vital sector while exploring alternative renewable energy sources.

Turbulent trends for UK wind 🗞️

The latest government auction for offshore wind projects has ended without any bids from developers, posing a setback for the UK's renewable energy goals. While solar, tidal, and onshore wind projects secured contracts, the lack of interest in offshore wind farms is attributed to the perceived low electricity generation prices set by the government, which developers argue are not economically viable.

The government cited global inflation affecting supply chains as a challenge for projects. Although offshore wind projects didn't secure deals, this outcome aligns with results in countries like Germany and Spain. Notably, the auction did fund numerous solar, onshore wind, tidal, and geothermal projects, marking the first inclusion of geothermal energy.

This failure to attract offshore wind bids hampers the UK's target to achieve 50 gigawatts of offshore wind power by 2030, compared to the current 14 gigawatts. Renewable energy advocates emphasize that alternative sources like solar cannot fully compensate for the capacity of offshore wind, which is considered a vital component of the UK's renewable energy sector. Orsted’s share price reacted strongly to the news.

Despite being regarded as a cornerstone of the UK's renewable energy portfolio, offshore wind projects have been challenged by rising construction costs due to factors such as increased steel and labor expenses.

The UK has been a global leader in offshore wind, boasting the world's four largest wind farms, supporting thousands of jobs, and contributing significantly to the country's electricity generation.

The government's annual auction invites companies to bid on renewable energy projects, ensuring they receive a guaranteed price for the electricity they produce, aiming to boost investor confidence and cut energy bills for consumers. If electricity prices exceed the agreed price, companies return the excess to energy suppliers, while suppliers pay the difference if prices fall below the guaranteed price.

However, critics argue that the £44 per megawatt-hour price floor set for the latest auction did not adequately consider the increased development costs, leading to the lack of offshore wind bids.

Industry leaders expressed disappointment, with calls for the government to reassess auction prices to support the offshore wind sector's long-term growth.

While the auction yielded no offshore bids, it did secure funding for 95 clean energy projects, amounting to £227 million, enough to power approximately two million homes. The government emphasized its commitment to decarbonizing the electricity supply, highlighting offshore wind's importance and vowing to collaborate with the industry to maintain global leadership in this technology.

Week in Impact Articles ✍🏽

Monday: Offshore wind auction fails to attract any bids

Tuesday: Germany backs delay to EV tariffs in boost to Sunak

Wednesday: Healthtech takes centre stage at IFA

Thursday: UK scientists develop 10-minute blood test to diagnose diseases

Friday: What’s the future of generative AI? An early view in 15 charts

3 Key Charts 📊

1. Visualising the EV revolution across countries

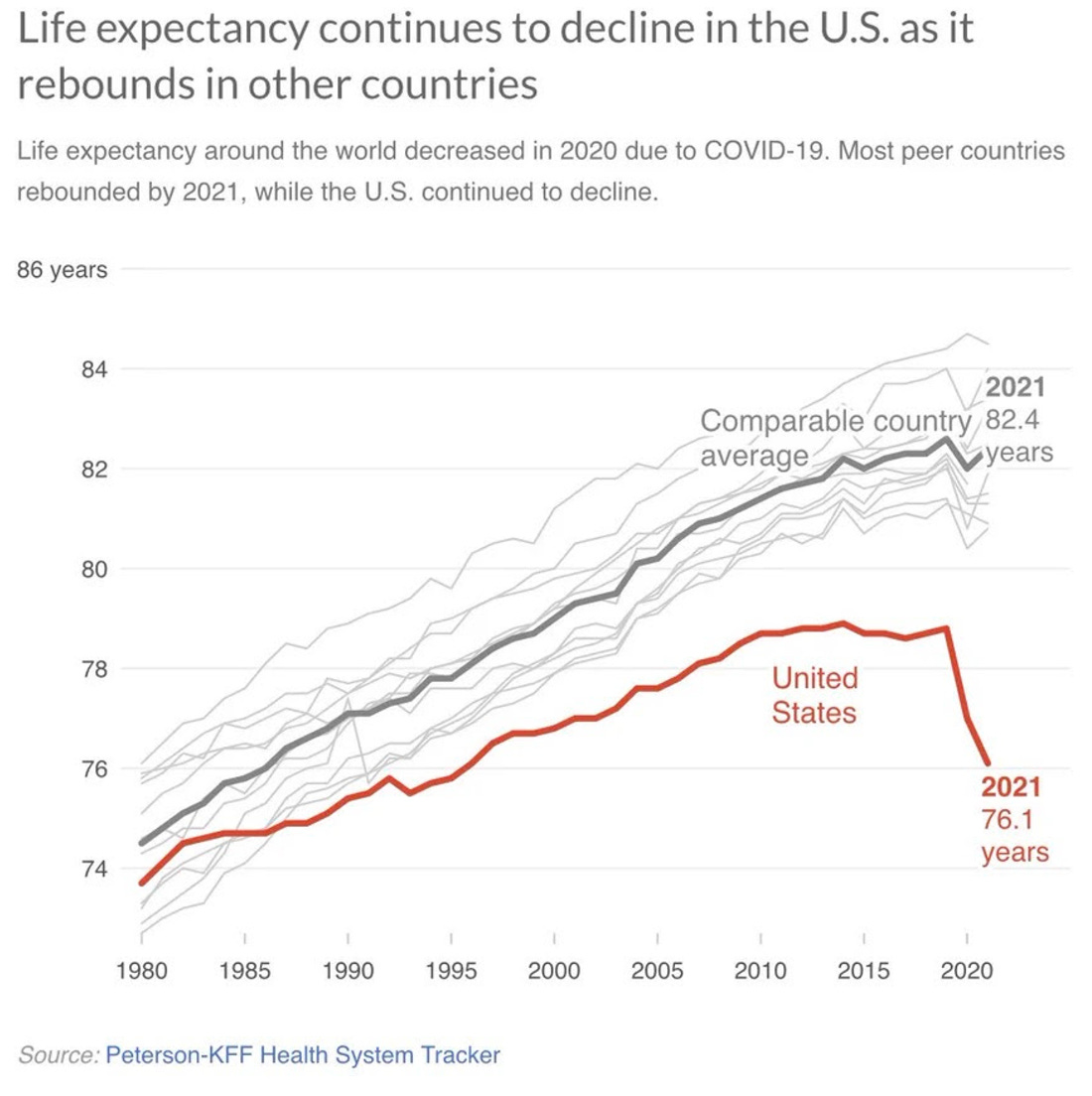

2. US life expectancy falls while the rest of the world stays flat

3. London’s air quality is getting better

Deal Capture 💰

Deals in the impact space across the UK and Europe

Caeli Energie

Low-carbon electronics developer Caeli Energie raised €10m. Led jointly by Asterion Ventures, Starquest Capital, Bpifrance and Rise PropTech.

E-Mobilio

EV platform company e-mobilio raised €10m. Led by SET Ventures.

Jude

Femtech startup Jude raised $4m. Led by Eka Ventures.

Opna

Carbon project startup Opna raised $6.5m. Let by Atomico.

Paptic

Sustainable packaging startup Paptic raised €23m. Led by European Circular Bioeconomy Fund.

Phycom

Microalgae producer Phycom raised €9m. Led by Invest-NL.

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.