Last week, we read through Forerunner’s Consumer Trends report and wanted to draw out the read across for our two investment themes: Consumer Health & Sustainable Consumption.

Read the full report here.

Consumer Trends: Sustainable Consumption & Consumer Health 🗞️

Forerunner publishes an annual report covering how key consumer trends are changing. This year, there was a lot of focus on health & wellness (”establishing a buyer’s market in consumer health”). There was much less of a focus on sustainability and circularity, but we are still incredibly excited about innovations in this area and will be publishing more on this in the coming weeks.

There was less focus on sustainability & circularity, with the three key themes of the year being: (1) Wellness, (2) Security, and (3) Gen AI.

Consumer Health: the tipping point into the mainstream?

Consumers today are not just reactive in their approach to health but are actively seeking tools that empower them to take control of their wellness.

The wellness market reached $1.8 trillion in consumer-directed spend in 2024. The majority of this went towards physical activity ($339b), personal care and beauty ($310b), and healthy eating, nutrition, and weight loss ($289B).

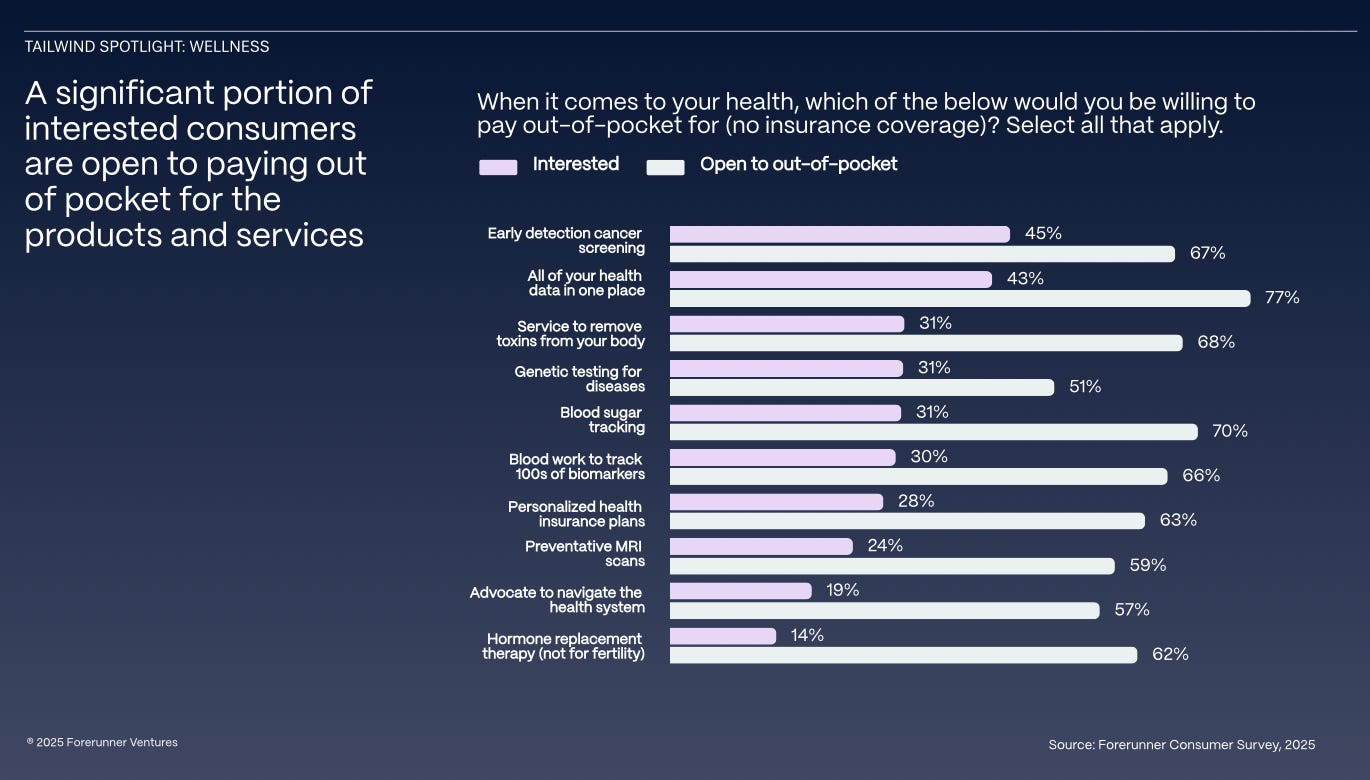

The Forerunner report also conducts a survey each year, and this year they asked whether consumers would be interested in various consumer health products over time (i.e. cancer screening, genetic tests, hormone replacement therapy).

They also asked whether people (assumed to be a mainly US-focussed survey) would be interested in paying for these items out of pocket. We are always cautious on reading too much into ‘intended spend’ surveys as these do not always correlate with actual spend over time, but directionally there is very strong interest in paying for a lot of consumer health products out of pocket.

There is a mix of net new and net existing spend across the consumer health spectrum. Examples of net new spend include Oura (health measurement), Eight Sleep (consumer hardware for better sleep), Superpower (longevity super-app). Examples of accessibility to existing spend include Hims (marketplace for consumer health products) or Growtherapy (therapy).

We think about this a lot at Eka in terms of the impact which solutions address underserved populations. People can be underserved in three key ways:

Existing products are not as accessible as they could be (i.e. home insurance).

Existing products are sub-standard (i.e. solutions for incontinence).

There are no existing products to serve any segment of the population (i.e. high sensitivity and specificity Stage 1 lung cancer diagnostic).

There are many interesting examples of where the next wave of technological innovation might impact consumer health. For example, Forerunner talks about survey respondents becoming increasingly open to using an AI therapist compared to a human therapist.

These are still the early days in AI adoption in health, but we look forward to seeing more data points about how consumers on the ground are thinking about improving their quality of life at scale.

👋 Getting in Touch

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.