We are thrilled to announce the launch of our first public report “Solving for Impact Tech 2023”, which was released yesterday. The report covers Eka’s Impact Thesis, the state of Impact unicorns, and the Impact funding landscape.

In short, we’re very bullish on Impact for a number of reasons: data & technology is making our world more efficient and exciting, consumer demand is swaying towards sustainability and better health, talent is moving to higher Impact roles, regulation is a helpful tailwind across Climate and Health, and larger investors are noticing the opportunity. There are early successes with the first wave of impact unicorns, but this is only the beginning of an even bigger structural shift.

We’d love to hear your thoughts and feedback over the coming weeks, so feel free to reach out to us on LinkedIn or email (estia@ekavc.com).

Solving for Impact Technology 🗞️

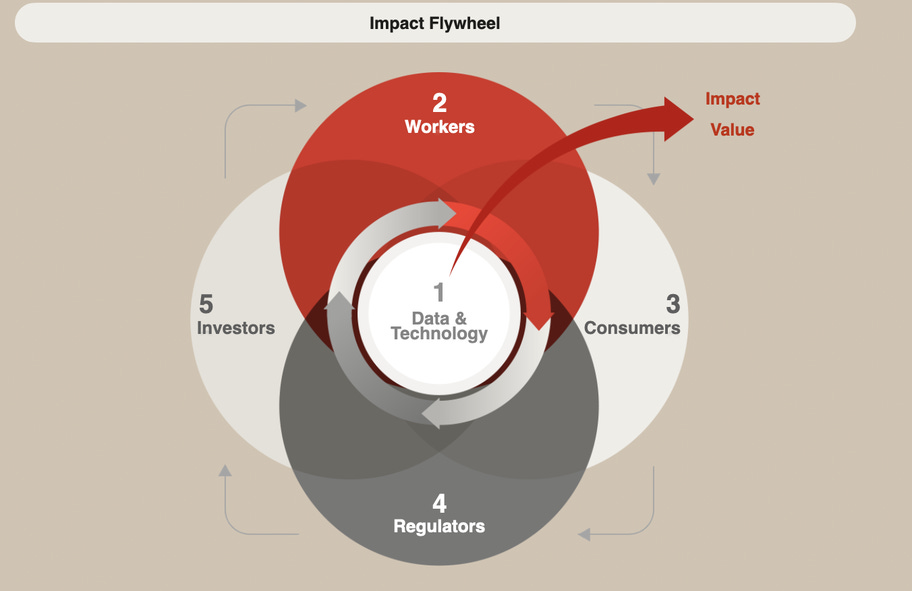

The impact flywheel is in motion underpinned by data and technology…

TLDR: We looked at x5 case studies across Impact drivers, which we see as Data, Workers, Consumers, Regulators, and Investors. The case studies range from the rise in regulatory pressures in climate & health legislation, to unpacking how students and young people are viewing work preferences as they enter the market.

… this is enabling impact innovators to outpace incumbents …

TLDR: This is a graphic we’ve shared previously, which underpins our Shared Value thesis within Impact (see Jon’s great explainer on Shared Value, and as applied to our investment in Hived or Urban Jungle). The takeaway is that incumbents work on archaic systems (business models, technologies, monetisation) which isn’t able to scale towards profitability and impact. Instead, innovators are able to harness data & technology to deliver better products at a lower price while achieving impact in lockstep.

… these innovators are tackling trillion pound industries which impact consumers’ daily lives.

TLDR: We break out Sustainable Consumption (”climate tech”) from Consumer Health (”health tech”) and pick out areas which most excite us and the community at the moment. We are looking closely at home decarbonisation, the circular economy, consumer wearables, and healthcare & AI.

As the size of the opportunity has become more evident, increasing capital has entered the market…

TLDR: There are many impact funds coming to market - around 40 in the last four years. We are encouraged by the increased attention in the space and welcome the larger funds to help with follow-on capital as the early-stage vintages start scaling. Climate Tech VC also wrote a great report on ClimateTech funding specifically here.

… and early winners have started to proliferate - leading to a further virtuous circle of talent and capital.

TLDR: There are >60 Impact unicorns above a $1b valuation since 2007. These have realised varying degrees of “actual” Impact, which we attempt to assess qualitatively by Impact Potential. This was achieved by looking at public resources and benching the names qualitatively against a few criteria, being inspired by the Impact Management Framework as well as our own criteria.

Week in Impact Articles ✍🏽

Monday: Humane’s new wearable AI demo

Tuesday: AI chatbot for cancer patients

Wednesday: Baby born from three people’s DNA in UK first

Thursday: Solving for Impact Tech 2023

Friday: Learnings from LLM

3 Key Charts 📊

1. Charting Covid-19 weekly cases, three years on from the start of the pandemic

2. Spring humidity in Europe is coming down over time

3. Thinking about the applications of AI more broadly

Deal Capture 💰

Deals in the impact space across the UK and Europe

Driveco

EV infrastructure charging startup raises E250m. Led by APG and included Mirova and Corsica Sole.

Equip

Financial security company Equip raises E2m. Led by XO Ventures.

Farmless

Rewilding play Farmless raised E1.2m. Co-led by Revent and Nucleus Capital.

Improvin

Agri-food business Improvin raised E3.5m. Led by Pale Blue Dot.

Liftango

Ride share startup Liftango raised £2.5m. Included Scottish Enterprise and Maven.

Voltfang

EV battery startup Voltfang raises E5m. Led by PropTech1 Ventures.

Wingcopter

eVTOL manufacturer Wingcopter raised E40m. Included EIB, Futury Capital, and Rewe Group.

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.