We’re hosting Women’s Office Hours on the 24th of February - feel free to share the link with your network!

The NHS published a new Medical Technology Strategy last Friday. The strategy is focussed on delivering value for money across the healthcare system, by leveraging larger datasets to evaluate the effectiveness of technologies. There’s also a strong emphasis on pricing and ROI beyond decentralised innovation schemes.

In short: a revamped focus on data analytics for Medtech products and software, renewed focus on interoperability across the system, and beefed up UK supply chains.

There are a few gaps in the strategy, namely how speed-to-market should look across the complex NHS Trust network. There is also little discussion around long-term funding solutions at the centralised and decentralised levels.

Revitalising the UK’s Medtech vision 🗞️

The UK’s MedTech market has an annual turnover of £28b. It makes up 31% of total life sciences turnover, funds >4k UK businesses, and provides >138k jobs across the UK. Turning to public health provisioning, the NHS currently spends £10b a year on MedTech. The updated strategy starts with three pillars: product, price, and place.

Product: inclusive and efficacious products for all, regardless of ethnicity, gender, or any other attribute.

Price: value for money across the patient pathway, using data to ensure fair pricing for the NHS and suppliers.

Place: supply chain resilience with internationally competitive access.

The strategy looks at x4 strategic pillars to guide its broader vision.

1) Resilience of Supply

This is a common theme across most verticals we look at today. The strategy calls out the need for maintaining ‘basic capabilities’ to support production of MedTech within the UK. Existing schemes like the Life Sciences Innovative Manufacturing Fund are already helping promote life sciences in the UK.

The paper also calls out interoperability - something we’ve been looking quite closely at Eka for a few months now. They describe interoperability as a ‘fresh look at the way products are designed and the scope to remove unnecessary inflexibility, especially where the supply arrangements for these products are insufficiently resilient’.

2) Innovative and Dynamic Markets

There are 2m different products registered by MHRA today. The average trust uses 30k products. To add more focus to which products are used, the strategy calls for ‘prioritising value for money, where patient outcomes are a fundamental component of that value’.

One of the most interesting sections for us was around innovation support. The paper acknowledges that these have helped drive adoption in specific priority fields. But they also add complexity to procurement and don’t address the structural adoption challenge.

3) Enabling Infrastructure

Data is key here. Most of MedTech data is decentralised, meaning there is no single data standard across the healthcare system. Data collection also tends to be reactive rather than proactive. The Independent Medicines and Medical Devices Safety Review noted that registries are established following safety breaches or identification.

There’s also a strong emphasis on circular economy here, where the approach calls for reuse, remanufacture, and material recovery within the Medtech market (the NHS is 4% of the UK’s total carbon footprint today).

4) Specific Market Focusses

Two areas: 1) MedTech in the community, and 2) Diagnostics. The first is focussed on Medtech in community care, worth about £1b per year. They include continence products, dressings for wound care, and reagent strips for home-testing. It also notes that administrative arrangements are rooted in a ‘one size fits all’ approach dating back to the 1980s, in a non-personalised approach.

In diagnostics, the focus is shifting closer to the patient with community diagnostic centres and leveraging data & AI to improve pathways. The four priorities within diagnostics are:

Elective Recovery

Early Diagnosis

Industry Engagement

Pandemic Preparedness

We are encouraged by the strategy on the whole given our focus on compounding data advantages within healthcare. However, we would welcome increased transparency around investment across the network as well as potential improvements around speed-to-market.

3 Key Charts 📊

1. Disasters displaced >3m Americans in 2022

2. BP’s energy outlook for 2050 decarbonisation

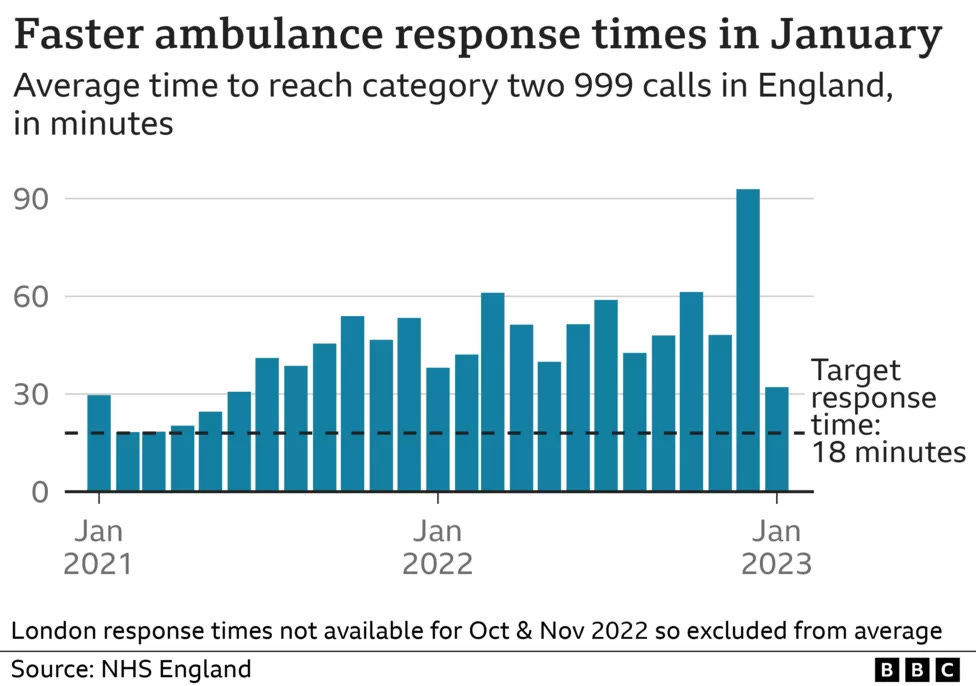

3. UK ambulance times are improving in early 2023

Deal Capture 💰

Deals in the impact space across the UK and Europe

Evonetix

Deeptech startup Evonetix raised £20m in an extension round. Led by Foresite Capital.

Kelpi

Materials company Kelpi raised $3.6m in Seed funding for its non-polluting fabric dyeing company.

LoveCocoa

Sustainable chocolate maker Love Cocoa raised $5.25m in a seed round.

Smart Green Shipping

Retrofit company Smart Green Shipping raised £1m.

Wikifarmer

Farming marketplace Wikifarmer raised a €5m seed round. Led by Point Nine.

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.