Beyond carbon: how to think about waste in fashion

Issue 70 l Eka’s Weekly Roundup (12 April 2024)

We’ve been thinking about how to capture the entirety of Sustainable Consumption thesis.

A lot has been written about carbon mitigation (and more recently, climate adaptation). You only need to look at the various fund targets to see that this is the key focal point for a lot of climate investing.

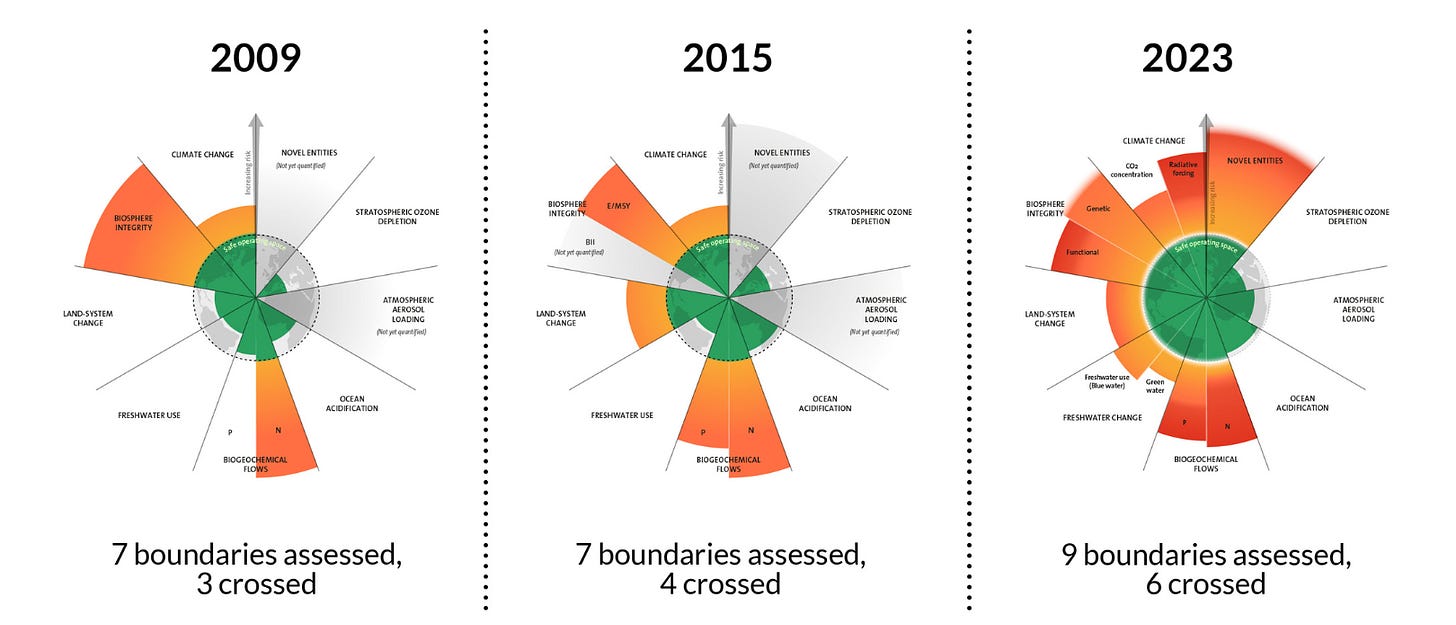

More recently, there has been shifting attention into other areas of climate including land, water, and material usage. Transition VC has written about how they use planetary boundaries frameworks to shape their investing.

This week, we take a look at Fashion as a case study for how to think about impact beyond carbon. This is the first of three parts on what we wear, what we eat, and how we move.

Part 1: What we wear 🗞️

Defining the problem with GHGs…

Fashion is about 2% of global greenhouse gas emissions (GHGs). For context, construction is around ~10% and Food is closer to ~25%.

But greenhouse gases are only one part of the problem.

… only gets you so far. We need to think more broadly.

Climate also includes waste products, material usage, and natural resource depletion. Frameworks like the Planetary Boundaries are a helpful, multidimensional way to look at Climate, beyond GHGs. They include other climate vectors like ocean acidification, biogeochemical flows, fresh water use, and land system change.

Huge markets requite sophisticated solutions…

Taking a step back, fashion is a massive industry with complex, international supply chains. As of 2021, the industry was valued at over >$3tn with units doubling over 15 years. Environmental impact is felt at both ends of the value chain. In production, land and water usage is material, with high amounts of insecticides and pesticides being used to manage crops. At the post-consumption stage, >80% of items are sent to landfill with very low % numbers being recycled or repurposed.

Going one step further, we need to think about the carbon footprint multiplier relative to the $ spend on goods. For example, we spend the least comparatively on mobility but this leads to the highest carbon footprint adjusted for spend. Similarly, we spend a mid-range amount on food & clothing, but these disproportionately high impacts on land and water usage.

Fashion is therefore a ‘high impact’ sector, with especially high opportunities in material design and natural capital usage.

… which are sensitive to the markets in which they operate

Solutions in Europe will be different to those in South East Asia. Below, we show the per capita footprints across (i) Energy, (ii) Carbon, (iii) Water Usage (Scaled & Unscaled), (iv) Spending, and (v) Wages & Income.

The high spend economies are also those who have the power to shape the broader fashion supply chains. As an example, the US has very high expenditure on textiles, with moderate energy consumption and GHG emissions in fashion. Australia has very high GHG emissions and expenditure on textiles.

We are now re-mapping sustainable fashion

A lot has changed since we last looked at fashion. As a result, we’re starting from scratch and re-building our view of fashion.

This isn’t our work but is an awesome map from Matteo Renoldi and his colleagues at Dealroom. Feel free to reach out and suggest names which may be missing from this list below.

Week in Impact Articles ✍🏽

Monday: Wearable AI: will it put our smartphones out of fashion?

Tuesday: State of Grocery Europe 2024: Signs of Hope

Wednesday: Digital Health Download: April 2024 (this has some great soundbites on the diagnostics question which we wrote about last week)

Thursday: England could witness 13-fold surge in clean energy with policy support, study finds

Friday: MIT-derived algorithm helps forecast the frequency of extreme weather

3 Key Charts 📊

1. The strongest job growth is set to come from health-related roles

2. Feeling excited and engaged? Moving to the office might be the reason

3. Up, up, and up: home payments for median-priced homes reached >$2k in the US

Getting in Touch 👋.

If you’re looking for funding, you can get in touch here.

Don’t be shy, get in touch on LinkedIn or on our Website 🎉.

We are open to feedback: let us know what more you’d like to hear about 💪.