The Financial Conduct Authority (FCA) published this week new sustainability measures, in order to improve transparency for sustainable investments. Today, there are $18 trillion in ESG-focused assets globally (includes what we define as Impact and ESG). The FCA's new Sustainability Disclosure Requirements will help investors make more informed decisions about investing by avoiding greenwashing, introducing clear marketing requirements, and creating new product labels depending on the impact level.

New disclosure rules for UK funds 🗞️

The Financial Conduct Authority (FCA) has confirmed an extensive set of measures aimed at elevating trust and transparency in this rapidly expanding landscape. There are two key developments here.

Sustainability Disclosure Requirements: The FCA has introduced robust disclosure requirements to enhance the trustworthiness of sustainable investment products.

Investment Labels Regime: A labelling system will empower investors with clear and reliable information, acting as a guide through the complexities of the market.

This is similar to the SFDR regulation in the European Union which we have written about in the past. The labels match quite closely to the SFDR’s Article 8 and 9, as shown below.

More practically, there are three steps which the FCA will introduce.

Anti-Greenwashing Rule: The FCA is implementing an anti-greenwashing rule. This mandates authorized firms to ensure that their sustainability claims are fair, transparent, and devoid of any misleading information. This is the soonest change which comes into force (May 2024). To provide further clarity on the FCA’s expectations, they are still consulting on guidance for the anti-greenwashing rule. The consultation was published at the same time as the SDR document (earlier this week), for response by 26 January 2024.

Product Labels: The introduction of product labels, outlining clear sustainability goals and criteria, seeks to empower investors with the knowledge needed to make informed decisions. The ‘highest’ impact label, Sustainability Impact, is similar to SFDR’s Article 9. This is an interesting point on financial return:

Naming and Marketing Requirements: Naming and marketing requirements will serve as a safeguard, preventing products from making unwarranted claims regarding their positive impact on sustainability.

The implementation timelines will start in earnest in late 2024 for ongoing measurement, but labels can be used from mid 2024 onwards.

This significant step forward aligns seamlessly with the FCA's commitment to building trust within the sustainable investment market. Tested with over 15,000 individuals, these measures also reflect the sentiments revealed in our Financial Lives survey, where a significant majority of UK adults expressed their desire to invest in a manner that protects the environment and contributes to positive social impact.

Week in Impact Articles ✍🏽

Monday: Germany to pay into climate funds despite budget crisis

Tuesday: NHS England faces lawsuit over patient privacy fears linked to new data platform

Wednesday: Substance, impact, climate and AI, looking to Slush 2023

Thursday: Government pledges to boost Britain’s access to nature ahead of COP28

Friday: State of European Tech 2023

3 Key Charts 📊

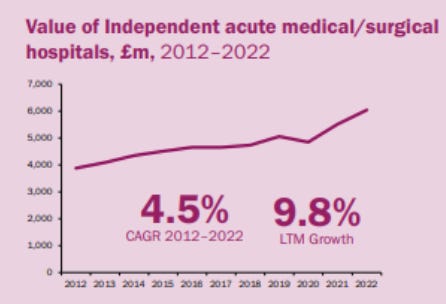

1. UK independent hospitals are gaining value

2. Swiss Re’s nat cat pricing index is set to keep growing at c5%

3. COP28’s outline for the days ahead

Deal Capture 💰

Deals in the impact space across the UK and Europe

BeCause

Hospitality sustainability platform BeCause raises $2m. Led by Ugly Duckling Ventures.

Braincube

Manufacturing IIoT platform Braincube raises E83m. Led by Scottish Equity Partners and BPI France.

Cradle

GenAI biotech Cradle raised $24m. Led by Index.

OneClick LCA

LCA platform One Click LCA raised E40m. Led by PSG Equity and InfraVia Capital Partners.

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.