For our first newsletter of 2023, we look at quite a few issues ranging from the UK macro slowdown, technological progress, and healthcare patents (a big start to a new year!). In short, we believe that investing in the right types of impactful technologies could have outlier growth potential for the broader UK economy.

Unpacking technological progress 🗞️

🎀 Technology is, we believe, an exciting lever

The UK economy is slowing down. Some of the slowdown is due to sticky effects like impacts on labour and capital, which are hard to catalyse.

There is a relevant technological opportunity. Technology is a relevant and exciting lever which has, potentially, been under-utilised as an engine for scalable economic growth and utility.

We need to be careful about scientific quality. There is some debate over how the quality of patents and research has trended over time. We are encouraged by the strong growth in academic output, but would also pay attention to genuine quality improvements (output, utility) over time.

Patent ‘ever-greening’ is an example of dilutive progress. Extending existing patents without funding new research and development inhibits future growth.

On the whole, technology is exciting when thinking about growth. The drastic improvements in pricing, sustainability, and choice over time across a variety of products have the potential to improve productivity and outcomes, in our view.

🇬🇧 Setting the scene: the UK economy is slowing

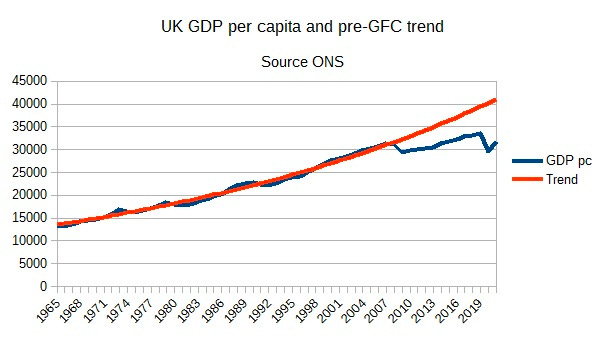

We’ve been reading a lot about the UK’s macroeconomic outlook since the New Year. Simon Wren-Lewis wrote this blog post about declining UK GDP output relative to it’s historical trend line, which puts down to lower productivity growth as a result of lower investment. The banks are predicting light-to-moderate recessions for the UK in 2023 (Goldman, JP Morgan). This is the chart showing how GDP in the UK is averaging today, versus its pre-GFC trend line.

The UK ‘productivity puzzle’, arguably coinciding with the GDP slowdown, has been written about heavily by various authors (PwC, McKinsey). Some of this could be down the UK’s relative under-investment in certain types of technologies.

This is a more practical example of how McKinsey breaks out the UK comparison in digitisation to other European countries (from 2017 - will have changed from here).

📱 Debating technology’s role in growth

Since the new year, there have been quite a few commentaries about how it technological progress could be slowing. The Hustle published a chart showing patents by company in the US (hint: it’s a lot), Chartr showed the increase in patents granted over time, and Noahpinion wrote about the decreasing disruptiveness of scientific papers and patents. We show each of these charts below in respective order.

Companies are issuing a lot of patents…

… the rate at which patents are being granted is increasing …*

* similar trend in the UK (see chart on gov)

… and yet there is a downward trend in patent ‘disruptiveness’

Noahpinion explains this chart from this original paper pretty well, so we’d encourage you to go and read his take on this in his post.

🏦 Is economic growth all that matters?

There is a strong counterargument for this ‘economic growth’ talk. Technology improves our lives far beyond economic output - it improves utility, happiness, and broader definitions of ‘output’. For example, it should improve quality of life, which won’t necessarily be measured in economic output figures.

🏥 How patents practically affect us and output: a healthcare case study

Healthcare is a good example when thinking the declining utility of patents relative to economic outputs but also patient outcomes. This paper does a great job of the ‘ever-greening’ effect in healthcare. Pharmaceutical companies tend to apply for patent extensions given the high costs of drug development. This means that once the patent is issued and feasibility is proven, the companies are given some time to recoup losses and make a profit through annuities. This then should fund further R&D improvement.

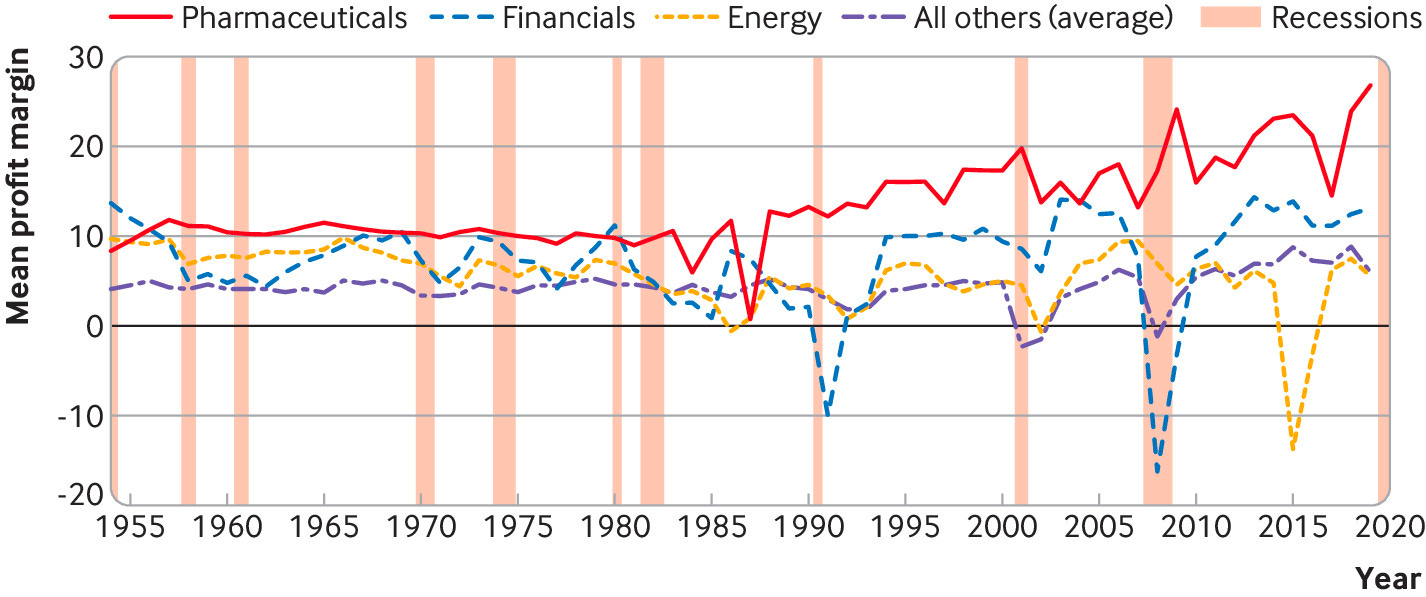

However, once the drug is developed, they extend patents while simultaneously increasing margins. As shown in this BMJ article, pharmaceuticals maintain high average margins various economic cycles (again not updated for 2021/22).

This is probably a (another) long rabbit role to go down, so we’ll save taking a proper look at healthcare profits, margins, and R&D spend for another newsletter.

Needless to say, it feels like there is an opportunity for impactful healthcare investment. Specifically, investment around digitising NHS workflows, addressing the patient backlog, and creating novel solutions to healthcare conditions.

🔭 So, where is technology delivering significant returns?

There are definitely reasons to be hopeful. For example, there are a few cases of technology ‘beating’ Moore’s Law. We show how this applies to the cost sequencing DNA (below). One of the most powerful incumbents here is Illumina, which has been pioneering parallel sequencing or next-generation sequencing.

So technology hasn’t exhausted all ‘low hanging fruit’. But we need to be mindful about which pockets we choose to back, and for what purpose (output vs. utility).

3 Key Charts 📊

1. Public-charger instillations need to speed up across Europe

2. Emissions from plastic production are scheduled to go up

3. UK VC activity ends 2022 in a better position than other European countries

Deal Capture 💰

Deals in the impact space across the UK and Europe

Hystar

Green hydrogen producer Hystar raises $26m in a Series B. Led by AP Ventures and Mitsubishi.

Inflow

Digital health company Inflow raised $11m in a Series A. Led by Octopus Ventures.

InfraFleet

Green infrastructure group InflaFleet has raised a £10m round. Led by Octopus.

Peppy

Digital health app Peppy raised a £37m Series B funding. Led by Albion.

QV Bioelectronics

Medtech company QV Bioelectronics raised £2m. Led by the Fink Family Office and Science Angel Syndicate.

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.