In celebration of International Women’s Day this week, we thought it was worth flagging a few key statistics around women in VC and in the founder ecosystem. The pipeline of young women in both sectors is encouraging, with close to 50% of junior VCs being women and 20% of UK incorporated companies being founded by women. US graduate statistics in the Ivy Leagues suggest women are in close to 40-50% of the graduate programs for STEM subjects, though this isn’t the case at the country wide level yet. On the whole we’re still quite a way off gender parity in VC, founders, and universities, and more needs to be done to right-size the imbalance.

Tracking the pipeline 🗞️

Venture Capital

European Women in VC published a report last year tracking 400 venture firms managing each at least E25m in AUM. They found that on average 85% of VC General Partners were men, and 15% were women. When looking at actual investment power, this number decreases to 91% and 9% given varying fund sizes. We show how this splits out by geography below.

The headline split gets better when looking at more junior levels (as expected). FYI we weren’t able to reconcile the 77% / 23% to the initial stats in the report, but suspect this is due to slightly different bases being used given low transparency by position.

At the most junior position, the split is almost 50/50 between men and women. This trends down as the positions get more senior, before an almost 10pt drop off between Seniors and General Partner.

Understanding the pipeline into VCs is important - many junior positions come from male-dominated industries like tech startups (27% of tech roles are held by women), investment banking (broadly 50% at entry level but 30% at mid-career), or consulting (30-40% are women depending on sources).

Founders

The proportion of female-led business incorporations in the UK was 20% in 2022 (Alison Rose Review). This is up slightly from 17% in 2017.

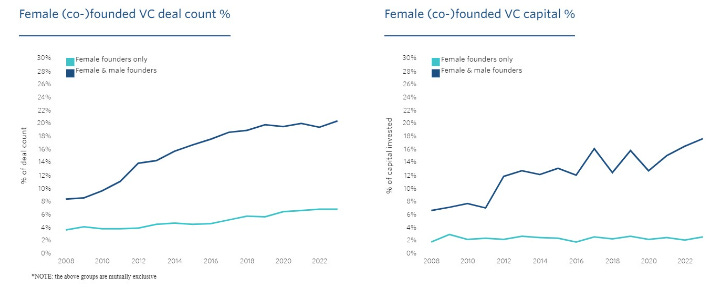

In the US, the proportion of deals and capital invested in women and mixed teams has been increasing - but it’s nowhere near the equitable level. The proportion of capital allocated to women only founders is hovering around 2% and 4% for deal count. This picture is better for the mixed teams, at around 20% on both fronts.

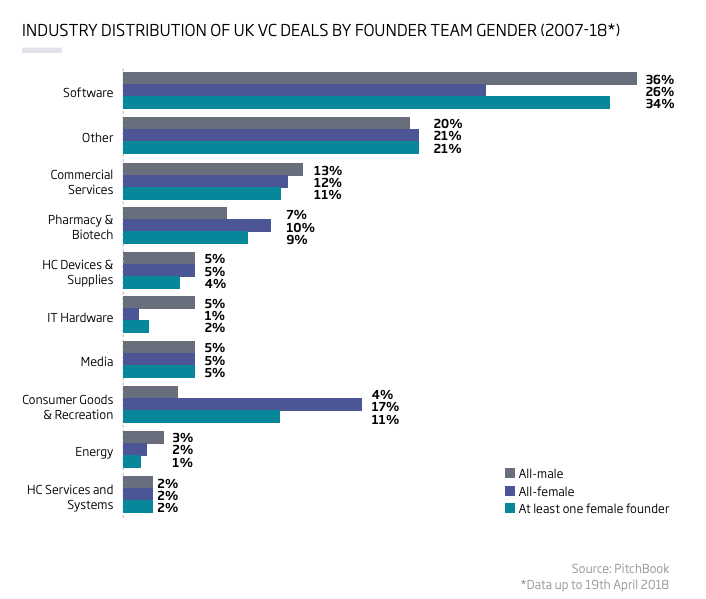

The funding gap differs greatly by sector. The BBB published an extensive report in 2019 covering the UK Venture Capital and Female Founders ecosystem, and found that there were significant sectoral differences. All-women teams over-indexed to consumer goods & recreation, while they under-indexed in software. This will have changed today given the changing distribution of deals (more energy, less consumer) but we expect the directionality to be similar.

University

Many VCs suggest that the pipeline issue starts at universities. This podcast with Katie Ray from The Engine (MIT-linked VC fund) flags that MIT, Harvard, and Stanford PhDs and post-docs are broadly even at the gender level.

Close to 40% of MIT graduates are women, and 50% for undergraduates. The podcast also notes that these women tend to outperform their male colleagues in many academic settings given the higher barrier to entry before admission.

The picture is different when looking at the entirety of the US’s graduate system. There is a lower amount of women in Engineering and Maths & Comp Sci degrees for graduate schools (though an over-indexing trend in other technical areas like Health & Medical Sciences and Biological Sciences).

Self-Reflecting

One of our partners Camilla Dolan wrote a great LinkedIn post about how we’re thinking about diversity at Eka Ventures including business ownership and LP advisory representation. Eka Ventures is 50% female-owned, and has a 60% female-team across investments and operations.

We currently have 23% of our portfolio with a woman in the founding team, which broadly matches our top-of-the-funnel pipeline statistics of 30-40% women in the founding team. There has also been a slight drop-off since the start of the year which we are aware of and working hard to counteract. Additionally, while this is a typical industry metric, we don’t think it’s a very accurate way of looking at representation because it doesn’t account for role or ownership. We are currently working on a better metric which we will publish in our Impact Report.

We still have a long way to go before achieving parity, but are very actively implementing changes within our process to get there including more female office hours internally and externally, organising female founder and VC dinners, and improving our top-of-the-pipe process.

3 Key Charts 📊

1. Mineral production is geographically concentrated

2. Net Zero in the context of profits, tax, and household spend

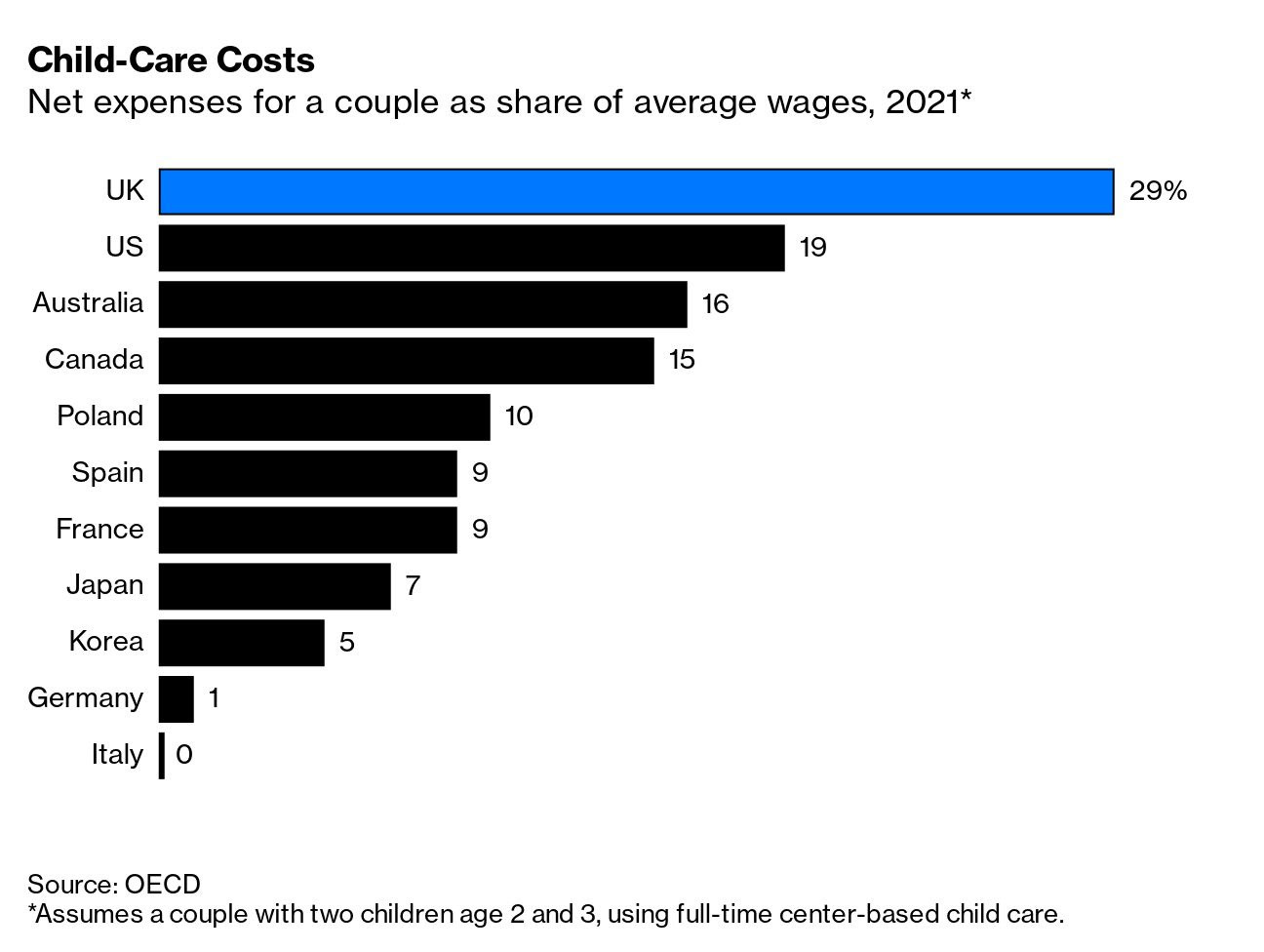

3. Childcare costs (again)

Deal Capture 💰

Deals in the impact space across the UK and Europe

Evove

Waste water company Evove raised a $6.7m Series A. Led by At One Ventures.

GenoME

Health tech company GenoME raised £1.4m.

MEplace

Learning startup MEplace raised $1.4m seed round. Led by Active Partners.

ViridiCO2

Waste conversion company ViridiCO2 raised a $3.8m seed round. Led by EQT Ventures.

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.