Welcome to our fourth edition of Eka’s impact newsletter 🥳!

We invest in early-stage technology businesses with either 1) environmental and/or 2) social impact at the core of the business. This newsletter will be focussed on tracking interesting stories across these themes in the UK and Europe 🌎.

This week, we look back at the Impact fundraisings across the UK in Q3. These seem to be holding up better than the Non-Impact raises when stripping out the Covid comps, but all are seeing year-on-year declines (as expected). The early October data is interesting with Impact fairing worse than Non-Impact in the first twelve days of the month, but there is a large base effect which means we wouldn’t put too much weight on these early signs.

Q3 Impact Deals Retro 🗞️

We looked back at the Impact fundraisings announced on Beauhurst during Q3. Beauhurst looks at UK-only fundraisings and can log deals with some time delay, so this list will not be completely accurate. However, we thought the data was helpful directionally around quarterly funding trends.

Source: Beauhurst and Eka.

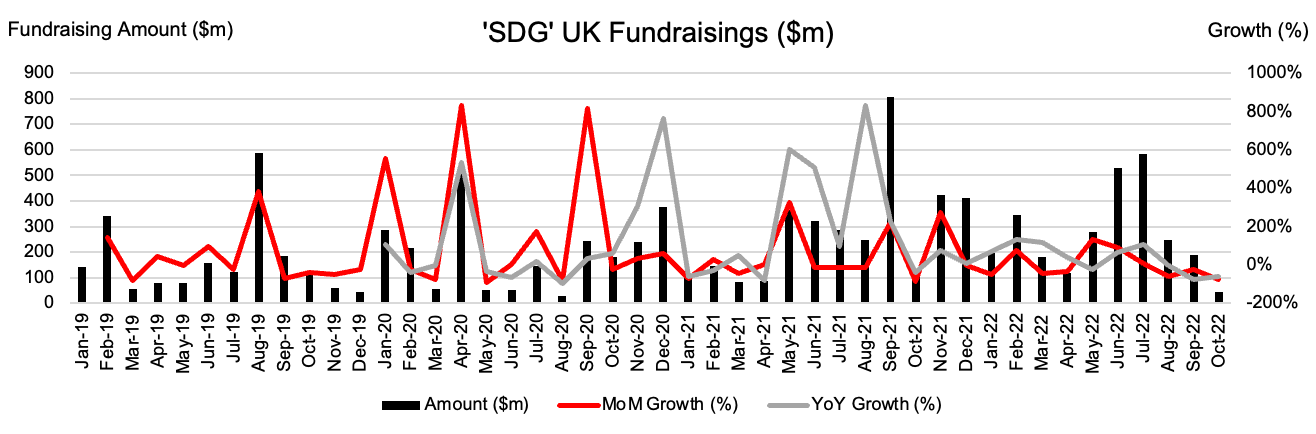

We also pulled Dealroom’s ‘sustainable development goal’ fundraisings to get a sense of the trend over time. When looking at the run-rate out of Q3, we can see a slowdown in fundraisings at $188m in September compared to $584m in July of this year. There is some seasonal slowdown towards the backend of summer as with every year, though comparing these levels to 2020-2021 numbers can be misleading given the frothy market.

A better way to evaluate the time-trend is to look at the fundraisings on a three year stack. Q3 21 fundraising amount is up 114% compared to Q3 19. This is a better sense of a ‘normalised’ market. The early signs on Q4 are not as encouraging. The grossed-up October amount is down c60% on the same 3-year stack basis, but these are quite low bases at <$100m. We also note that the SDG chart is quite lumpy, with low bases creating outlier deal value and skewing the time series trend.

Source: Dealroom. Note October values have been grossed up using the month-to-date numbers ($17m) to get a better whole-month picture (estimated $44m, as shown above).

This is especially interesting when compared to total UK fundraisings, which means SDG plus Non-SDG. These were also soft in Q3 compared to 2020 and 2021. On a three year stack however, these were up 91% to $3.7b. The early Q4 signs from early October are also encouraging, with October being roughly flat on a three year basis (compared to October being down -50% year-on-year). Our conversations with various early-stage investors suggests there is quite a high degree of variability between funds and strategies around pipeline into Q4, but as expected we do expect a slowdown to continue into Q4 and H1 23.

Source: Dealroom. Note October values have been grossed up using the month-to-date numbers ($662m) to get a better whole-month picture (estimated $1,710m, as shown above).

Using these two previous charts, we can also back-out the split between Dealroom’s SDG tags and non-SDG tags. There isn’t a set trend here that we could pull out (beyond the fact that SDG fundraising as part of the mix is still very small). We think this is because the SDG and Impact raises are still in their early stages compared to bigger-ticket raises of 5-10 year old companies. We will be curious to see how this evolves over the next few years.

Source: Dealroom.

As a reminder, these were the big-ticket UK Impact raises in Q3.

Tesseract. The energy company raised $78m in the quarter from Balderton and Lakestar. The proceeds will be used on building renewable energy assets as well as developing the tech platform.

Neurofenix. Neurofenix is a medtech company specialising in sensor-based stroke rehab. They raised $7m in their Series A, led by AlbionVC. The raise is aimed at helping Neurofenix with hiring & clinical trials, as well as a US expansion.

Suvera. Virtual care platform Suvera closed their seed extension round of £5m in July. The company works with GPs to provide remote care for patients with long-term chronic conditions.

Modulous. Sustainable construction company raised £10m in their Series A. Investors included Sustainable Future Ventures, Regal London, and CEMEX Ventures. The proceeds will be used on developing the Modulous software platform used in the home building process.

Nanopath. Nanopath is a molecular diagnostics company. They raised $10m in a Series A, co-led by Norwest venture Partners and Medtech Convergence Fund. The funding will be used to build out the technical team and enhance clinical partnerships in their GTM.

3 Key Charts 📊

1. Early-stage funding was resilient during the GFC

2. The rise of online secondhand fashion

3. Timing of BECCS deployment and impact on global warming

Source. *Note BECCS refers to bioenergy with carbon capture and storage.

Deal Capture 💰

Deals in the impact space across the UK and Europe

Algo Paint

Algae-based plant company Algo Paint raised a €3m seed round. Investors included EDG and Amundi.

Blackbullion

Financial wellbeing platform Blackbullion raised £2.5m. Led by Calyx Venture Fund.

GoHenry

Financial education app GoHenry raised $55m in its growth round. Includes Edison Partners, Revaia, and Nexi.

Net Purpose

Sustainable investor platform NetPurpose raised £10m in its Series A. Led by ETF Partners.

Ochre Bio

Chronic liver disease drug developer Ochre Bio raised $30m in its Series A. Investors included Khosla Ventures, Hermes-Epitek, Backed VC, LifeForce Capital, and others.

Silveray

X-ray technology company Silveray raised £2.2m in a seed round. Led by UK Innovation & Science Seed Fund.

Worn Again

Polymer recycling firm Worn again raised $31m. Included H&M, Oerlikon, and Sulzer.

Wunder Mobility

Mobility software and hardware solution Wunder Mobility raised €12m. Included KCK and Blumberg Capital.

Upcoming Events… ⌛

… you can catch us at in the not-too-distant future.

… and Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.