Electric vehicle’s batteries are arguably the important component of the car. In recent months, there’s been a lot of newsflow about (1) how battery supply chains are consolidated in a few countries (IEA), and (2) pricing of materials inhibiting the growth of electric vehicles (Al Jazeera).

However, both of these problems are seeing early signs of improvement. First, new developments in silicon production as reported by Bloomberg could offer an alternative to Chinese graphite. Second, Sifted and The New York Times have written on lithium’s falling prices in recent weeks could help drive down the EV battery cost curve.

While Eka doesn’t invest in the underlying material production, we have a strong thesis around consumer adoption of electric vehicles and see this as an incremental positive for the broader energy transition.

Battery Materials 🗞️

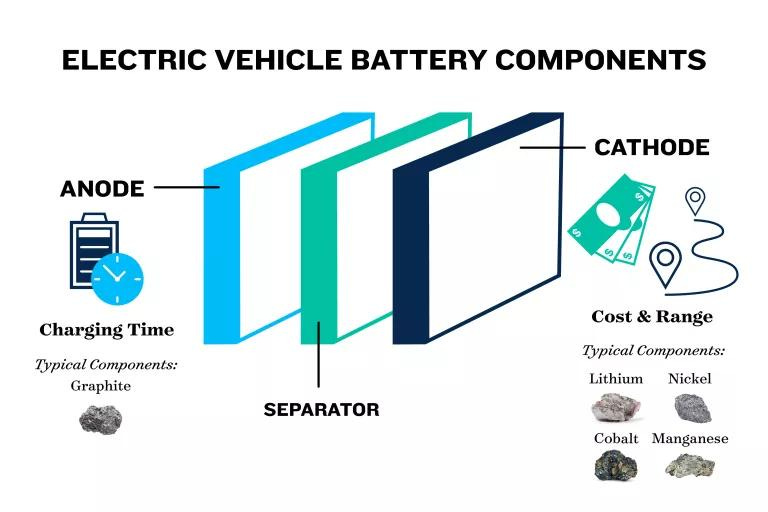

Electric vehicle batteries have two components: anodes and cathodes. Anodes typically consist of graphite, while cathodes consist usually of lithium.

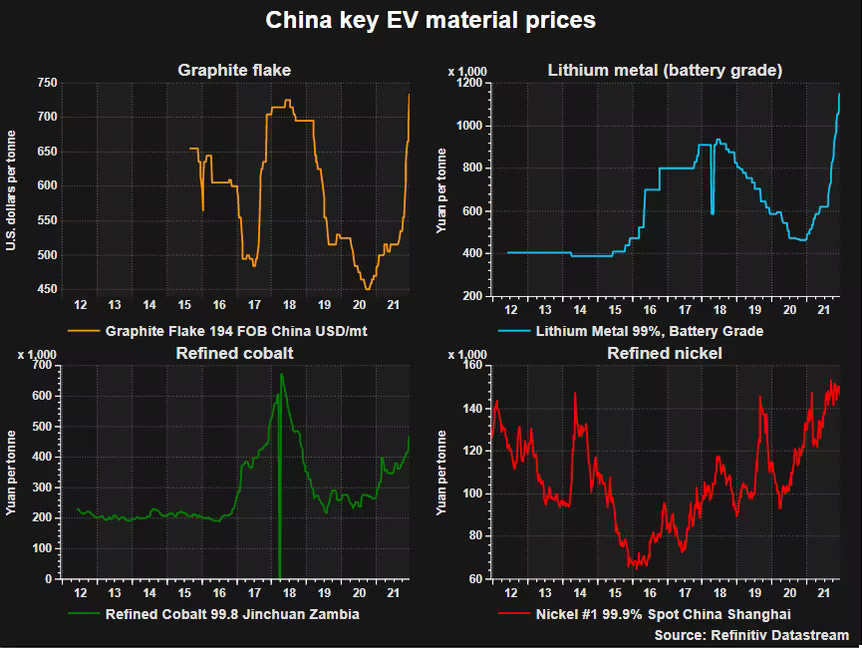

We will focus on these two materials, graphite and lithium, in a bit more detail. Given their importance in EV batteries, their procurement determines the supply, pricing, and reliability of batteries.

🪨 Graphite

Anodes have been made of graphite since lithium-ion batteries were invented in the 1980s. The graphite supply chain is incredibly consolidated, with anodes have been made of graphite, which is extracted or processed almost entirely in China. An estimated 70% of total graphite comes from China.

This creates strong dependencies on Chinese supply, which at times has faced supply crunches as seen through the Covid-19 lockdowns (Reuters). Consultancy Benchmark Mineral Intelligence (BMI) estimated a 20,000 tonne graphite deficit in 2022. For context, 20,000 tonnes of graphite can provide batteries for 250,000 electric vehicles.

This week, Bloomberg reported that Sila had created a Titan Silicon which could rival traditional graphite anodes. Compared to graphite, silicon has lighter weight and smaller volumes which improves the overall dynamics of the battery. Titan Silicon has an ability to store 10x more charge than graphite, leading to 20% more energy density. In future releases, it estimates it will be able to achieve a 40% increase in energy density.

It’s durability over time is also better than industry benchmarks for cycle life. With >1,100 cycles, the battery will retain 80% of initial capacity.

This will take time to work itself through supply chains. According to Reuters, industry experts only expect silicone-based anodes to replace graphite-based anodes in a decade or so.

Still, this is an exciting development on the anode side which we believe is necessary to accelerate the energy transition.

🪙 Lithium

Lithium is a soft, silvery-white alkali metal that is commonly used in cathodes. Lithium is a relatively abundant element in the earth's crust, but the concentration of economically viable lithium reserves is limited to a few countries, including Australia, Chile, and Argentina. Similar to graphite, this concentration of reserves has led to concerns about the geopolitical implications of the lithium trade.

As shown in the pricing chart earlier in the post, lithium pricing saw extreme inflation in the last 2-3 years given increased demand for battery production. Today, the price is down over 30% from all-time highs in mid 2022 according to Benchmark Mineral Intelligence. The NYT reported that this was due to automakers not selling as many electric vehicles as previously intended, leading to suppliers over-producing lithium.

For context, the cathode component of a battery is 50% of total lithium-ion cell costs. Total battery costs make up 30-40% of the electric vehicle price according to the UK’s Advanced Propulsion Center. So lithium is indirectly linked to 15-20% of the car price assuming the cathode costs are 100% lithium, or closer to 10% if we assume 50% lithium.

We have already seen Tesla drop the price for its latest model at the start of the year, with the Model 3 Performance decreasing -14% to $62,990 in the US or the Model S Plaid decreasing -15% to $135,990 (source).

However, this decrease in lithium pricing realistically will need time to work through the supply chain before hitting automakers income statement given the long and complex raw material supply chain. Lithium is usually bought on fixed contracts, between three and twelve months long, which is typical in commodities markets.

Additionally the negative EV demand shock could need more than a 15-30% price decrease to create mass-consumer adoption. There are more policy tailwinds on the way, with the Biden administration announcing favourable policies this Wednesday which could see 2/3 of total new light-vehicle sales being battery-powered vehicles by 2032 (source).

3 Key Charts 📊

1. Comparing the costs of electricity and gas

2. Tesla’s key models are decreasing as part of the registration mix

3. Diverging paths between food inflation across the Euro area vs. the world.

Deal Capture 💰

Deals in the impact space across the UK and Europe

Allotrope

Energy startup Allotrope raised £5m. Included Suzano Ventures.

Cognassist

Neurodiversity platform Cognassist raised £4m. Led by Gresham House Ventures.

Futraheat

Heat tech startup Futraheat raised a £2m seed round. Led by Clean Growth Fund.

Nolea Health

Mental health and employment company Nolea Health raised £1m. Led by Frontline Ventures.

Solasta Bio

Agritech startup Solasta Bio raised £4m. Included Yield Lab Europe and SIS Ventures.

Underdog

Marketplace Underdog raised a €3.8m round. Included Founders Future, Sistafund, Tivoli Capital, and Leia Capital.

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.