Venture returned $600b in value to the UK ecosystem in the last ten years. While funding growth has slowed, and may not pick up to the 2019-21 speed for quite some time, there are many benefits that the UK tech scene can capture: 1) talent spillovers, 2) availability of capital, 3) greenfield in new sectors such as climate and deep-tech. Tech Nation’s last report has a number of policy recommendations to keep the UK’s startup world alive and kicking - we take a look at these below.

TLDR: plug in more patient capital, invest in diversity at every level, and promote outlier value creation.

How to build a scale-up 🗞️

Tech Nation’s latest report published yesterday sets out the next decade’s agenda for UK tech.

The UK tech ecosystem is currently valued at >$1tn. Over the last ten years, scale-ups returned just under $600b in value to the UK. Over the next decade, to return the same rate of 3.7x investment, UK tech firms will need to target exits worth $2tn.

An overview of UK tech

The number of rounds at all stages decreased in 2022. This was the lowest level of rounds in the UK for the past five years.

Financing rounds in $ terms have also come down. The chart below shows a stark contraction in later stage rounds of $250m+ companies. Seed remained relatively resilient throughout 2022.

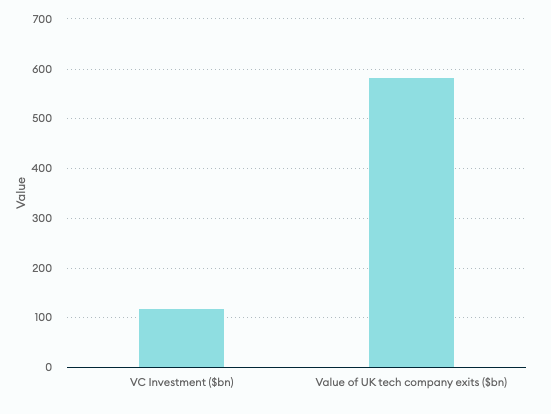

Exits have been just under $600b in value between 2014 and 2023, compared to $120b of funding in VC investment. Exits here are defined as acquisitions, SPACs, or public listings. The key sectors in the UK which have performed particularly strongly are fintech (5x in the last decade), health-tech (2.4x) and deep-tech (2x).

Only 6% of total UK tech companies achieve an exit. 0.12% achieve an exit value of over $100m. The numbers for VC-backed companies are slightly higher - we have seen values of 30-40% exit success rates compared to the 5% shown below. The report suggests that close to 11% of all tech companies are VC backed in the UK.

Where we are on diversity

Diversity has been improving (as we’ve previously written about [here]) but is still a long way off where it should be. The proportion of VC investment going into companies with at least one female founder is between 9-13%.

The early-stage funnel is looking more encouraging. At the pre-seed stage, close to 20% of investment is going to companies with at least one female founder. As the stages progress, this percentage comes down to roughly 5-10% at the growth stages.

Moving beyond gender, location is another important diversity measure. Greater London remains the crown jewel for UK VC funding. This is followed by South East England.

Scorecard by sector

In generalist tech, FinTech is still the highest funded sector within the UK. This is 3.3x larger than any other industry in the UK. Energy saw a slight increase in 2022 as did Transportation. Health shot down after a strong performance during the Covid-19 pandemic.

The report doesn’t explicitly call out climate tech, but mentions more than 300 climate and impact funds being developed in the past three years, which has tripled the amount of funding going into the sector to $270b.

Policy recommendations

The report recommends a few Impact-related policies:

Patient capital. Plug patient capital into all stages of company growth. 15x investment in deep-tech and climate tech must be made by the end of the decade to stimulate and sustain growth.

Diversity. Improve diversity metrics at the startup and investor level. Within startups, make sure this is across functions and seniority levels.

Value Creation. Ensure the ecosystem is geared to generate outlier returns. Capital and talent must continue to be effectively recycled across the ecosystem.

3 Key Charts 📊

1. Hot topics within impact investment: inclusion, access, and equity

2. ESG to become mainstream within the decade

3. Mapping out climate developments by generation

Deal Capture 💰

Deals in the impact space across the UK and Europe

Bacx

British sports supplement brand Bacx raised £1.2m. Led by Sebastian Vettel.

Carbonable

Carbon blockchain startup Carbonable raised a $1.2m round. Led by Ethereal Ventures and La Poste Ventures.

HT Materials Science

Heating startup HT Materials Science raised a $15m round. Included Aramco Ventures and Barclays.

MVision AI

AI cancer platform MVision AI raised a E5m round. Led by J12 Ventures and Voima Ventures.

Piclo

Flexibility marketplace Piclo raiased a £8m Series B. Co-led by Future Energy Ventures and Clean Growth Fund.

PocDoc

PocDoc raised a £2.5m extension for their seed raise. Led by Forward Partners and MMC Ventures.

The Climate Choice

Carbon supply chain company The Climate Choice raised a $2m round. Led by Gutter Capital.

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.