Ember put out its European Electricity Review looking back at the 2022 energy shock. There are a few interesting snippets from the report which we hadn’t seen previously: 1) the monthly run-rate of coal generation coming out of 2022 is looking healthier than many had expected, 2) much of this was to offset the drop in hydro and nuclear generation from this summer, and 3) decreased demand was a big piece in managing the overall energy market.

Overlooked points for energy in 2022 🗞️

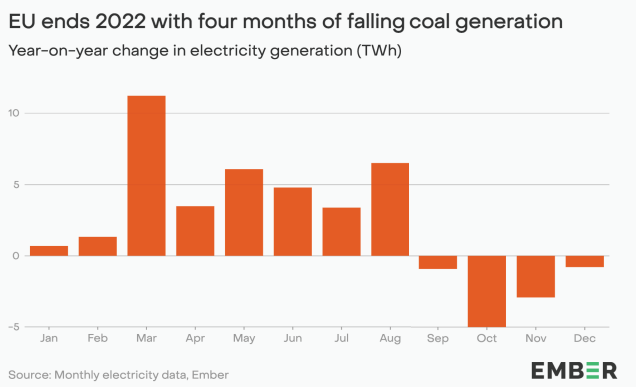

1. Coal surge did not materialise in winter (but 2022 is up on 2021)

Coal generation in the EU fell by -2% in September, -13% in October, -7% in November, and -2% in December. This is in contrast with what forecasters had been predicting given the energy crisis. Looking at the trend year-over-year however, there was a slight increase on 2021 of +7% in 2022. This was mainly down to coal generation in late Q2 and early Q3.

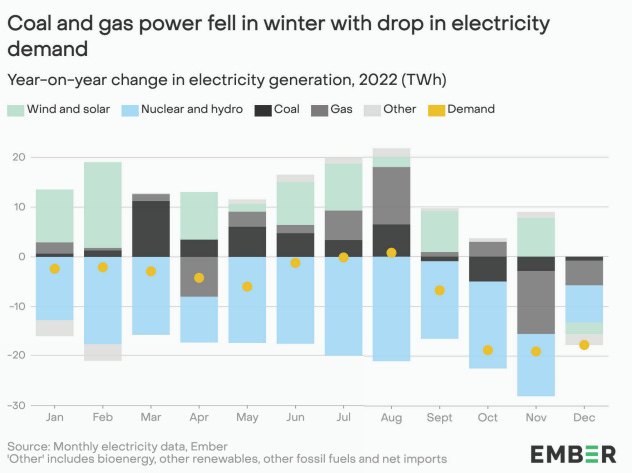

2. Hydropower and nuclear generation shortfall caused coal’s uptick

Nuclear and hydro generation fell -185TWh year-on-year in 2022. 185 TWh is equivalent to 7% of EU’s total generation. The majority of the shortfall was covered by increased solar and wind generation. Coal contributed to 1/6th of the shortfall while gas was almost unchanged. Interestingly, demand also decreased materially by -79TWh year-over-year.

European droughts led to weaker hydropower generation

Europe faced its worse drought in at least 500 years last summer (European Commission). This hit the Alpine region with generation being below 9% of the worse year so far this century. By early 2023 however, hydro stocks were only slightly lower than historical averages.

French nuclear capacity dampened with maintenance

EU nuclear power was down 16% year-over-year, or -119 TWh. Most of this fall (69%) was from French outages, with another 27% being due to the unwinding of German nuclear plants. French capacity has slowly been coming back to the grid with 72% of total capacity being operational in early January 2023 (compared to 48% average over 2022).

3. Electricity demand was effectively low in 2022

Europe saw an -8% decrease in electricity demand during 4Q22. Mild temperatures helped offset demand, with October, November, and December seeing warmer temperatures by 1.9C, 0.8C, and 0.9C respectively (compared to 2021). However, there was more to the demand decrease than just warmer temperatures.

While it’s hard to quantify, there were a few other factors at play. There were some reductions in industrial and commercial output, some reductions from cost-of-living on the consumer side, as well as some additional voluntary behaviour change. The report does question how much of this will be structural demand shifts versus a 2022 anomaly.

3 Key Charts 📊

1. Health & fitness apps in the UK: period tracking for the young, public health for the old

2. European electricity emissions are, on the LT view, coming down

3. Consumer excess savings are almost back to zero

Deal Capture 💰

Deals in the impact space across the UK and Europe

Entocycle

Insect farming startup Entocycle raised £4m in its Series A. Led by Climentum Capital with participation from Lowercarbon, Teampact, and Ace & Company.

Fairphone

Sustainable electronics company Fairphone raised a $53m growth round. Led by Invest-NL (ABN AMRO Sustainable Impact Fund) ad existing investor Quadia.

Fuergy

Energy management system Fuergy raised €16m. Led by Pro Partners Holding.

Greenspark

Climate advisory Greenspark raised £1m. Led by Fuel Ventures.

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.