Welcome to our first edition of Eka’s impact newsletter 🥳!

We invest in early-stage technology businesses with either 1) environmental and/or 2) social impact at the core of the business. This newsletter will be focussed on tracking interesting stories across these themes in the UK and Europe 🌎.

For this first edition though, we are proud to announce that Eka is officially a B Corp! We share our key learnings from the process below.

B Corp Accreditation 🗞️

We are pleased to announce that we are officially a B Corp with a score of 116.

Short introduction for the uninitiated.

B Corp Certification is an accreditation available to for-profit corporations which meet the highest standards of social and environmental performance. These can be from any industry (e-commerce, traditional retail, venture capital…). Companies must score at least 80 out of 200 points on the B Impact Assessment to meet B Corp Certification. Other VCs which are certified B Corps include Bethnal Green Ventures, MMC, and Eutopia.

So what did we learn?

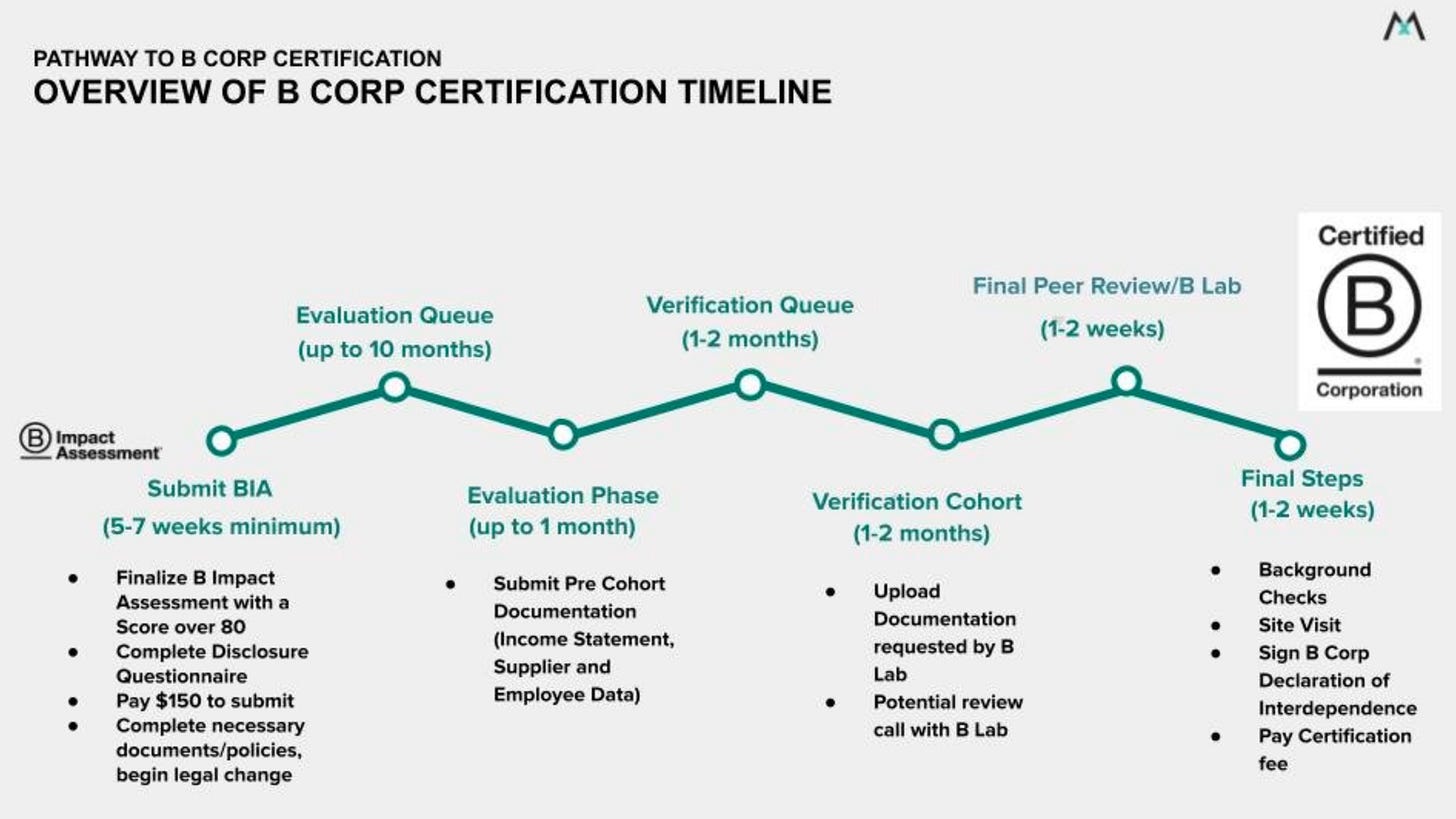

1. The accreditation process is lengthy.

We started the process in April 2021, which equates to roughly 17 months of working towards the certification. The process is quite detailed and we thought the rigour was impressive. There is however quite a lot of downtime between the various sections.

2. It raises the bar for internal standards.

They spend a lot of time on internal policies. This made us solidify internal processes - we refined our employee reviews, investment due diligence process and ESG policy. We changed some legal documents to amend our key stakeholders to include the environment.

3. There’s a whole community behind it.

Once you become a B Corp, you can access the B Hive which is the community for accredited companies and partnerships. This is an exclusive social media network for certified companies. There are also events and networking opportunities available.

Eka’s scorecard: where did we do well, where we can improve?

We scored 116 points out of a possible 200. For context, the median score is 51, with 80 being the threshold for certification. We highlight the key takeaways below:

Governance was our best performing segment. This is one of our key internal values, so we were pleased that it came out highly. We scored well on all components (mission & engagement, and ethics & transparency).

Environment needed more disclosure. We weren’t able to give evidence or validate much of the Environment section’s questions given we don’t have total understanding of our building’s water or electricity sourcing, for example. This is something we are working on.

… the process needs to be repeated every three years for re-certification. After a celebratory drink, we’ll spend the next few months reflecting on how to build Eka in an even better way!

3 Key Charts 📊

Scroll to see which of these caused some controversy in the Eka team…

1. Capacity build is needed for various green materials

2. Mortgage rates to weigh on consumers

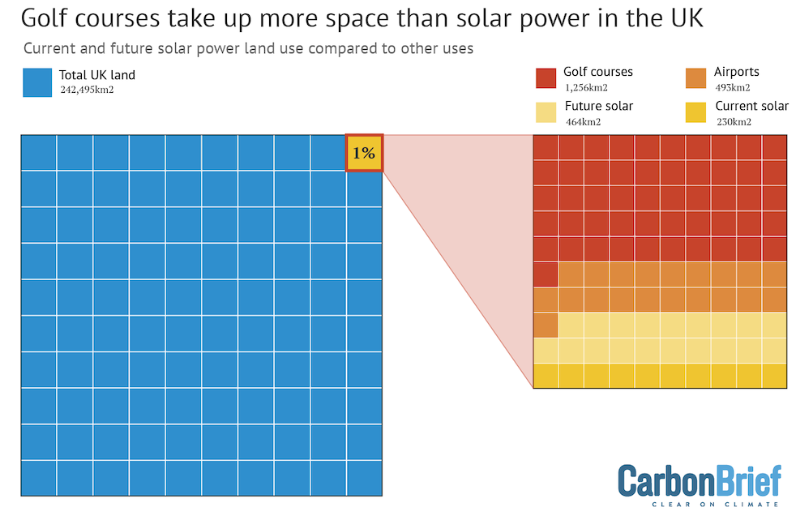

*3. Golf course land use outstrips solar power use in the UK

*Note - this one caused quite the debate between Eka golfers and non-golfers. We recognise that the golf UK land use and solar power land use are not totally like-for-like comparisons, but we thought it was worth sharing either way!

Deal Capture 💰

Deals in the impact space across the UK and Europe

Amply

ML and bio-information company AMPLY raised £630k in a Seed investment. Includes contributions from Co-Fund NI and QUBIS Innovation Fund.

Datamaran

ESG risk management software announced a £12m Series B raise. Led by Fortive.

Exasun

Solar roof company Exasun raised €9m. Contributions from ABN Amro, Invest-NL, and Wienerberger.

Greener Guide

Environmental consultancy service Greener Guide raised £530k in a Seed investment.

Sweetch Energy

Renewable energy company Sweetch raised a €6m round. Led by EDF Hydro and CNR.

Tilt

Digital fashion app Tilt raised £2.66m in a Seed stage. Contributions from Earlybird, Seedcamp, and TQ Ventures.

Rival Foods

Plant-based meat developer Rival Foods raised a €6m Series A. Led by PeakBridge and Roquette Ventures.

Next Week… 📅

… we’ll be looking out for BBG’s Tech Summit and Clim.

…Upcoming Events… ⌛

… you can catch us at in the not-too-distant future.

Bloomberg Technology Summit - London, 28 September.

Tech Nation x Net Zero - October, 6 October.

Catalyst - Belfast, 18 October.

Slush - Helsinki, 17-18 November.

… and Getting in Touch 👋.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉

We are open to feedback: let us know what more you’d like to hear about 💪.