Silicon Valley Bank published a note on the state of climate tech funding as of H1 2023 this week. The report focuses on government support, diversification with climate tech, and data measurement. The headline is that climate tech funding remains resilient relative to generalist sectors, with VC investment falling -21% compared to the start of 2022 compared to -41% for other technology sectors over the same period.

Running the numbers for H1 2023 🗞️

This report highlights key takeaways regarding achieving net zero and the state of climate tech investments. Deal count is down, but not by as much as other sectors.

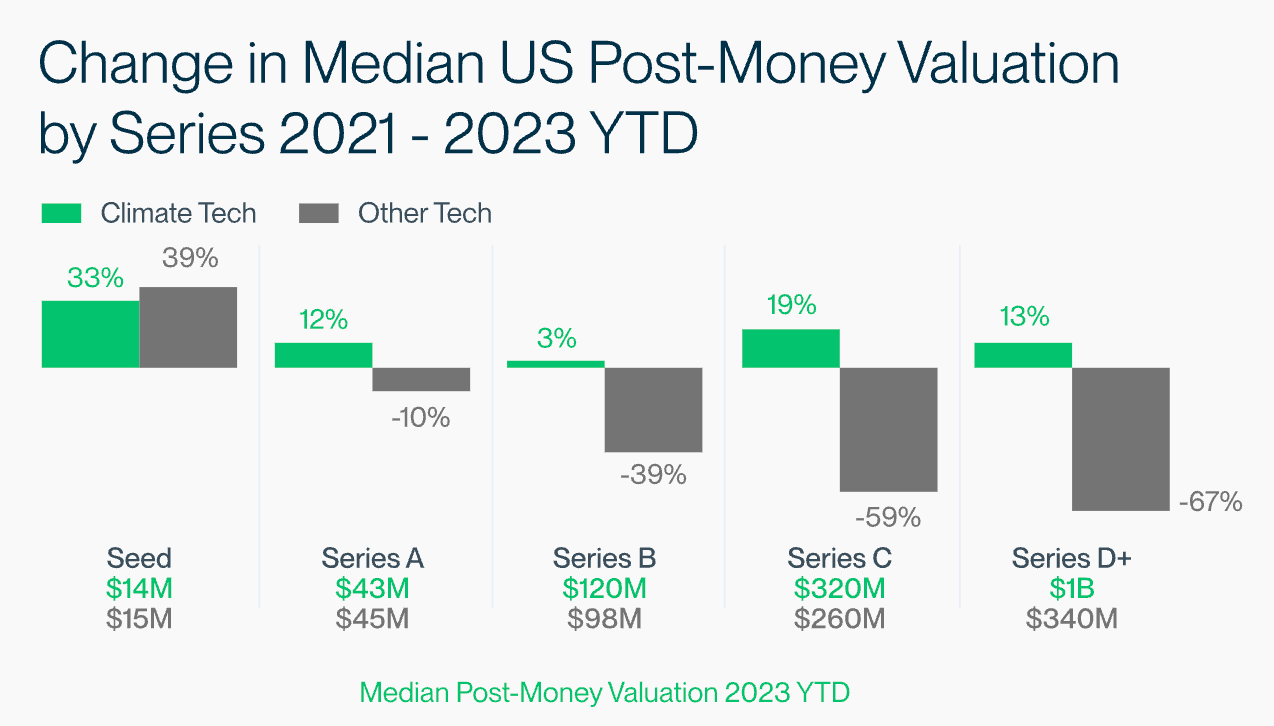

Turning to valuation, this interestingly saw less of an uptick in seed than other tech. On the whole though climate tech valuations have risen over 2021-2023YTD relative to other tech.

One of the most interesting charts we thought was the default rate on infrastructure finance projects. Green projects have lower default rates over the life of financing compared to non-green infra projects. This links well into our shared value thesis as written in Solving for Impact Tech.

Beyond the charts, the key points relate to:

Government support: Massive federal spending is driving momentum for clean energy projects, improving the economics for climate tech investors and founders.

Climate tech diversification: Combining clean tech innovations with artificial intelligence and software creates opportunities to optimize, decrease costs, and develop new markets, leading to a more diverse cohort of climate tech companies.

Measurement of data: Capturing and synthesizing data from climate tech innovations generates new revenue streams, benefiting both hardware and software companies.

Week in Impact Articles ✍🏽

Monday: Circularity Gap Report 2023

Tuesday: Millennials Rising Cancer Cases

Wednesday: Google Clothes’s Try On Feature

Thursday: Sequoia’s Tech Talent Map

Friday: GP Bullhound’s Titans of Tech

3 Key Charts 📊

1. Looking at renewables vs. oil & gas with hiring data

2. AI basket of winners in public equities (Barclays)

3. Energy’s key phases by innovation

Deal Capture 💰

Deals in the impact space across the UK and Europe

Adamo

Adamo Foods raises £1.5m. Included SFC Capital.

Cleanhub

Waste company Cleanhub raised €6.4m. Led by Lakestar and Integra Partners.

Nyra Health

Digital therapy platform raises €4.5m. Led by Mass Mutual and Wellington Partners.

Squake

Travel industry carbon calculator raised €4.5m. Led by Simon Capital.

Supercritical

Carbon removal marketplace company Supercritical raises $13m. Led by Lightspeed.

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.