We’ve been writing about Health x AI for over two years now (see our initial primer here), but we wanted to send a brief update on how the Big Tech companies have progressed in their Health x AI efforts at the 2025 halfway point.

Microsoft published its "Path to Medical Superintelligence” at the end of June, with its AI diagnostician demonstrating 4x increase in accuracy over experienced physicians in correctly identifying complex medical cases. Google has expanded its open-source MedGemma model, launching powerful new multimodal models capable of interpreting both medical images and text with high efficiency. Even Meta, while taking a different approach, is influencing the health and wellness sector through changes to its advertising policies.

Let’s dive in.

Incumbents (continue to) make moves in Health x AI 🗞️

Microsoft’s path to medical superintelligence

Last month, Microsoft published its Path to Medical Superintelligence which showed that the Microsoft AI Diagnostic Orchestrator correctly diagnosed up to 85% of NEJM case proceedings, which is 4x higher than a group of experienced physicians. Unsurprisingly, this is also achieved at a lower price point than human physicians.

In the post, we also learned that Bing gets 50m health related sessions every day (Bing had 100m daily actives in 2023, no more recent numbers were found). This correlates pretty well to my ChatGPT queries!

Microsoft is also expanding the capabilities of its Dragon Copilot, an ambient AI solution designed to reduce clinician burnout by automating clinical documentation.

NVIDIA focuses on robotics, surgery, and medical-specific supercomputers

At its GTC 2025 conference in March, NVIDIA solidified its position as the foundational engine for the AI healthcare revolution and launched the NVIDIA Isaac for Healthcare platform, designed to accelerate the development of medical robotics for surgery and diagnostics.

For researchers and smaller clinics, NVIDIA introduced the DGX Spark, a "personal AI supercomputer" compact enough for a desktop but powerful enough to process vast medical datasets.

Nvidia also launched Holoscan 3.0 for real-time medical imaging and unveiled significant upgrades to MONAI, its open-source AI platform that unifies diverse data types like medical imaging, genomics, and patient records to create a more holistic view of patient health.

Google launches low-cost & high-performance Health AI model

Google (& Deepmind) continues to champion an open approach to AI in medicine and launched (last week!!) MedGemma, an open-source multimodal AI model capable of understanding both medical text and images.

The tool has a few different uses including image classification, interpretation, and text-based medical question answering.

The cost is about one tenth of the cost of Deepseek while maintaining high performance on the MedQA score, with the text variant scoring 87.7% or within 3pts of DeepSeek R1.

This follows ongoing work on its Articulate Medical Intelligence Explorer (AMIE) from 2024, an AI system optimised for nuanced diagnostic conversations, signalling a future where AI can act as a sophisticated partner to medical professionals.

Amazon partners with General Catalyst and launches partnerships hubs across EMEA

Amazon announced a partnership with General Catalyst earlier this year to accelerate Health x AI enterprise adoption. The collaboration is focused on building and deploying a new generation of AI-powered solutions to address critical industry needs.

More recently, Amazon launched its Health AI Hub to accelerate healthcare innovation in EMEA. Early case studies include:

And:

We’ll be looking at Amazon in further detail in a future newsletter, so expect to hear more from us here.

Meta is the slower of the bunch in 2025 (which makes sense), but note its changes in advertising policy

Meta is in a less natural place to innovate on Health x AI given its core segment…

… but it did change its Health & Wellness policy for advertisers.

As of February 2025, advertisers are no longer able to track bottom-of-funnel events (like conversions) if the brand account itself is labelled as health and wellness on Meta. Additionally, they aren’t able to build an audience based on conversion events. This means that advertisers will need to get creative with how they advertise products in this sector.

The core of these changes is to prevent the sharing and use of potentially sensitive health information for advertising purposes. Under the new regulations, websites and apps categorized by Meta as "health and wellness" will face limitations on the use of Meta's Business Tools. This includes a wide array of services, from those dealing with specific medical conditions, mental health support, and substance abuse to broader wellness topics.

Has there been a change in ROAS?

We weren’t able to find lots of credible data, but this article suggests a 30-40% decrease in ad efficiency due to missing data (!). One to watch.

✍🏽 Week in Impact Articles

Tuesday: A cloud-seeding startup did not cause the Texas floods

Wednesday: The permitting crisis for renewables

Thursday: The $2 trillion global wellness market gets a millennial and Gen Z glow-up

Friday: Ten-year NHS plan signals greater role for plurality and incentive in echo of Blairite reforms

📊 3 Key Charts

1. Population decline has little theoretical impact on global warming

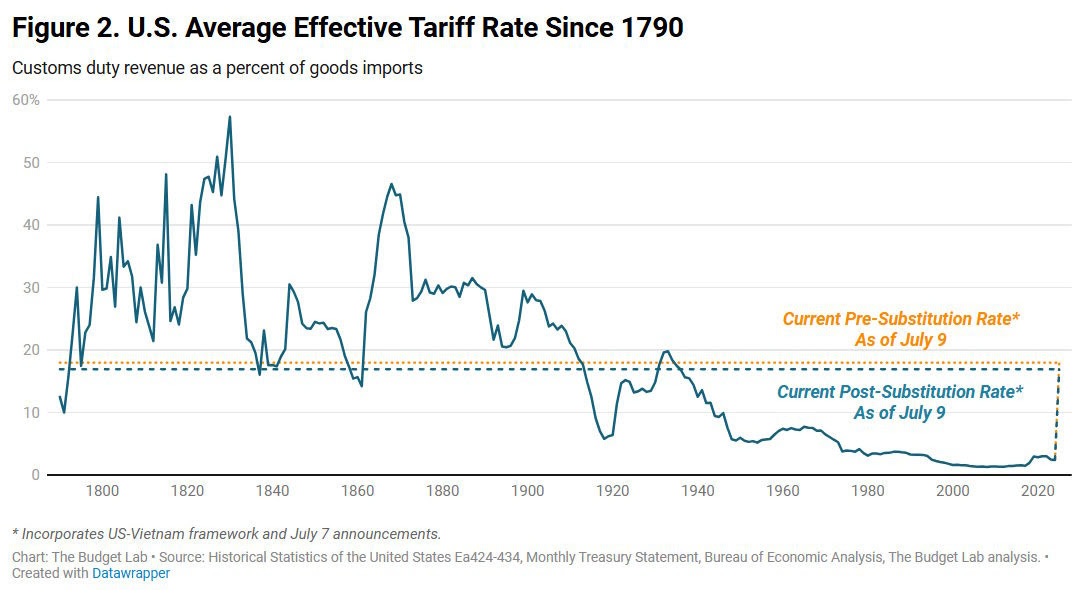

2. Looking at the US effective tariff rate since the late 18C

3. Where do materials emissions come from in the supply chain?

🗣️ Review of the Week

👋 Getting in Touch

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.