Consumer Code: D2C, to SaaS, to AI

Issue 111 l Eka’s Weekly Roundup (25 February 2025)

Consumer technology refers to companies which are building products & services where the primary user is an end-consumer. It also includes companies which are building software to support the consumer economy.

Consumer technology companies have historically generated outlier returns and redefined industries. This includes Amazon (retail), Tesla (automotive), Airbnb (travel), Spotify (music), and Netflix (media).

Each technology and platform shift enables a new wave of value creation, a window where category defining companies can be created:

Wave 1: E-commerce and enabling infrastructure

Wave 2: Mobile/SaaS

Wave 3 (current): AI

These investment windows provide a unique opportunity in which to invest into companies that will define the next decades

Whilst each wave creates new opportunities, many of the underlying aspects of what is needed to build category defining consumer technology companies stay the same and investors who specialise in consumer start to recognise these hallmarks and consistently identify the “hits” that emerge with each new platform shift.

What we mean when we talk about consumer (hint: it’s not just D2C!) 🗞️

As mentioned, consumer technology refers to two types of companies: those building products & services for end-consumers, but also those which are building software to support the consumer economy.

In the first bucket, companies are innovating in the key consumer-spend verticals which include Vinted (fashion), Gousto (food), Bolt (mobility), Rightmove (housing), Mubi (media), Travelperk (travel), Cult Beauty (beauty & personal care), and Whoop (wellness).

The second bucket refers to enabling technologies supporting the economy. Consumer technology under this definition includes the broader consumer supply chain & enablement services. Ultimately, the consumer economy underpins both direct-to-consumer businesses and enablers like Shopify, Unity, and WhatNot.

Investors have been sceptical of investing in consumer technology in recent years. As Rex Woodbury highlights in a recent post, only 7.1% of Seed funding in 2023 went to consumer businesses — down from 14.3% in 2019. Consumer tech has historically produced some of the biggest wins, including Google, Facebook, and Amazon.

One explanation is that Consumer companies' hits are larger, amplifying the power law.

Consumer follows a ‘winner-takes-all’ or ‘winner-takes-most’ dynamic where there is (and taking inspiration from a Bessemer article which quotes Prof Eisenmann):

Natural monopolies: rare in consumer but can exist, think of Rightmove.

High multi-homing costs: high costs when user affiliates with multiple platforms (remember bargain hunting in food delivery days?)

Network effects: value compounds as users grow (social media, marketplaces… almost everything with nodes)

Low requirements for differentiation: Relatively homogeneous user needs, means effective consumer products have a mass global appeal (ok not commodities but Spotify?).

That’s why consumer specialists excel in consumer investing, because they understand what the Consumer Playbook looks like more than generalist investors.

With every technology shift comes a new wave of generational companies. These find innovative and new ways of applying new tools to big consumer problems.

So what’s changing in Consumer, which makes us excited? Five things:

The AI wave is having two impacts on Consumer. First, there are now new tools with which to build better features for consumers (i.e. nutrition tracking via image recognition, intelligent emotional life companions using LLMs, or energy bill trading & selection using AI).

Second, the tools to build consumer-facing tools have become much more accessible which means the barriers to entry have gotten lower for incredible founders. Speed of execution becomes even more important in this paradigm shift.

Consumers are spending more on health & wellness and sustainability (see ONS data analysis). They are however prioritising price & “return-on-investment” so products need to be at incredible quality.

The public markets have shown that consumer companies have shown they can create strong shareholder value post Covid-19 correction, and are willing to price these at premium valuations for exceptional products.

Consumer problems have a playbook and we understand the playbook. Our core focus at Eka is unpacking metrics like customer acquisition, lifetime value, retention, network growth, which means we have a right to win for the best consumer companies.

At its core, Consumer Technology includes businesses which help consumers better live their daily lives, and there should be a lot of value attached to this goal.

Consumer technology has evolved to become more SaaS like

The evolution of consumer business models can be categorized into distinct waves:

Wave 1: Internet/E-commerce

Early-stage companies capitalized on domestic markets, establishing strong local presences as they required offline infrastructure. Examples here include Allegro in Poland or The Hut Group in the UK.

Wave 2: Consumer Subscription Models

Leveraging the UK's expertise, companies like Runna, Cleo, and Flo have launched and tested in the UK and then expanded globally, offering subscription-based services that facilitate international scalability.

Wave 3: AI-Enabled Consumer Services

The UK's rich pool of AI and consumer talent creates an ideal ecosystem for the emergence of global leaders in AI-driven consumer applications.

Monetisation models have changed. Wave 1 monetisation was either 1P products & services (own-brand) or 3P (third party) marketplaces with a take rate commission. This evolved into more SaaS-like revenue models. AI is ushering new business models, in their very early stage.

See more below in GP Bullhound’s latest Consumer Subscription App report.

There are two massive opportunities in Consumer

Sustainable Consumption

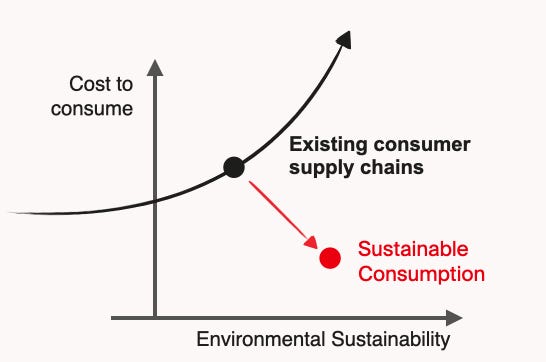

Linear, carbon-intense and opaque value chains supply our key consumer industries. They are responsible for c.65% of emissions, waste and biodiversity loss but unable to reduce this without a huge financial cost.

The application of AI, cloud, material science & intelligent design can enable circular supply chains powered by renewable energy. This new system will be capable of delivering better products at a lower cost with reduced emissions, waste and biodiversity loss.

Consumer Health

Healthcare spend (10%+ of GDP) is focussed on treating people when they are sick rather than helping them stay healthier for longer. The result is increasing chronic health conditions, unsustainable costs and a 20 year gap in healthy life expectancy between the poorest and wealthiest in our society.

We now have the technology to shift to a cost effective, consumer led, preventative model. Making life essential products more accessible, giving people the tools they need to develop healthy behaviours and helping diagnose & treat health conditions early.

We’ve started investing in these companies and are excited about their growth

Eka is a 2021 vintage £68m first-time fund investing in seed-stage Consumer Health and Sustainable Consumption companies.

Portfolio companies have headline revenue over £100m, and have raised >£100m of external capital in rounds led by investors like Index and Accel.

Multiple companies have gone from Seed to over $10m in revenue and two of these are over $30m.

The UK has been ahead in technology shifts compared to other markets

The UK is quick to adapt to technological shifts and leads in European e-commerce adoption.

The UK has long had leading internet infrastructure, digital-first consumer behavior, and a highly competitive business landscape that drives rapid innovation across consumer sectors.

Other examples include:

Online banking: 70% of UK adults use online or mobile banking compared to 50% in Germany and 63% in the US.

Smartphone ownership: The UK has a high smartphone penetration rate in Europe at 82.2% compared to the US at 81.6% and Germany at 81.9%. Interestingly, it also has a high penetration rate among 55+ year olds (30% versus 23% in Germany and 19% in France, though lagging behind the US at 40%).

Tech & digital services: these are 7%.) of Gross Value Added (GVA), more than any other European nation. In Germany and France, this is closer to 4-5%.

Other examples of technology adoption include online grocery adoption, digital payments, and next-day delivery services, all of which support the consumer technology economy.

The chart below highlights e-commerce adoption which has come more quickly in the UK than in neighbouring countries.

Specialist VC performance has been strong…

Specialist investors outperform the generalist benchmark.

Pitchbook analysed 1,306 funds with vintages across 2005 to 2020 and found that specialist funds outperformed generalists on IRR across vintages.

… and specialist consumer funds are no different.

The landscape of consumer investors broadly splits into 2 categories:

Global Series A and Growth Funds

These funds often built their early track record backing consumer winners at seed. As their fund sizes have got larger they have:

Migrated towards Series A and growth

Restricted the Universe of consumer companies they can invest into to those with multi-billion dollar addressable markets

Examples here include Index and Entree Capital. It is often a specific partner within these funds that consistently “hits” the consumer winners:

Martin Mignot (Index): Revolut, Deliveroo, BlablaCar, Captaintrain

Danny Rimmer (Index): The End, Etsy, and Farfetch

Specialist Consumer Funds

Pre-seed and seed stage funds: These are often specialist emerging managers and family offices who have fund sizes structured in a way that enables them to “win” under two scenarios:

$1bn+ win: Consumer winners in markets with enormous TAM (for example fintech). Often take longer and are more binary - generally picked up at Series A by one of the global funds

Capital efficient “win”: Consumer winners in more discrete markets where the leading brand commands a strategic premium. Strategic exits at £250-500m. For smaller funds with higher ownership and limited dilution these can drive 25x+ returns.

There are partners and funds that consistently “hit” the consumer winners:

Jon Coker (Eka/MMC): Gousto, Bloom & Wild, Interactive Investor, Mubi, Runna

Mark Esiri (Venrex): Charlotte Tillbury, Just Eat, Revolut

Shan Drummond (Samos): Charlotte Tillbury, Bloom & Wild, Moneybox and CarWow

Series A stage funds: There is a segment of Series A/growth funds who are consumer products (vs consumer digital) experts and back companies that fall outside of the outcome scale that is needed by one of the Global Series A technology funds. Examples of these funds include Five Seasons and Iris Ventures. Hallmarks of this style of funds is:

Ownership focused: Buy primary and secondary shares to get to 30%+ ownership

Economics already work: Preference for £10m+ revenue and good unit economics

Consumer products (CPG): Typically invests in CPG orientated products rather than consumer digital products

Five Seasons examples:

Butternut Box: Secondary exit to L Catterton and GA at £500m

Y Food: Nestle partially acquires Y food at c$469m

The UK and European Ecosystem of early stage consumer investors with a track record of identifying consumer winners.

There are clear winners in UK consumer companies*

There have been many consumer winners in the UK since the 2000s. Note that this only includes companies where revenue in the last reported FY were >£50m in-year.

✍🏽 Week in Impact Articles

Tuesday: Single patient record data will be available to researchers by default

Wednesday: Blue Orca is Short Teladoc Health, Inc.

Thursday: Helix: A Vision-Language-Action Model for Generalist Humanoid Control

Friday: AI chatbot Sonny helps schools tackle mental health crisis

📊 3 Key Charts

1. The continuing livestock trend: 11x more chickens than in 1961

2. The power (and timelines!) of innovation: amazon vs. walmart

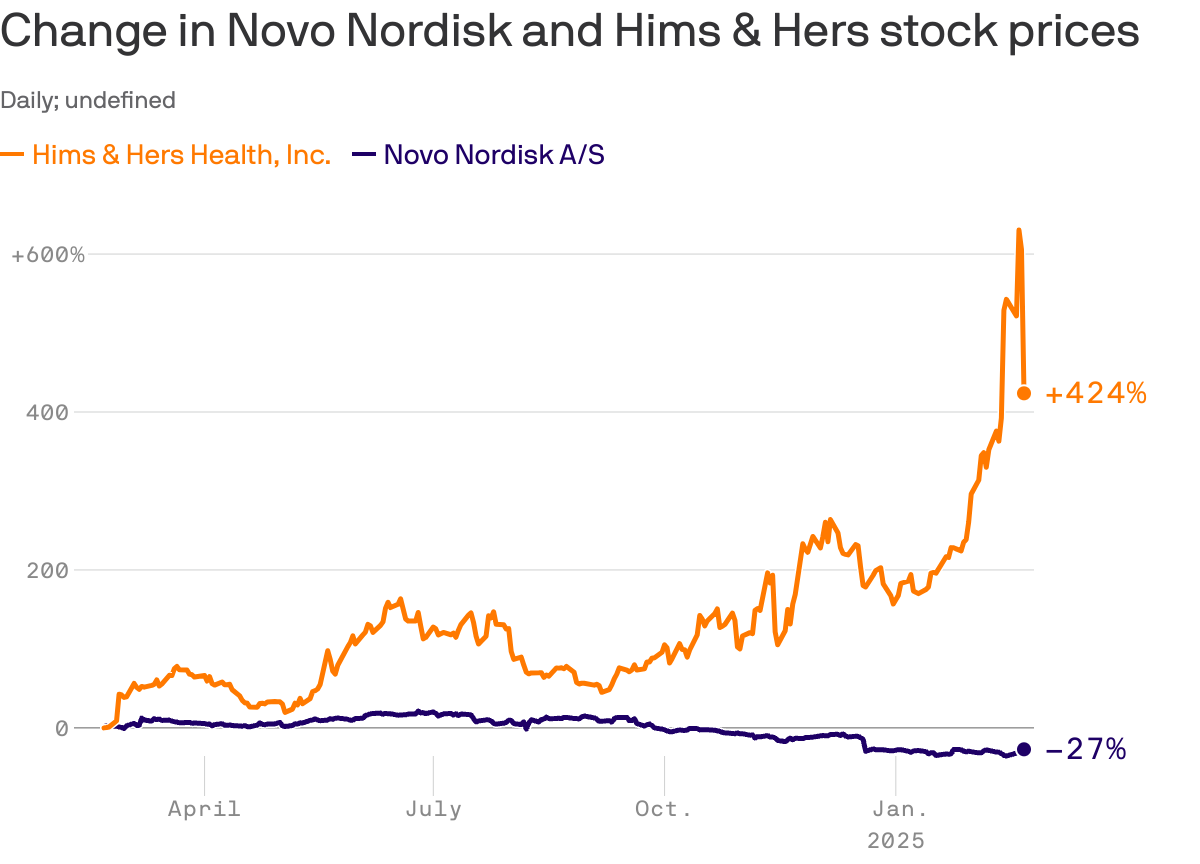

3. Compounder slump: hims & hers reverses gains

🎉 Eka Portfolio News

🗣️ Review of the Week

👋 Getting in Touch

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.