Welcome to our third edition of Eka’s impact newsletter 🥳!

We invest in early-stage technology businesses with either 1) environmental and/or 2) social impact at the core of the business. This newsletter will be focussed on tracking interesting stories across these themes in the UK and Europe 🌎.

This week, we take a look at Pitchbook’s Sustainable Investment Survey published earlier this week.

Sustainable Investment Interest 🗞️

Earlier this week, Pitchbook released a survey from a variety of investors, focussed on sustainable investing in private markets. The main takeaway for us is around the changing importance of ESG year on year. Having ESG embedded in the investment process became less important between 2021 to 2022. However this could be due to changing survey composition with newer LPs/GPs in 2022 being more negative around sustainability. However the trend around decreasing sustainability interest is consistent with previous recessionary periods, and we believe creates opportunities to invest in positive systems change. It is well known that businesses in early-stages during macro shocks tend to outperform those of different vintages, and we believe that is true in the impact space as well.

Changing attitudes towards sustainability

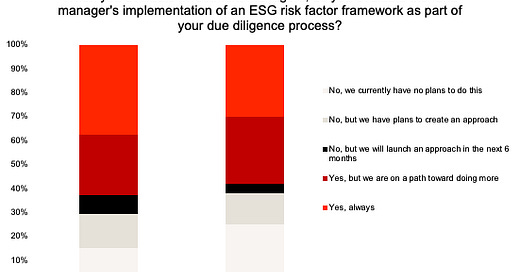

We start with the most interesting chart of the report, in our view. This shows how fund manager opinions have changed year-on-year around ESG in the due diligence process. There has been a material increase away from variations of ‘Yes’ to variations of ‘No’. The authors call out that this could be down to new survey takers in 2022 being more negative around sustainability and thereby skewing the results. The overall directionality of the report away from sustainability however is consistent with trends from previous recessions.

Impact comes in different shades

There is a broad consensus that sustainability means ‘environmental compliance & impact’ for the majority of investors. This could be down to climate advocacy being louder than that of social. This has been consistent with our experience in the funding environment through early 2022. By contrast, social and governance issues are lagging in terms of investor interest (though there is some slight discrepancy between LP and GP interest here in social, which we thought was interesting).

There’s also a good split on VC versus non-VC attitudes towards sustainability. The overall conclusion is consistent with the previous chart (i.e. environmental concerns are key). We do however find the difference in the first section interesting, around improving returns by applying ESG risk framework. VCs here aren’t focussed on improving investment returns by applying ESG risk frameworks. This is different to our thinking. We at Eka believe there is genuine shared value between impact and financial return (see Our Thesis in a previous post).

Putting numbers around ESG

Exactly how GPs and wider investors quantify ESG risk factors varies greatly. The majority have a custom methodology, with the rest being split quite evenly between using standard methodologies or not reporting on material ESG risk factors.

Of those who do impact investment work, almost half do not measure Impact results. This feels really material. As the impact investment industry matures, we believe that it will be a requirement to put numbers around portfolio impact (as it is beginning to be with SFDR and Article 9 disclosure in Europe).

ESG disclosure varies greatly by geography (this is already a known known). Europe over-indexes around material ESG disclosure with 2/3 of respondents requiring portfolio companies to measure and report. North America comparatively under-indexes with less than a half of investors having the same requirement.

We believe there is a real opportunity around innovating in impact investment looking into the next year. There are definitely strong macro and sentiment headwinds into 2023, but we still strongly believe in a positive structural change towards a more sustainable world which can be enabled by investors.

3 Key Charts 📊

1. Venture deployment in Q3 is slowing down (as expected)

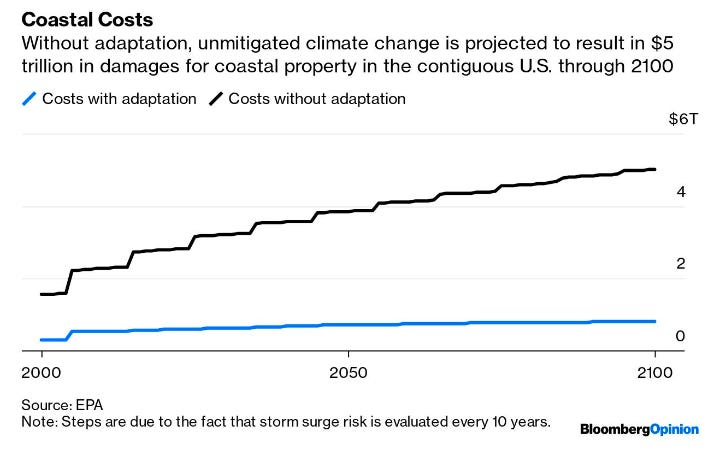

2. Comparing cost impacts with and without climate adaptation

3. House equity decline roughly matching GFC pace

Deal Capture 💰

Deals in the impact space across the UK and Europe

7Analytics

Flood prediction platform raised $2.5m in seed funding. Led by Momentum Partners.

Bud

Apprenticeship platform Bud raised £3m. Included Maven VCT.

Doccla

Health tech startup Doccla raised £15m in its Series A. Led by General Catalyst.

Foodsi

Food waste company Foodsy raised €1.2m. Included CofounderZone and Satus Starter.

Lawhive

Legaltech company Lawhive raised €2m. Led by Episode 1 Ventures.

Gourmey

Cultivated meat startup Gourmey raised €48m. Led by Earlybird Capital

GreenBytes

Food supply chain business GreenBytes raised a €1m seed round. Led by Crowberry Capital.

Optellum

Medtech company Optellum raised a £13m Series A. Led by Mercia.

Quantpi

Ethical AI company Quantpi raised €2.5m. Led by Capnamic.

Upcoming Events… ⌛

… you can catch us at in the not-too-distant future.

… and Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.