The EIF released their Ugly Duck 2023 report this week. As a reminder the EIF is a Limited Partner investing in European funds, with a focus on emerging managers. In it, they published data on the performance of top funds in their portfolio. We highlight a few interesting charts from the report below.

Spotlight on emerging managers 🗞️

Emerging managers are strong performers in the EIF’s top funds.

VCs are holding back deployment in times of uncertainty

The next generation of unicorns will be different, but won’t compromise on financial scale.

Week in Impact Articles ✍🏽

Monday: Uber takes on reverse logistics

Tuesday: EIF launches report on its funds

Wednesday: General Catalyst plans to unveil a new health company

Thursday: Could an AI-created profile picture help you get a job?

Friday: Q3 2023 Venture Monitor

3 Key Charts 📊

1. The disability gap, visualised by data collection and usage

2. Health and some sustainability seen in the EIF’s top performing funds

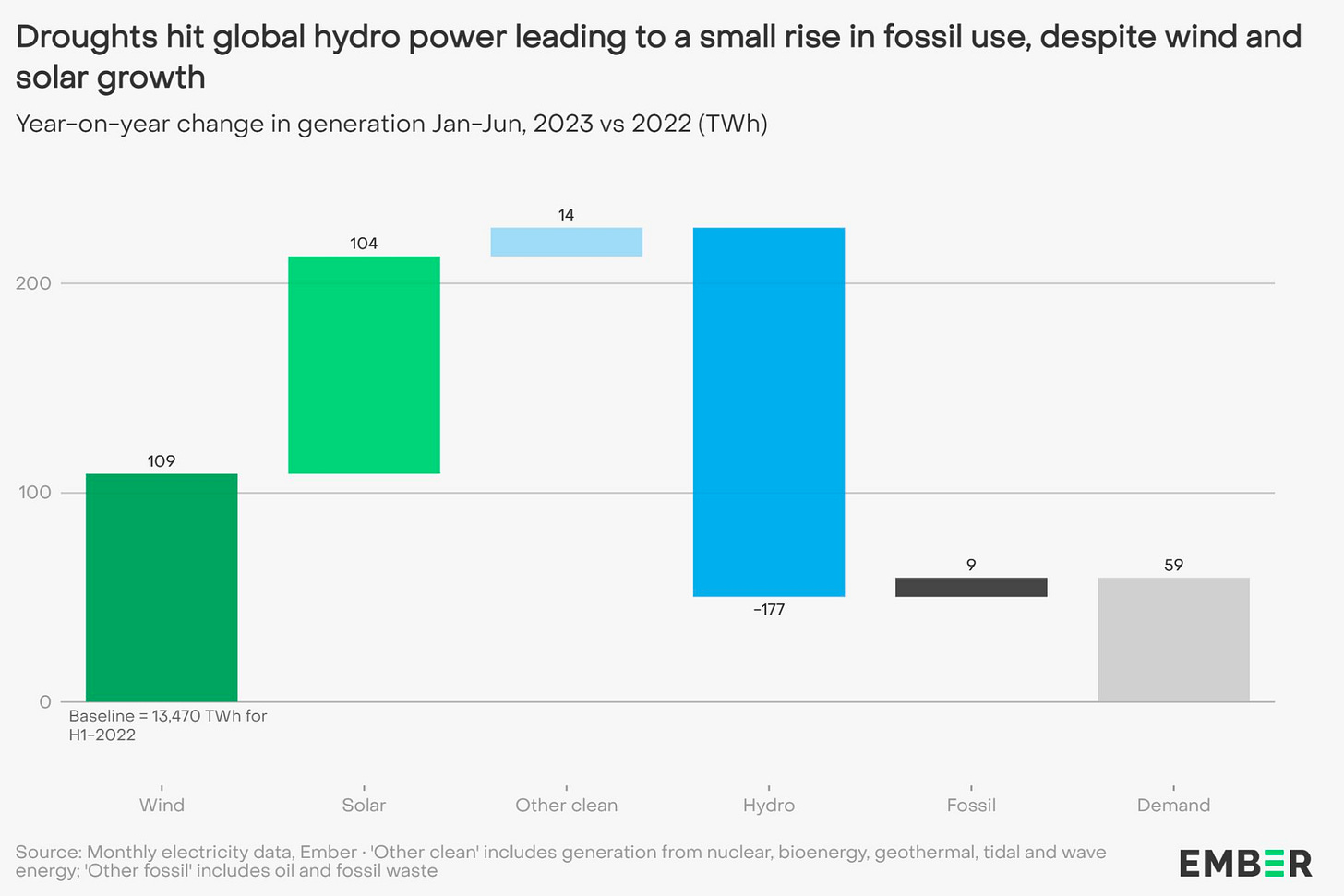

3. Hydro energy production drops due to drought

Deal Capture 💰

Deals in the impact space across the UK and Europe

Breathe Battery Technologies

Battery tech company BBT raised $10m. Included Lowercarbon and Speedinvest.

Carbon Equity

Carbon investing platform Carbon Equity raised E6m.

ECOsubsea

Hull cleaning solution ECOsubsea raised E11m.

Helio

Cloud computing platform Helio raised E5m. Led by QBIT Capital.

Purpose Green

Building digital twin provider Purpose Green raised E3m. Included Speedinvest and Atlantic Labs.

Tilak Healthcare

Eyetech company Tilak raised E10m. Led by Elaia and Cap Horn.

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.