The International Energy Agency released their Energy Technology Perspectives document for 2023. We took a (quick) look at the ~500 pages so you don’t have to!

In short, we are entering a new industrial age which will need investment in technologies and infrastructure. Clean energy supply chains today are concentrated, especially around critical materials. In other words, industries and economies will need to de-risk this over time to ensure supply into 2050.

🛢️ Out with the oil, in with the (re)newables ☀️

If you only take away one chart from the report, this is it. It shows exactly where we need to apply pressure and innovation in order to extract change. The remainder of the IEA’s paper spells out exactly how to make this new supply chain sustainable, equitable, and resilient.

1. Energy is entering a new industrial age…

Traditionally, our energy grid had been dominated by oil (in purple below). Hydrogen production has been predominantly fuelled with coal and natural gas. Renewables have played a relatively insignificant role in the overall energy supply, especially compared to the energy loss output of power generation (in grey below).

The chart below shows we need to be tomorrow: an energy supply chain rich in solar, wind, nuclear, and bioenergy (interestingly still a similar loss ratio). Oil will play a small role, mainly in chemicals manufacturing. Almost all other industries will be fuelled in a large part by renewables.

To get there, we need a lot of clean energy deployment. Assuming a net-zero scenario, we would need to more than triple solar electricity generation, have close to 3m of fuel cell trucks per year (near zero now), and change our hydrogen supply chains from relying on black hydrogen to green heating sources.

We will need to move quickly, and provide about $1.2tn by 2030 to bring enough capacity to clean energy technologies. Announced projects already amount to 60% of this figure, but there are gaps within mining and technology manufacturing.

2. … with each country requiring a unique approach to the transition.

Global supply chains are complex and interconnected. As shown below, the solar PV supply chain is dominated by China, with some other APAC countries also contributing strongly following cell manufacturing.

Relatively newer technologies such as heat pumps have had much more linear supply characteristics. The share of inter-regional trade in global manufacturing is <10% for heat pumps, compared to 60% for solar PV. These have also been adapted for specific climates, which make them less mass-producible.

3. There could be high concentration in energy supply chains …

There are certain supply chain components where supply is extremely consolidated. The graphic below shows the regional shares of global production for manufactured clean energy technologies and components. There are many more examples in the report where various countries dominate the supply chain for net zero.

This lead to significant trade (im)balances across various geographies. China has a strong dominance in energy technologies, with the US have a similar advantage in fossil fuels. Conversely, Japan and Korea are extremely dependent on fossil fuels, while China is dependent on certain critical minerals.

4. … so developing resilience early on will be important.

Prices of critical materials and energy have been volatile in the past two years, in part due to supply chain but also increasing organic demand. Notably, the price of lithium increased 10x since 2015 (used in EVs and other clean technologies).

The increase in price means the cost of the energy transition is highly variable depending on global minerals pricing.

There are a number of risks threatening the acceleration of the global clean energy transition. Low-risk includes solar PV and EV manufacturing. Infrastructure projects around electricity, and H2 are much higher risk.

5. Beyond energy, we need to think about critical materials…

Critical materials pricing and supply will be important for the transition. Demand for lithium is estimated to increased 7x between 2021 and 2030, mainly driven by EV batteries. Copper demand is ‘only’ going up 45% (the lowers in the five metals), 90% of which will be driven by clean energy technologies such as networks, EVs, solar PV, and wind turbines.

There will also be a growing secondary market, with secondary production of selected materials increasing as part of the overall mix to get us to net zero.

Secondary markets will depend on recycling, collection rates, advanced sorting technologies, and creating well-established production routes such as electric arc furnaces for steel.

6. … and the new energy economy beyond energy generation.

Beyond the direct net zero transition, we will also need to fund better infrastructure assets to support a move to electrification. This includes power transmission lines, distribution grids, and transformers - all of which are estimated to grow demand by 50% in a 2022-30 net zero scenario.

For example, the supporting infrastructure for low-emission hydrogen would require changing the tanker fleets and import terminals structure compared to the traditional LNG (liquified natural gas) markets. This is because hydrogen shipped as ammonia or LH2 is less energy-dense in volumetric terms, meaning supporting infrastructure will need to be larger at port facilities and with ships.

3 Key Charts 📊

1. Impact enterprise values are slightly down over 2021, but still up 40% on 2020

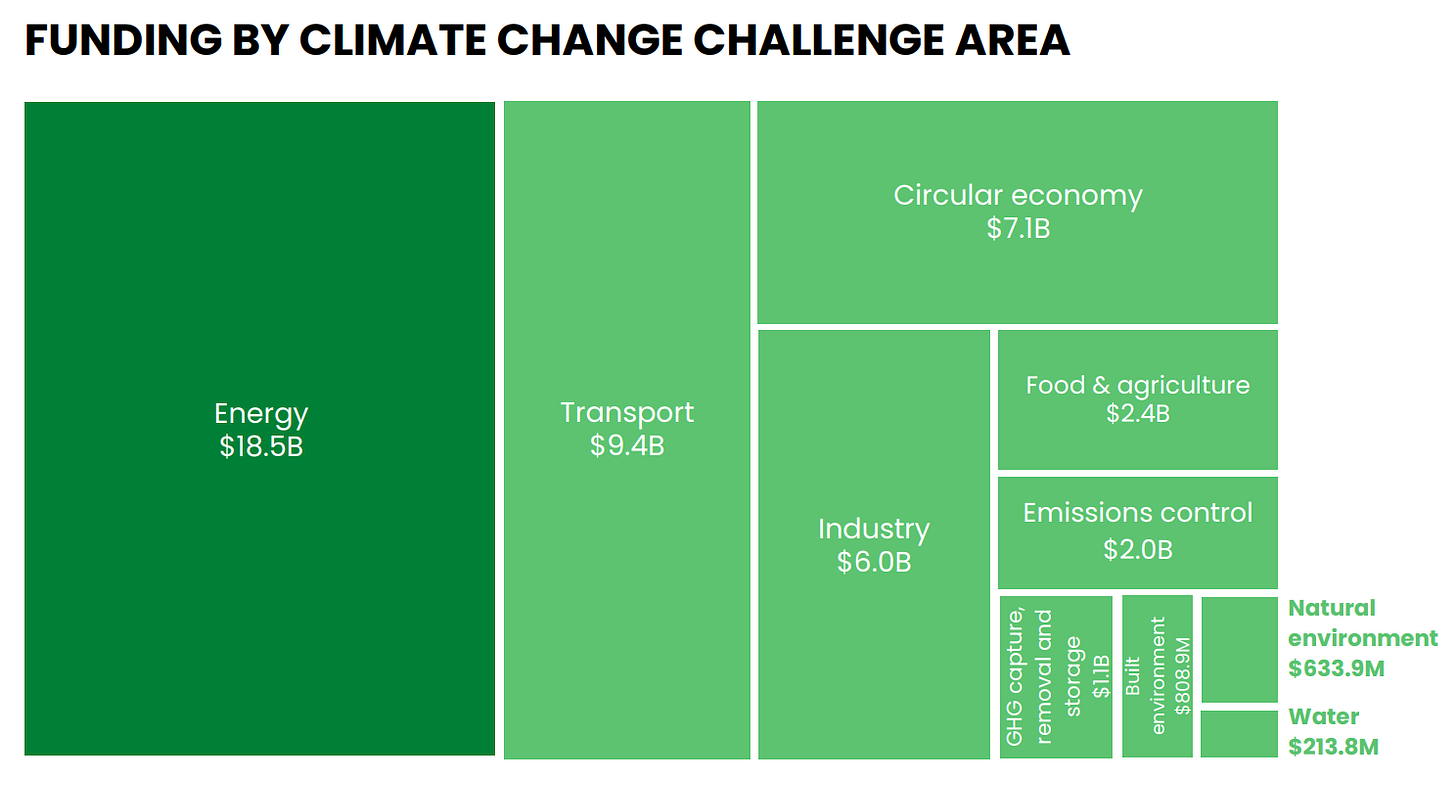

2. Energy gets the most climate-tech funding in 2022

3. Obesity in the US is a generalised problem

Deal Capture 💰

Deals in the impact space across the UK and Europe

CareLineLive

Digital management system for home care CareLineLive raised £3m. Led by Oakglen.

EnsiliTech

Fridgeless vaccine startup EnsiliTech raised £1.2m in its pre-seed. Led by the Science Angel Syndicate and Fink Family Office.

Multus Biotechnology

Alternative meat startup Multus raised a $9.5m Series A. Included $2.5m from Innovate UK. Led by Mandi Ventures, with SOSV, Big Idea Ventures, SynBioVen, and Asahi.

SunRoof

Solar PV company SunRoof raised a €13.5m extension to its €15m Series A. Included World Fund, Nordic Alpha Partners, and L&G Capital.

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.