Eka’s Weekly Roundup (7 July 2023)

Issue 39 l NHS into perspective

The King’s Fund published a report outlining how the UK’s National Health Service (NHS) compares to other national healthcare systems for 18 other countries.

The UK lags other countries around capital investment in healthcare infrastructure, such as CT and MRI scanners and hospital beds. There is a shortage of key clinical staff, including doctors and nurses, in the UK, and the country heavily relies on foreign-trained healthcare professionals. Remuneration for some clinical groups is less competitive in the UK than in other countries.

The UK healthcare system does on the positive side allocates a relatively low share of its health budget to administration, and has a higher prescription rate of cheaper generic medicines.

On the whole, while the NHS is not leading the pack in international comparisons, it is also not significantly behind. There are areas for improvement, particularly in infrastructure, clinical staff shortages, and health outcomes.

Taking another look at Health spending in context 🗞️

The report starts out by mentioning that much of healthcare is determined outside the traditional ‘illness’ pathways in hospitals and care homes. Extensive evidence reveals that the elements contributing to the advancement of health, well-being, and longevity surpass the impact of a healthcare system (Raleigh 2022).

Thinking beyond Healthcare in Hospitals

For instance, healthier ways of living, broader social determinants, primary education coverage, and income levels all play crucial roles in enhancing life expectancy. Although the health system can influence these factors, they are also significantly influenced by macroeconomic, political, legislative, and cultural aspects. To illustrate this, consider two countries with similar levels of healthcare expenditure, but varying health outcomes due to divergent regulatory approaches in promoting healthier lifestyles, such as the prohibition of smoking in public places or imposing higher taxes on tobacco or high-sugar-content products.

The UK is around the global average for perceived health…

OECD data shows that 73% of the UK public believe their health to be good or very good. This increases to 83% for high income earners, and comes down to 63% for low income earners. Some outliers around variance between high and low incomes include Germany and Belgium, with close to a 30pt difference between the the highest and lowest points.

… but trails on anxiety measures

The report collates various notes on countries’ mental health prevalence. In the case of the United Kingdom, there is a notable proportion of individuals who report experiencing anxiety symptoms (both before and during the Covid-19 pandemic, as depicted in Figure 4 below), while the prevalence of depression symptoms falls around the average. Nevertheless, it is important to exercise caution when making comparisons between countries due to cultural and societal variations that can affect individuals' willingness to report mental health issues (OECD 2021).

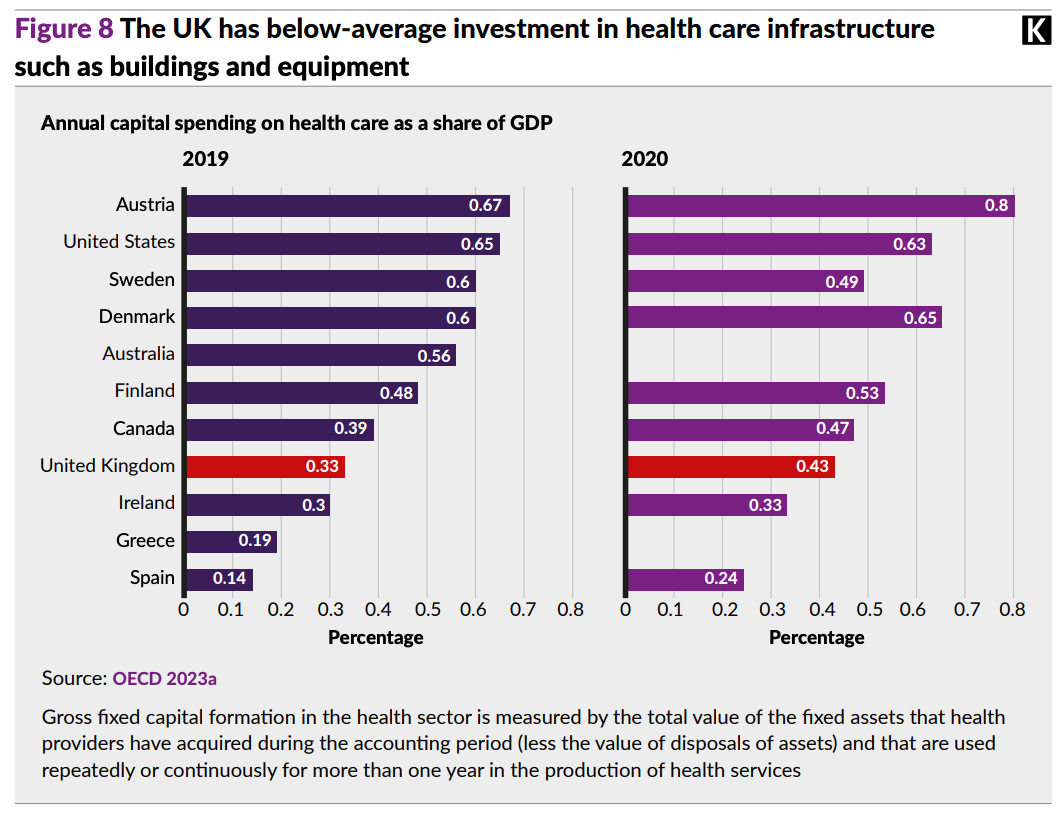

Healthcare capex trails other countries…

The OECD provides separate data on capital investment. It reveals that the United Kingdom's capital investment in healthcare is significantly below average compared to other countries in our comparison. In 2019, the UK allocated 0.33 percent of its GDP for capital investment in healthcare, while the average for comparable countries was 0.48 percent (refer to Figure 8). Previous analyses have consistently demonstrated that the UK's healthcare capital investment has remained below the average of comparable countries for nearly two decades. In fact, in 2019, an additional £2.5 billion would have been required to reach the average capital spending of comparable countries in England.

Another area where the UK falls behind is around CT and MRI scanners. Similar to overall capital investment, there is no universally defined optimal level of diagnostic equipment. The OECD acknowledges that an insufficient number of scanners can result in longer wait times and potential under-diagnosis of health conditions. Conversely, an excess of scanners can lead to the unnecessary and costly utilisation of equipment with little clinical benefit. The quantity of scanners in a country can also be influenced by historical and broader societal factors. For instance, Japan stands out as an outlier, possessing a significantly higher number of scanners per capita compared to other countries. An intriguing example is an MRI scanner located at a gas station in Yamaguchi prefecture, highlighting Japan's extensive and well-established diagnostic equipment manufacturing industry. Additionally, access to diagnostic devices plays a role in the competitive market dynamics among smaller private hospitals in Japan.

… and so do staffing numbers

While the UK's National Health Service (NHS) is frequently recognized as one of the largest employers globally, alongside Walmart, McDonald's, and the People's Liberation Army of China, this does not imply that the UK possesses the largest healthcare workforce in the world. The UK's distinction as one of the world's largest employers is influenced by the organisational structure of various healthcare systems, as well as the NHS's dominant position as a single employer within the UK healthcare sector. Examining the overall health and care workforce across different countries, approximately 12.4 percent of jobs in the UK are held by health and care workers, which falls around the average for our comparison group of countries. However, it is lower than countries such as the Netherlands, Sweden, Finland, and Denmark, where more than 15 percent of jobs are occupied by the health and care workforce.

The doctor-to-nurse ratios can indicate variations in care models. Some countries have a lower number of physicians per person, such as Canada, Japan, and the United States, while others have fewer nurses per person, including Greece, Italy, Portugal, and Spain. However, the United Kingdom exhibits remarkably low figures in both of these staffing indicators.

One surprise was a relatively low administrative spend

Despite its relatively small proportion of health spending (as shown in Figure 19), administrative spending often becomes a focal point for governments or local leaders aiming to reduce overall healthcare expenditure. Consequently, healthcare systems frequently witness endeavors to minimize bureaucracy, cut red tape, and engage in "wars on waste." In comparison to other healthcare systems, the United Kingdom's spending on administration falls below the average.

The variation in administrative spending across health systems can be influenced by structural or broader societal factors. For instance, regions with a more geographically dispersed population may encounter higher costs in revenue collection. However, the OECD emphasizes that the financing model of a healthcare system, whether predominantly based on taxation, social health insurance, or private health insurance, significantly contributes to the levels of administrative costs (OECD 2017).

Week in Impact Articles ✍🏽

Monday: Why LNG terminals will not be transporting hydrogen any time soon

Tuesday: North American climate startups grab global VC favour

Wednesday: GPT stops defying gravity as monthly visits slow

Thursday: Ill in England? Your Location Can Determine If You Live or Die (the prettiest data visualisation you’ll see in a while!)

Friday: Global climate tech startups running list

3 Key Charts 📊

1. Coal consumption is declining…

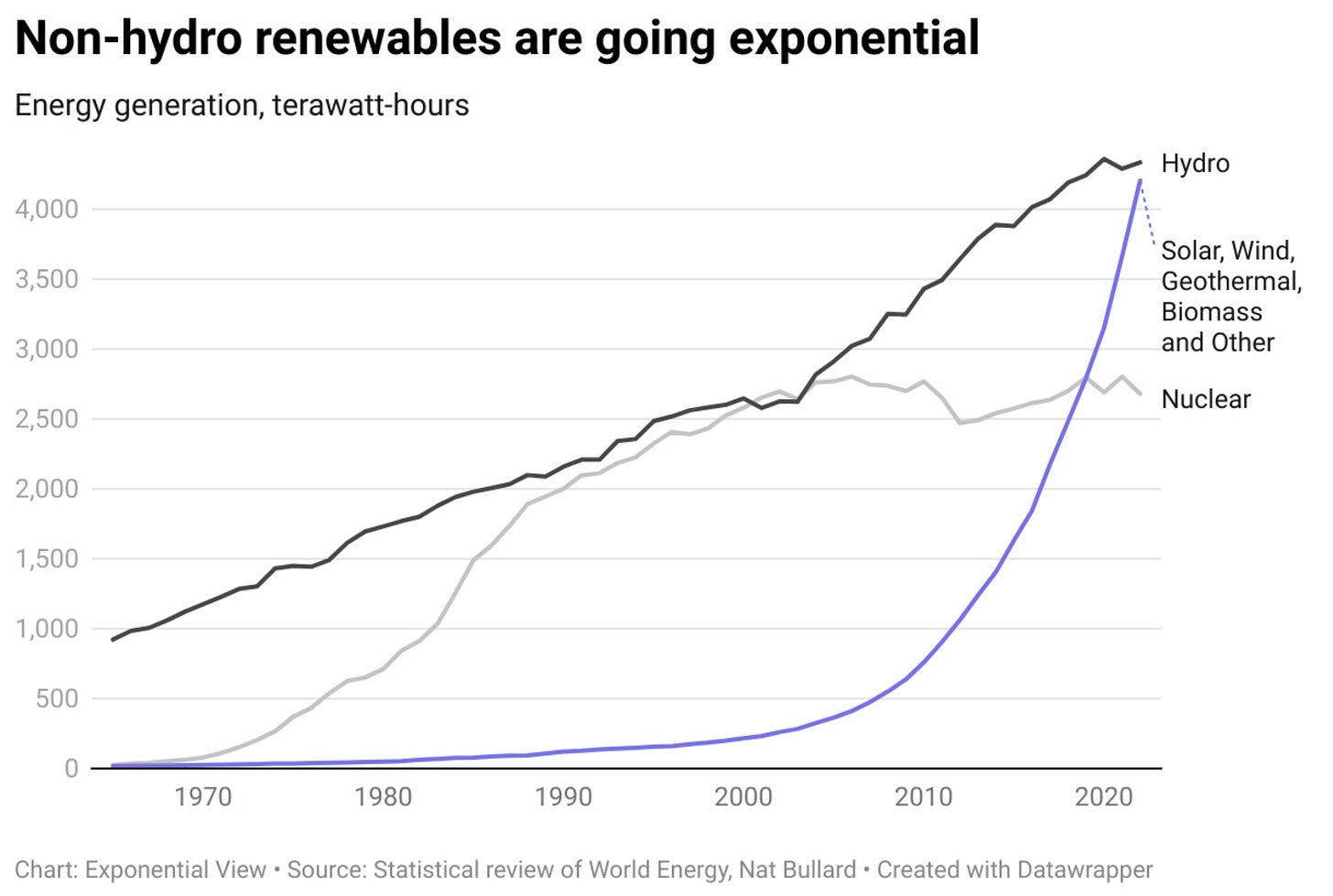

2. … with renewables going exponential

3. Breaking down sweeteners since 1999

Deal Capture 💰

Deals in the impact space across the UK and Europe

ChargeX

Battery startup ChargeX raises €11.5m. Led by UVC Partners.

Eaze

Sleep coach Eaze raises €1.7m. Led by Redstrone and EnjoyVenture Human Impact Fund.

Neko Health

Health tech start-up Neko Health raises €60m. Led by Lakestar.

Reyedar

Deeptech startup Reyedar raises €3m. Led by Cottonwood Technology Fund.

uMed

Clinical trials facilitator uMed raises £10m. Included Delin Ventures, Albion, and Playfair.

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.